Pensioners to protest at HSBC's annual meeting

- Published

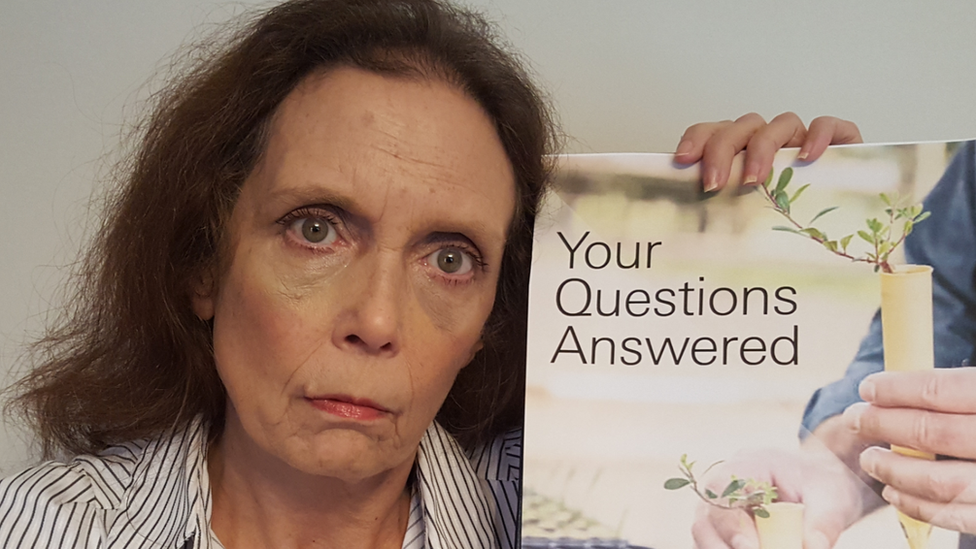

Sharon McGeough-Adams will be campaigning at HSBC's annual general meeting

Sharon McGeough-Adams faces losing £200 a month from her HSBC pension and will protest at the bank's annual general meeting on Friday to demand changes.

Having worked for the UK's biggest bank for more than 37 years, she says it is money that could be put aside for other necessities, such as fuel.

The loss is caused by the bank's move to reduce pension payments when the recipient receives state pension.

HSBC has said it would cost £450m to stop the practice for future payments.

Ms McGeough-Adams is one of 52,000 members of the pension scheme - technically the 1974 Midland Bank defined benefit pension scheme - whose company pensions will be reduced when they reach state retirement age.

A campaign group she helped form has requisitioned a vote at the annual general meeting (AGM) which calls for the bank to "abolish, or effectively remedy, the unfair discriminatory practice".

As well forcing the issue to be discussed at the AGM, she and other members of the campaign will protest outside the meeting in Birmingham.

"It's a shame they won't come and talk to us," she says.

The bank is urging shareholders not to vote for the resolution, arguing that the practice is legal and that it was sent a statement by the pensions minister in November 2017 confirming that the government does not support withdrawal of the policy.

The resolution needs the backing of 75% of investors and one of the influential bodies which advises major shareholders, ISS, is recommending voting against.

But requisitioning the vote at the AGM has given the long-running campaign a new voice. Last year, a scheme member told BBC Radio 4's Money Box how just over £1,800 of her £6,400 a year pension - a third - was affected.

Lower paid women

Ms McGeough-Adams said: "HSBC needs to urgently end the injustice of its clawback policy which is causing many people to have to choose between food or fuel in their retirement."

Her reduction takes place in a few years' time - she is 61 - and she left the bank in 2012 after working her way up to manage two branches in Stoke-on-Trent on a salary of £23,000 a year.

The pension scheme was a non-contributory pension final scheme and staff were eligible to join between 31 December 1974 and 1 July 1996.

Until June 2009, it was a final salary, non-contributory scheme and taken on by HSBC after it took over Midland Bank in the early 1990s.

When members reach state retirement age, the bank says it adjusts payouts from the scheme so that the total sum received by the pensioner is "broadly maintained".

The campaigners call the practice "clawback" - the bank calls it "state deduction" - and argue it was not properly described to them.

They argue that it "penalises the lowest paid, creating financial hardship" and "indirect discrimination" as the majority of lower-paid staff are women.

HSBC said the scheme is not "unfair, disproportionate or discriminatory" and argues that describing it as "clawback" is not justified.

John Ralfe, an independent pensions consultant, said the "rules are being followed" and the idea behind such a practice was to smooth out pensions between company retirement, at say 60, and state pension age.

HSBC calculates it would cost £450m to stop the state-deductions.

Campaigners say other firms have ended the practice and also argue it was used to explain why they were paid less than new recruits. "We were told it was worth it's weight in gold," said McGeough-Adams.

It is a story echoed by Denise, who does not want to give her surname, who said that when she discovered her salary was less than a new colleague's, she was told it was because she had a non-contributory pension scheme.

'Fighting back'

She later discovered her payments would be reduced when she received her state pension. "They called it non-contributory but I felt I had a made a contribution," said Denise, who worked at the bank for more than 40 years.

MPs have lent their support, including Clive Betts, the MP for Sheffield South East, who in a video issued by the campaigners said: "HSBC is depriving long-term and loyal former employees of the pensions they have worked so hard to earn".

Campaigners say that the amount clawed back is calculated on the number of years they worked at the bank, not their salary or seniority, so it affects the lower paid most. And they were more likely to be women.

The Equality and Human Rights Commission has written to HSBC to ask for further information after being contacted by MPs and says that the scheme "could put women at a particular disadvantage compared to men as they are more likely to have been on lower salaries".

"The rising costs of pensions led many providers to change their schemes. However, these should be justified as being a proportionate way to achieve a legitimate objective," the EHRC said.

Shirley Eidman, another founder of the campaign, says the group feels it needs to take a stand through the AGM.

"We're fighting back, whether we get anywhere is a another thing," she said.

- Published6 March 2019