Is China losing the battle against an incurable pig virus?

- Published

China claims to have culled more than one million pigs, but analysts believe the figure may be under-reported

Global pandemics that impact on food supplies are scary things.

The latest threat comes from African swine fever, a highly contagious virus with no known cure, and a near zero survival rate for infected pigs.

The good news is that the disease is not harmful to human health. The bad news is that it will probably hurt our wallets.

The epicentre of the current crisis is China, the world's biggest producer and consumer of pork. It alone accounts for more than half of the world's pig population.

China is struggling to contain the disease, which has spread to every part of the country since August last year.

China is home to around half of the world's pig population

After months of claiming the situation was under control, Beijing is now warning that pork prices in China could rise by more than 70% in the second half of this year.

This in turn would have a knock-on impact on China's economy, given that pork prices are an important contributor to its inflation levels.

Official data released over the past week reinforce the seriousness of the situation.

China's National Bureau of Statistics says the country's pig population has fallen by nearly 40 million to 375.3 million from a year earlier, because of the swine fever outbreak.

However some analysts believe that China has been under-reporting the situation, partly due to local farmers withholding information about outbreaks.

Looking ahead, the epidemic could decimate around 200 million pigs in China, according to a grim report by Rabobank.

It forecasts that China's pork output will fall by 30% this year, creating implications for global commodity markets.

Suckling pigs are eaten at Chinese weddings and big ceremonies as a sign of wealth

"To give you some context, the decline here in China is now almost as much as the total amount of pork produced in the EU as a whole," says Rabobank global strategist Justin Sherrard.

He says that China cannot import enough pigs to make up the shortfall.

"We don't believe there's enough animal protein available in the world to make up the difference.

"And so it will be disruptive in those other markets. You will see prices increase in those other markets.

"At one level you can say a shortage in one region is good news for another region. But the magnitude of these changes are such that this is going to be disruptive in other markets.

"It's not a simple situation where you can say 'oh yes but surely they can just import the difference'."

China is, however, trying to boost pork imports from another big producer - the US - to make up for its lost domestic supply. There's just one problem - President Trump's trade war.

US pork exports to China are currently facing tariffs of 62% because of the continuing trade dispute between both countries.

The usual tariff rate for US pork exports to China is 12%, but an additional tariff of 50% was added last year due to their spat, making American pork significantly more expensive for Chinese consumers.

Rabobank's Mr Sherrard calls their current trade tensions an "unwelcome complication", but predicts the pork shortage could lead to an accelerated deal between the two sides.

"In the end, we will see that there'll be some sort of temporary, or maybe even a permanent, resolution of the trade dispute to try and get that pork meat and other animal proteins flowing from the US to China," he says.

"In fact there have been stories of huge volumes of US pork being shipped to China already despite those tariffs being in place."

Pork is a staple of day-to-day Chinese cooking

The situation is already being reflected in the financial markets - US lean-hog futures on the Chicago Mercantile Exchange have risen around 60% over the last month.

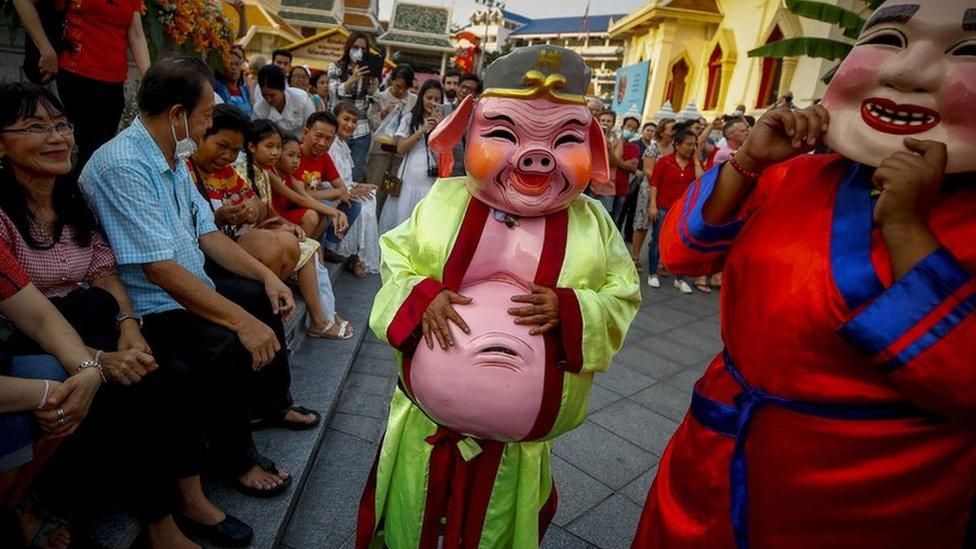

In addition to the outbreak in China, there are also now reports of the virus in Vietnam, Laos, Cambodia, Thailand and other countries in Southeast Asia.

Europe has also been affected by African swine fever in recent years, which can be carried by both domesticated pigs and wild boars.

"After devastating the Baltic nations and eastern Poland in 2014, African swine fever emerged in the Czech Republic and near Warsaw," says Lynn Morgan, head of Europe at global research firm Ipsos Business Consulting.

"Pork prices collapsed due to insufficient domestic production and more than a third of pig farms went out of business."

Global Trade

She believes that Germany, the largest pork producer and exporter in Europe, has the most to lose from further outbreaks.

"Recent analysis has suggested we could expect African swine fever to emerge in the German wild boar population over the next four years," she says.

Pigs infected with the fever usually die within 10 days.

If a single pig is found to test positive for the virus, the entire herd has to be slaughtered. Farmers usually suffer substantial financial losses in the process.

While African swine fever can live on for weeks or months in uncooked and frozen pork, it is not harmful to humans, according to the World Organisation for Animal Health., external

American pork is now more expensive for China to buy

But that could change. Russia's chief epidemiologist believes the virus could potentially mutate further, external given the similarity between pig and human physiology.

Meanwhile, the UK's National Health Service website states that: "Many global outbreaks of infectious illnesses (pandemics) that have occurred in recent history are thought to have been caused by viruses previously only found in animals. After mutating, the viruses became capable of infecting humans."

Aside from being a meal staple, the pig is historically and culturally one of China's favourite animals.

It is one of the 12 animals of the Chinese zodiac and 2019 is the Year of the Pig, according to the Chinese lunar calendar.

But until the African swine fever epidemic is brought under control, there is clearly little to celebrate.

- Published28 January 2019

- Published5 February 2019

- Published22 January 2019

- Published14 February 2018