Quietly-spoken investor seeks change at Barclays

- Published

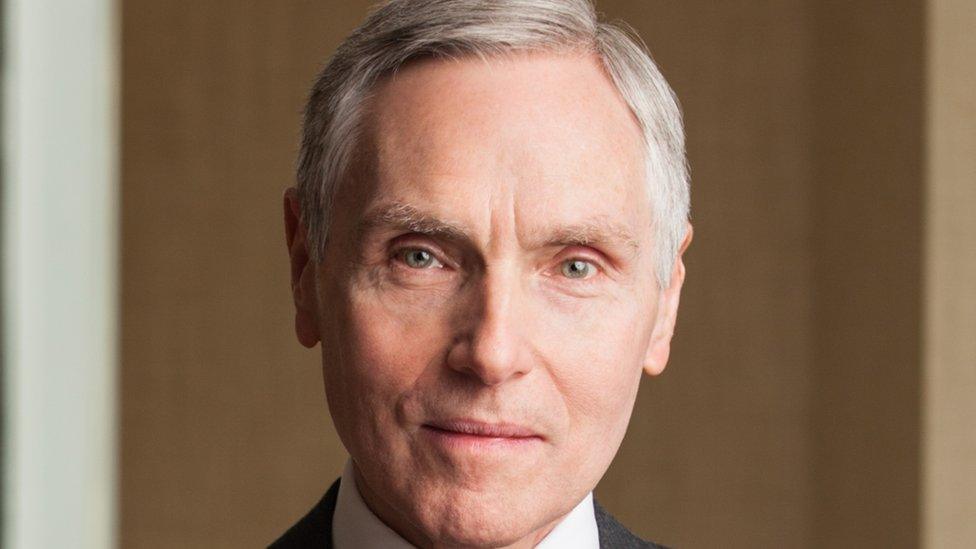

Edward Bramson wants a seat on the board of Barclays.

A 68-year-old who speaks so quietly that it can be difficult to hear what he says is making a big noise at Barclays bank.

Edward Bramson has amassed a 5.5% stake in the bank and on Thursday is urging shareholders to elect him to the board.

He wants the bank to scale back its investment division to boost returns at the lender.

Barclays counters that it is already making efforts to boost performance and that he should not be on the board.

'Some sympathy'

While few expect him to win at the annual general meeting, Mr Bramson - who was born in the UK and left for the US in the mid-1970s - does have a message that resonates with some major investors.

"We have some sympathy with the concerns he's raised... mainly around the performance of the investment bank and cost control," David Cumming, chief investment officer for equities at Aviva Investors, told BBC Radio 4's Today Programme.

"The issue we have is that he's been pretty successful in terms of critiquing aspects of Barclays performance, but hasn't really offered a credible alternative strategy," he added.

Mr Cumming has said Aviva will not back Mr Bramson's attempt to get on Barclays' board, even though the insurer also has a stake in Mr Bramson's investment vehicle, Sherborne Investors.

The approach Mr Bramson is taking at Barclays is similar to he one he has taken at other companies. He buys up a stake, tries to get elected to the board by other shareholders and then sets about cutting costs to boost returns for investors.

'No brainer'

It has earned him the title of "activist" investor - although it is different from the louder style used by others who also make their money by trying to force through change at companies.

Carl Icahn, for instance, has a twitter account and appears on television channels when embarking upon his efforts to overhaul companies.

Mr Bramson's bank challenge is not expected to be successful

In 2015, Mr Icahn had his sights on Apple and wrote open letters to chief executive Tim Cook saying the shares are "still dramatically undervalued". He gave interviews in which he described his belief that the shares should be worth more as a "no brainer".

Mr Bramson, in contrast, offers his opinion behind closed doors in meetings with influential investors as he tries to win their support.

He is rarely photographed, but the Financial Times has described how he dresses in high-waisted trousers and speaks with a Transatlantic accent.

'Enhanced value'

Born in 1951, Mr Bramson is said to have left the UK for New York in 1975 after becoming disillusioned with Harold Wilson's government. His move Stateside was also reportedly precipitated by getting stuck in a lift during one of the power cuts which hit the UK in the early to mid-1970s.

He started out his investment career in private equity - buying companies and selling them off later - through his Hillside Capital business before tweaking his investment approach in 1986 when he founded Sherborne.

Its website lists only one other manager, Stephen Welker, and provides this description of their investment approach: "We seek to enhance value in our portfolio companies by offering our participation on the board, rather than through majority ownership and control of the company."

"Our firm's approach provides current shareholders with a new alternative. In the absence of an operational turnaround, shareholders in underperforming companies can choose to continue with the existing situation, sell their shares at a loss, or hope a buyer for the whole company may emerge offering a modest premium to a depressed share price," it adds.

Since 2003, when he concentrated his turnaround investing activities as a minority shareholder in publicly-quoted companies, Mr Bramson has pursued 10 activist campaigns, six of which saw a member of Sherborne Investors joining those boards.

For instance, in 2011 he became chair of fund manager F&C after tabling resolutions which led to investors voting off the incumbent.

Barclays chief executive Jes Staley

He can show persistence.

Take Electra investment trust as an example. He first started building a stake the business, which owns companies such as dining chain TGI Fridays, in 2014, but took two attempts to get elected to the board.

At the time he told the Daily Telegraph in a rare interview, external: "Even if we don't win the vote, we're not going away. I've told the board: I think we're OK. They think we're scum, which is fine. It's fear of the unknown."

In the end he prevailed, stepping down as chief executive in March 2018, just as he was starting to build his stake in Barclays.

He remains on Electra's board and his biography on the website states he has never received any remuneration from the company.

But, it can be a brutal business. So that Electra could return £2bn to investors, it sold off most of its investments. Last year it attempted to find a buyer for what was left but is now in the process of winding itself up.

While Mr Bramson is not expected to be successful on Thursday, the bank's board and its chief executive Jes Staley will be looking for clues as to whether he will walk away - or keep rattling for change.