Philip Green: what's gone wrong at his Topshop empire?

- Published

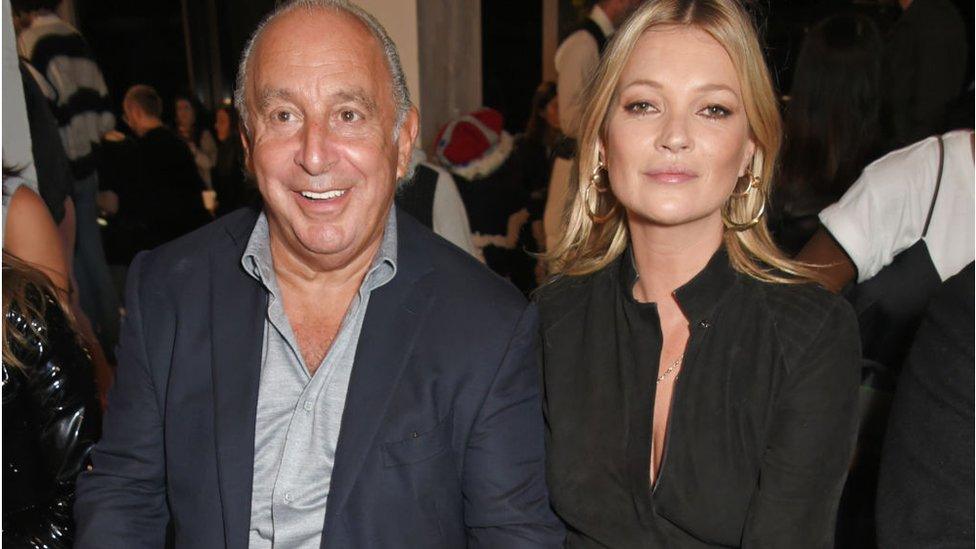

Sir Philip has worked with supermodel Kate Moss on two Topshop ranges

Arcadia Group has long dominated the British High Street, but are its glory days coming to an end?

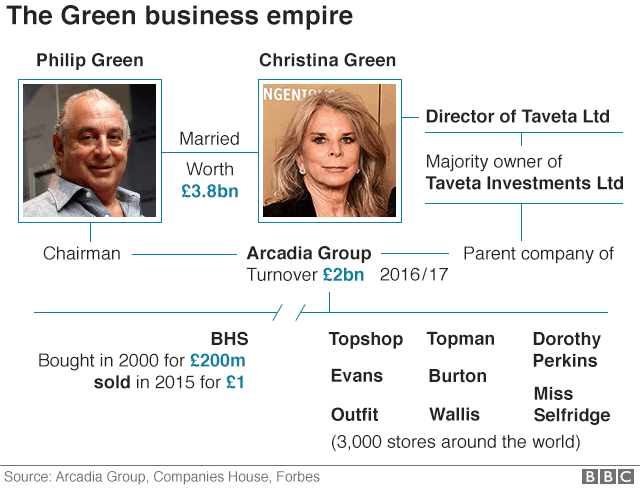

Sir Philip Green's retail empire - which owns Topshop, Burton, Dorothy Perkins, Evans, Miss Selfridge, and Wallis - is reportedly seeking a rescue deal that would allow it to cut rents and close stores.

It would be a big fall from grace for a business that not long ago was talking about cracking the US and China, and a blow for Sir Philip, who made his fortune in fashion retail.

So what went wrong?

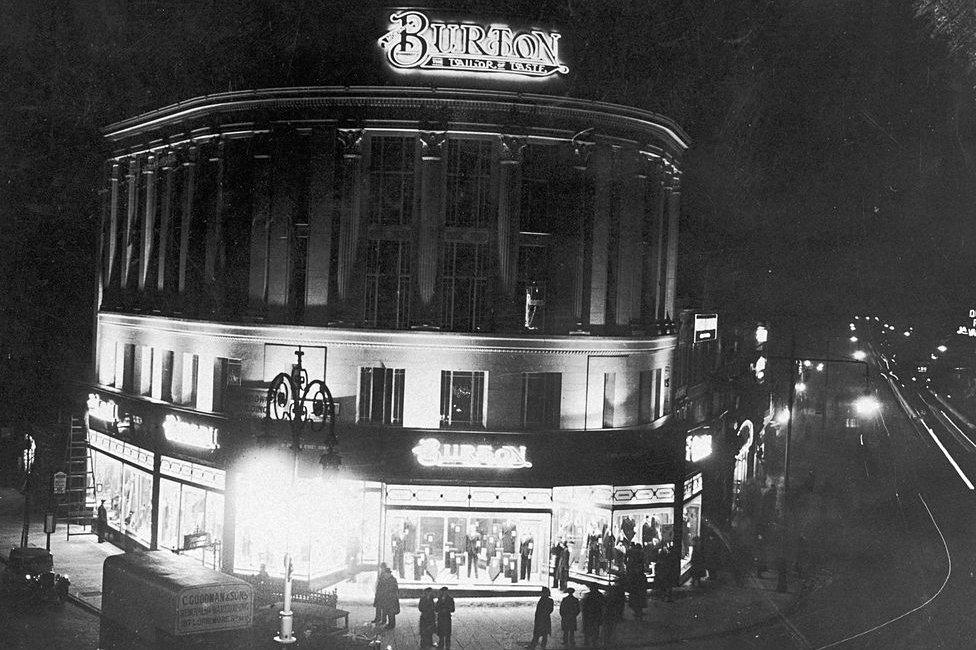

Arcadia grew out of Burton Group, whose roots go back to 1903

What is the history of Arcadia?

The Arcadia Group's origins date back to 1903 and the formation of the Burton menswear chain, which grew to acquire brands such as Topshop and Dorothy Perkins, and renamed itself Arcadia in 1998.

In 2002 Taveta Investments, owned by the Green family, bought Arcadia and delisted it from the stock exchange. Sir Philip, who had bought the now defunct BHS department store chain for £200m in 2000, installed himself as chief executive.

The entrepreneur swiftly set about "cutting the fat" out of the group, offloading failing brands and cutting jobs, says retail analyst Richard Hyman.

"He very successfully reduced the cost base, making brands like Dorothy Perkins more profitable. He is famous for running a no frills operation."

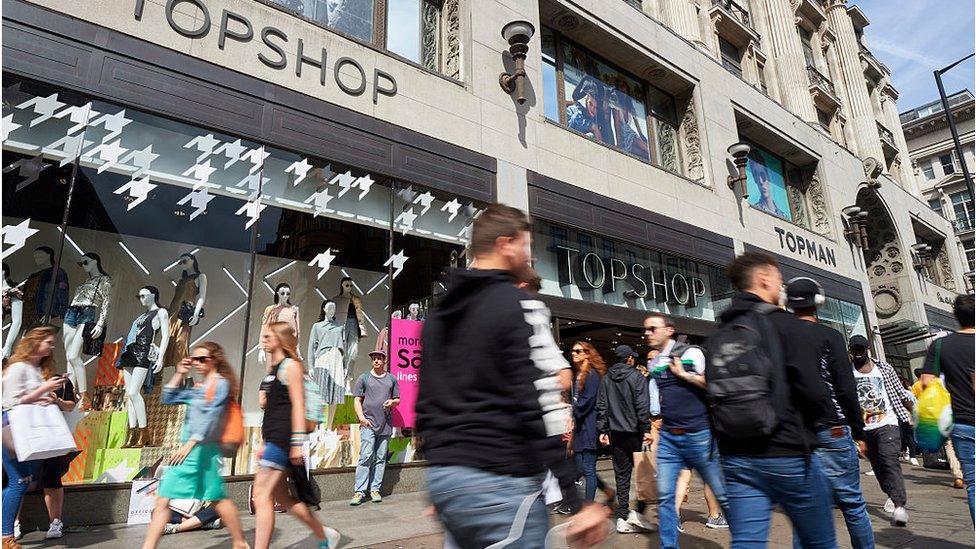

Topshop is considered the jewel in Arcadia's crown

What was behind the rise of the fashion empire?

The group seemed to be doing well, particularly the jewel in its crown, Topshop, which became known as a trend setter and attracted celebrity endorsements.

Kate Moss has twice worked with Sir Philip on Topshop lines, while Cara Delevingne, the model-turned-actress, became the face of the brand in 2014.

Sir Philip, who is reported to be worth almost £4bn, also appeared to be doing well from his acquisition.

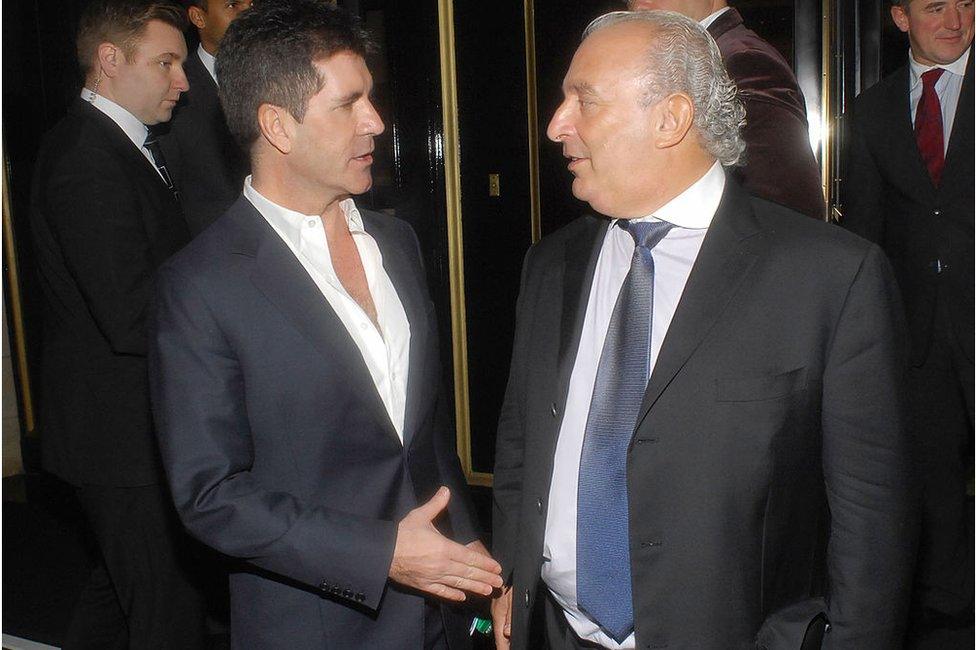

In recent years, he has been snapped partying with everyone from Bill Clinton to Simon Cowell, and reportedly spent £20m on his 55th birthday party in the Maldives.

However, Mr Hyman believes that behind the scenes, all was not well at Arcadia.

"Arcadia for many years has been a business with one very good brand - Topshop - and others that are somewhat past their best.

"In a growth market it is easy to paper over the cracks, and there was a growth market from the mid 90s up until the financial crisis in 2008."

Where are we now?

Today Arcadia has 1,170 shops in 36 countries, although the majority are concessions or franchises.

It has also shut 200 of its UK stores over the past three years, and may be set to close more as it struggles with a challenging market.

The group now faces intense competition from a crop of more contemporary "fast fashion" retailers ranging from High Street behemoths like Zara and H&M to pure online players like Asos.

It's also faced the same problems as other High Street retailers, including rising business rates and labour costs, too many unprofitable stores, and inflexible leases that make it hard to close failing shops.

"We've had 10 years of austerity, people don't spend like they used to, and we're massively over shopped," believes Eric Musgrave, a fashion commentator and former editorial director of Drapers magazine.

"The speed at which the market is changing, and the number of new fashion rivals, has basically overwhelmed them."

Richard Lim, an analyst at Retail Economics, says the rise of online shopping's been a big factor too. "Not only are retailers facing fixed costs they face huge costs fulfilling online orders. That's a lot easier to handle if you are a smaller, nimbler operator."

Music mogul Simon Cowell with Sir Philip in 2010

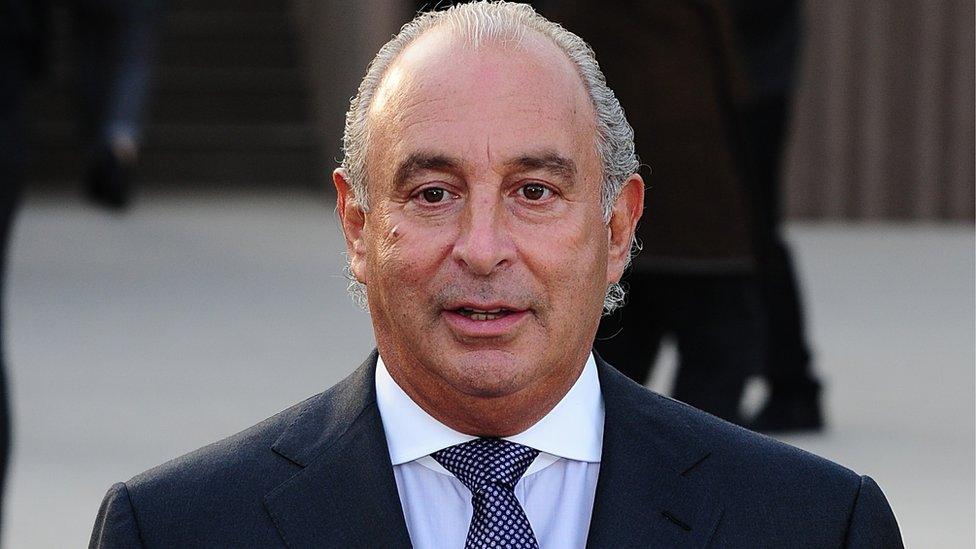

Was Green to blame?

Some say that Sir Philip, who is reported to have run Arcadia with an iron fist, has been too slow to change.

Lord Stuart Rose, a former boss of M&S and retail rival, told the Financial Times in 2015: "He's more of a yesterday's man than he is a tomorrow's man... Time has caught him up."

It is also unclear whether a spate of personal scandals has damaged the group's performance.

The tycoon received widespread criticism - and calls to strip his knighthood - after he sold BHS for £1 to serial bankrupt Dominic Chappell in 2015.

Fast fashion brands such as Pretty Little Things pose a threat to traditional retailers

MPs accused him of stripping money out of the firm before the sale, leaving it with a pensions deficit of £571m, which Sir Philip eventually paid £363m into.

More recently Arcadia faced a consumer backlash after Sir Philip faced allegations of sexual harassment - claims he strongly denies.

What next?

Reports suggest Arcadia will seek a Company Voluntary Arrangement (CVA) - a solution that would enable it to avoid going bust by closing stores and cutting rents.

However, while this has worked for other struggling retailers such as Byron Burger and New Look, some question whether landlords will be prepared to grant Sir Philip concessions given his reported personal wealth.

The tycoon could also seek to sell the business, but some say prospective buyers could be put off by its large pension liabilities.

The ailing retailer has two final salary plans with a combined deficit in 2018 of £537m.

- Published15 March 2019

- Published10 April 2019

- Published28 January 2019

- Published27 November 2020