World markets tumble amid US-China trade tensions

- Published

Global stock markets have tumbled after US President Donald Trump's unexpected threat to impose new tariffs on Chinese exports.

On Wednesday, Japan's Nikkei 225 index lost 1.5% after the Dow Jones ended down 1.8%.

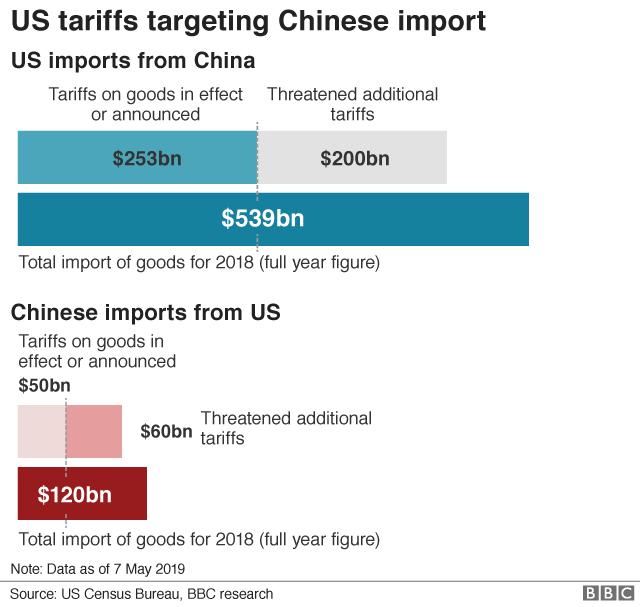

The US president has vowed to double tariffs on $200bn of Chinese goods on Friday, amid claims Beijing is trying to row back on a trade deal.

But a Chinese delegation is still due in the US for trade talks this week.

The talks, led by Chinese Vice Premier Liu He, are due to resume in Washington on Thursday.

Asian markets lost ground on Wednesday, after investors in the previous session had sought shelter in safer government bonds and the Japanese yen.

"As we digest the significance of the tariff threat, we are a little less hopeful that we are going to see progress at the end of this week that will forestall the additional tariffs," said Tony Roth, chief investment officer at Wilmington Trust in Wilmington.

In the US the S&P 500 fell for the fourth session in five days, closing 1.7% lower

Boeing, the largest US exporter to China, declined 4% and construction equipment giant Caterpillar fell 2.3%.

London's FTSE 100 fell 1.6% on Tuesday.

In Europe, France's Cac-40 and Germany's Frankfurt's DAX index declined for a second day, with both losing 1.6%.

Late on Monday, US trade representative Robert Lighthizer accused China of trying to substantively change the text of a deal between the two countries as it neared its final stages.

However, he insisted an agreement was still possible.

"We're not breaking off talks at this point. But for now... come Friday there will be tariffs in place," he said.

The stock market falls come after a period of strong first-quarter earnings for US companies.

Of the 414 S&P firms that have reported earnings so far, about three quarters have beaten analyst forecasts, according to data from Refinitiv.

- Published7 May 2019

- Published16 January 2020

- Published2 December 2018