What the Jamie's Italian collapse can teach rival chains

- Published

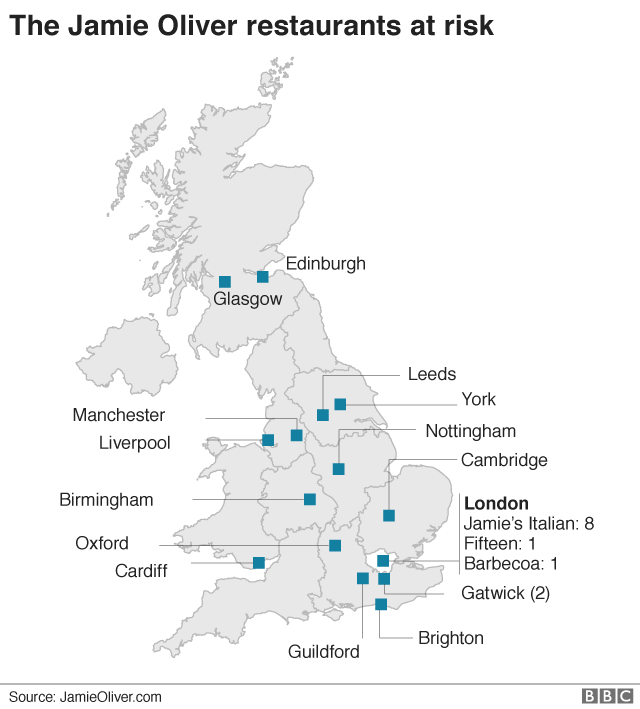

Earlier this week, Jamie Oliver's restaurant group went into administration, with 1,000 jobs being lost.

The group, which includes the Jamie's Italian chain, Barbecoa and Fifteen, has been reduced from 25 restaurants to three.

It appears to be part of a broader trend, according to statistics from data firm CGA.

Chains saw a 1.1% drop in restaurant numbers in the year to March, a sharper decline than the 0.1% drop recorded in the year to December, which was the first fall in a decade.

What's going on?

"It is symptomatic of a wider issue on the High Street," said Kate Nicholls, who is the chief executive of trade body UKHospitality.

She said 15 restaurants a week were closing, as a "murky" political and economic outlook takes its toll on consumer spending.

After a decade in which the restaurant sector was hungry for growth, the number of restaurants contracted for the first time last year, as chains digested the implications of 10 years of rapid expansion.

During that period, many chains were bidding for the same High Street properties, pushing up rates and causing them to overpay for sites, according to EY's hospitality expert, Christian Mole.

Profit margins are also under threat from rising food costs. Uncertainty over Brexit has knocked the value of the pound, hurting importers, Mr Mole said.

Meanwhile, restaurants - which often depend on workers from overseas - could see wage costs increase if Brexit hinders their ability to hire foreign staff.

Chains such as Jamie's are also facing a change in consumer behaviour.

Mr Mole said "cash-rich [but] time-poor" younger people had a growing appetite for "grab 'n' go" options from the likes of Itsu, Wagamama and Leon.

But people are still eating out, said Karl Chessell, business unit director for food and retail at CGA. "The difference is this huge increase in the supply of the market. Unless you know your customers really well, there's a pretty crowded market."

There are still 5,785 restaurants that are part of a chain in the UK, and the picture depends on where in Britain you are.

The fastest closure rate of 2.8% is seen in southern England, with 1.3% in London. In the north of England, the closure rate is just 0.4%, while in Scotland, more chain restaurants were opened than closed, CGA data showed.

But more closures for the year are likely, said Mr Chessell. As well as fiercer competition, food price inflation, staff costs and business rates have all added pressure, he said. Still, some chains are expanding, with Indian food chains Dishoom and Mowgli opening restaurants.

"There will be definitely be some winners in this market. It's not all doom and gloom."

Brands offering quality and good value will do well, he said.

What went wrong at Jamie's?

"I think the problem is the market has changed and the company has not been able to respond quickly enough," said Paolo Aversa, senior lecturer in strategy at Cass business school, an Italian and lover of Italian food.

More customers want healthy food, he said. And they are often looking for something new, he adds. This doesn't play to the strength of big chains like Jamie's, where consistency is on the menu.

Trouble on the High Street has been difficult to spot

"A lot of hype was connected to his persona," he adds, which works in the short run, but can struggle as a strategy over time.

Value for money, a slew of competitors in the market for Italian food, and demand for new experiences through pop-up restaurants all may have contributed, he said.

Where are we eating now, then?

Still in restaurants, but eating habits are shifting, as evidenced by the rapid rise of firms like Deliveroo, which today says it will open in 10 new towns.

Deliveroo now operates in more than 100 towns and cities across the UK.

Global sales at the firm more than doubled in 2017, jumping to £277m, but its losses continued to increase, doubling to nearly £185m as it invested in global expansion.

The firm employs more than 60,000 couriers - mostly using bikes or mopeds - to deliver food from restaurants to customers.

- Published22 May 2019

- Published22 May 2019

- Published17 December 2018