Green secures rescue deal for Topshop empire

- Published

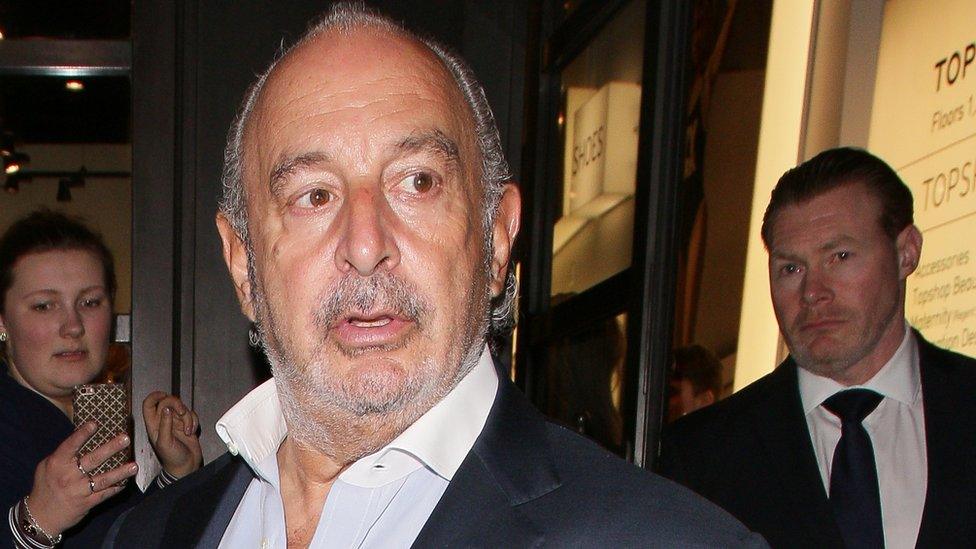

Sir Philip Green

Sir Philip Green's Arcadia retail empire has been saved by a rescue deal that will trigger the closure of 48 stores and a thousand jobs.

The plan, covering stores including Topshop, Miss Selfridge and Wallis, was approved by Arcadia's creditors.

After a week's delay and five hours of discussion Arcadia's landlords finally agreed to rent cuts, 23 store closures and 520 job losses.

Once the plan is in place another 25 stores and 500 jobs will be axed.

Ian Grabiner, CEO of Arcadia Group, said he was "confident about the future of Arcadia".

"From today, with the right structure in place to reduce our cost base and create a stable financial platform for the Group, we can execute our business turnaround plan to drive growth."

What just happened?

Arcadia's landlords were voting on the company's rescue plan, known as a company voluntary arrangement (CVA). This is an insolvency process that allows a business to reach an agreement with its creditors to pay off all or part of its debts.

In the case of Arcadia it will involve store closures and reduced rents across 194 of its 566 UK and Irish stores over a three-year period.

Last week, Arcadia secured the backing of pensions trustees, the Pension Protection Fund and most of its suppliers, for its plan.

However, it came up against stiff resistance from one of its biggest creditors, the shopping centre operator Intu, which called the deal "unfair" and voted against it.

Intu owns and manages some of the UK's biggest retail properties.

A spokesperson for the group said: "We firmly believe that the terms of the Arcadia CVA are unfair to our full rent paying tenants and not in the interests of any of our other stakeholders, including Intu shareholders and the 130,000 people whose jobs rely on the success of our prime shopping centres."

Lady Tina Green, Sir Philip Green's wife and Arcadia's majority shareholder, has also committed to pay £25m annually into the pension funds over three years, plus an additional £25m.

Rt Hon Frank Field MP, Chair of the Work and Pensions Committee, said: "Now that, thankfully, Arcadia's life has been extended, the Committee will try to ensure that the Pensions Regulator gets an effective programme in place to ensure that Arcadia staff receive in full the pensions that Sir Philip and Lady Green have promised them."

Tina Green, owner of Arcadia with her husband, Arcadia chairman Sir Philip Green

Why was the vote so important?

If the CVA had not been passed Arcadia had said it would have been forced to go into administration.

Troubles at the group came to a head when it announced that sales in its stores open for more than a year fell 9% in 2018-19.

Profits this year are expected to be £30m, compared with £219m two years ago.

Faced with fixed charges of £100m a year, the group said it was struggling to pay its way - so it decided on a CVA.

A CVA is a renegotiation of terms with a company's creditors as part of an insolvency procedure.

Arcadia had argued that it was "over-rented", paying too much for the space it occupied and the CVA initially called for cuts of 30% to 70%. However, after stiff resistance from the landlords it softened its demand to rent cuts of between 25% and 50%.

What went wrong with Arcadia?

Retail analysts say Arcadia's misfortunes are due less to rentals than to its failure to compete.

They say it has been losing out to contemporary "fast-fashion" retailers, ranging from High Street chains, such as Zara and H&M, to pure online players such as Asos.

Chloe Collins, senior retail analyst at GlobalData, said: "Most of its brands such as Dorothy Perkins and Miss Selfridge have lost relevance in today's retail landscape due to their uninspiring fashion ranges and weak multichannel offer.

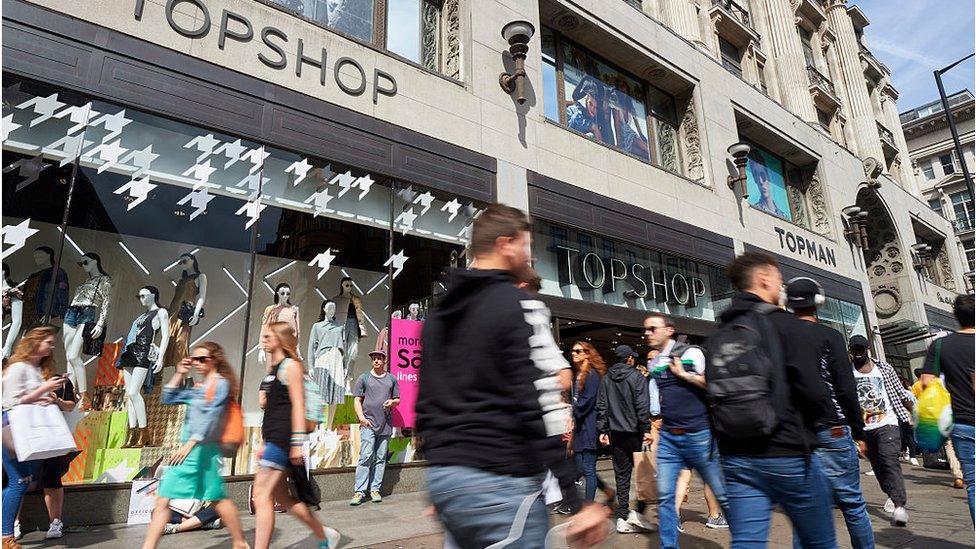

"Even Topshop, which used to be Arcadia's star player, has lost appeal."

While many believe Arcadia needed more investment the Green family stands accused of taking billions out of the group at the point when it need it most.

In 2005 a £1.2bn dividend, the largest corporate payout in UK history, was paid by Arcadia's parent company, Taveta, to the Green family.

Topshop is considered the jewel in Arcadia's crown

Will the CVA save Arcadia?

Lady Green has agreed to invest £50m of equity into the group, in addition to the £50m of funding already provided in March.

However some analysts believe it may be too little too late.

The investment would be "too thinly spread", GlobalData's Chloe Collins said.

"The agreed closures still leave Arcadia with an estate of around 500 stores which have been neglected for far too long and are now unable to match competition which moves in favour of experience-led shopping," she added.

Ed Cooke, chief executive of retail property organisation Revo, said: "It is clear that a CVA alone will not be enough to save the jobs of 18,000 hardworking Arcadia employees, and we hope the restructuring plans for the brands will be enough to ensure they have a sustainable future."

The restructuring has to be done quickly. Catherine Shuttleworth chief executive and founder of Savvy Marketing warned "the clock is ticking - if they don't act fast they will be back with another CVA".

She said: "They have to invest heavily in online. Shoppers at Topshop and Topman are more and more dissatisfied - they have to create a more seamless online shopping experience.

"They may also have to speed up the store closure programme, to have fewer but better stores, and they may sell off brands. They have been saying they already have some buyers interested."

As for Sir Philip's involvement Ms Shuttleworth said: "So long as he produces the money, that's all that matters. Otherwise he should just let his management get on with it and stay away."

- Published11 June 2019

- Published5 June 2019

- Published3 June 2019

- Published26 May 2019