Waterstones boss takes helm at Barnes & Noble

- Published

The boss of UK book retailer Waterstones is being parachuted in to help the turnaround of giant US chain Barnes & Noble.

James Daunt's appointment was announced as part of a takeover of Barnes & Noble by hedge fund Elliott Management, which already owns Waterstones.

The deal values the largest US book chain, hit by the rise of online sites such as Amazon, at close to $700m.

Elliott hopes Mr Daunt can repeat his turnaround of Waterstones.

Mr Daunt said: "Physical bookstores the world over face fearsome challenges from online and digital. We meet these with investment and with all the more confidence for being able to draw on the unrivalled bookselling skills of these two great companies."

He will be based in New York, but remain at the helm of Waterstones. Elliott bought a majority stake in Waterstones last year from Russian billionaire Alexander Mamut, who rescued the chain from near-collapse in 2011.

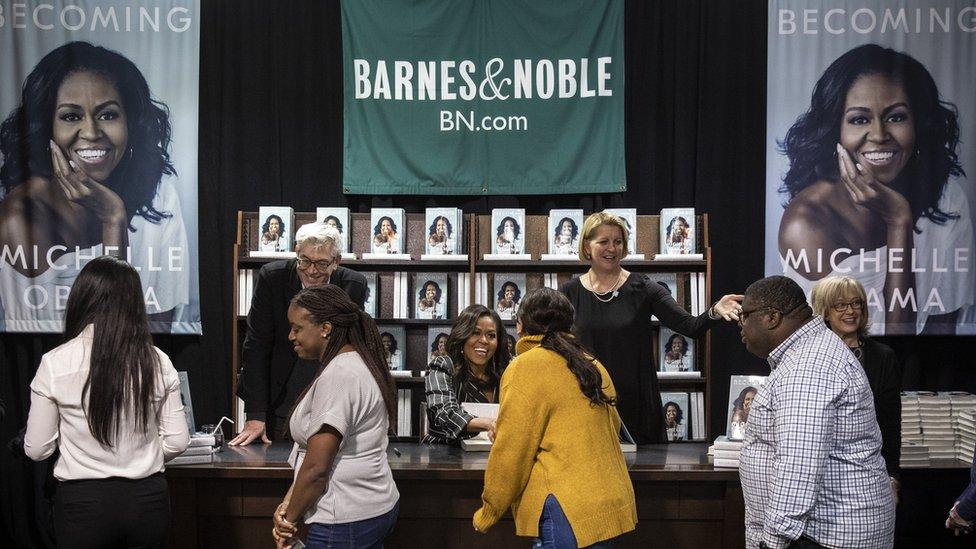

Michelle Obama signs copies of her bestselling book at Barnes & Noble in New York City.

Barnes & Noble has been listed on the New York Stock Exchange since 1993. Its rapid growth and big-store format helped to sideline many independent booksellers.

But the chain suffered after Amazon turned the market upside down, and Barnes & Noble's efforts to pull in a more tech-savvy audience with its Nook e-book reader failed to compete with the Kindle and other tablets.

In 2014, Barnes & Noble closed its New York Fifth Avenue store - once the world's largest bookstore - and has faced declining sales for at least the past three years. It has about 627 outlets.

Last year it made a loss of $137.7m before tax on sales of $3.6bn.

Leonardo Riggio, founder and chairman of Barnes & Noble, said: "We are pleased to have reached this agreement with Elliott, the owner of Waterstones, a bookseller I have admired over the years.

"In view of the success they have had in the bookselling marketplace, I believe they are uniquely suited to improve and grow our company for many years ahead."

Waterstones has faced its own challenge from Amazon, but it returned to profit in 2016 after six years of losses. Mr Daunt oversaw a big investment in the stores, concentrating on turning them into places to browse and organising more in-store events.

He said Elliott's financial backing would allow him to invest in Barnes & Noble's store estate and "make them look a bit nicer".

- Published8 April 2019

- Published28 December 2018