Paris Airshow: Difficult decisions for Boeing lie ahead

- Published

All Boeing 737 Max aircraft remain grounded after two fatal crashes

Boeing is coming to this year's Paris Airshow, which starts on Monday, facing some difficult decisions in the wake of the two deadly Boeing 737 Max crashes, while its global rival Airbus is widely expected to unveil a long-range version of its best-selling A321 - potentially taking away some of Boeing's customers.

With almost 2,500 companies exhibiting and 320,000 visitors expected over seven days, the show at Le Bourget on the outskirts of Paris is one of the aerospace and defence industry's key trade fairs for a sector that generates global revenues of some $685bn annually.

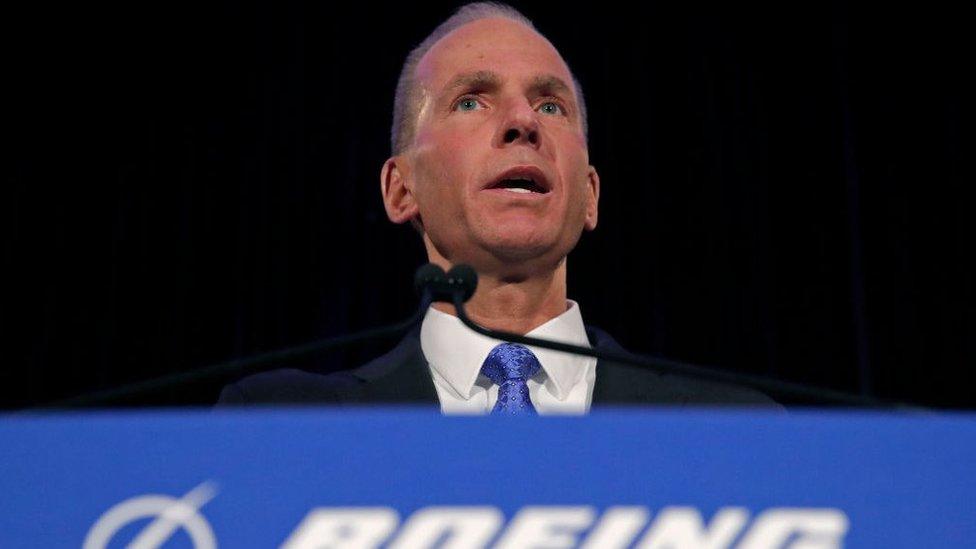

Expect most of the press attention to be focussed on Boeing's CEO Dennis Muilenburg, and how the firm is working with aviation regulators to get its troubled 737 Max aircraft back in the air.

Piling on the pressure facing Boeing executives, just this week a US Federal Aviation Administration (FAA) official indicated that airlines' fleets of Boeing 737 Max aircraft might be grounded until the end of the year - longer than many had been expecting.

"The highest priority for us is the 737 Max's safe return to service," said Mr Muilenburg recently. Indeed, it has been a key seller for the US firm, which has roughly 4,500 unfulfilled orders for the aircraft.

Boeing's Dennis Muilenburg says the firm's priority is getting the 737 Max flying again

For Airbus - under new CEO Guillaume Faury - it is the first airshow at Le Bourget since it made the decision to end production of its flagship A380. But the much-heralded unveiling of its A321XLR, is likely to garner positive headlines.

This is a single-aisle long-range airliner which Airbus hopes will generate new orders. Several carriers have already reportedly expressed an interest, including IAG - the parent group of British Airways and Iberia.

For Airbus this is possibly a strategy to counter Boeing's eventual NMA (New Midsize Aircraft) that the US firm has been working on. The twin-aisled NMA, also labelled the 797, has been designed in two variants: a 225-seat plane with a 9,300km (5,700 mile) range and a 275-seater flying 8,300km.

However, unlike Airbus's A321XLR this would be a totally new aircraft - so it would take a lot longer to see the light of day.

Airbus is expected to launch a new long-range version of its A321 aircraft

Away from the marketing battle between Airbus and Boeing, there will be more focus on unmanned aircraft, lighter and stronger alloys and composite materials - but the most significant developments may well be developments in hybrid and all-electric aircraft engines.

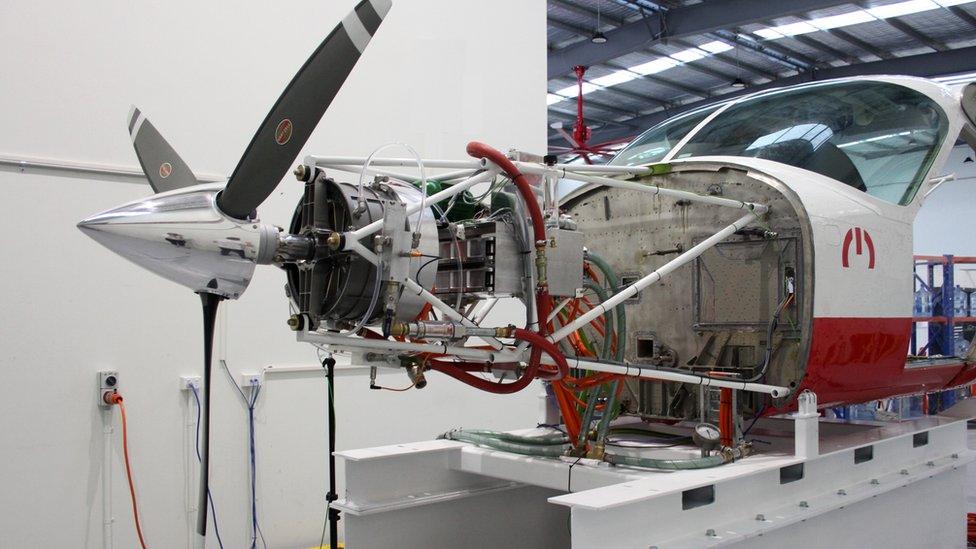

US firm magniX is showing off two of its electric motors at the show. It is working with North America's largest seaplane operator to retrofit the entire fleet with electric engines and magniX motors will also power the new all-electric Alice, a small passenger aircraft from Israeli firm Eviation.

MagniX says it wants to transform the "middle mile" segment of the market - that's cargo and passenger flights up to 1,000 miles (1,600km). "As we debut our propulsion system at the Paris Airshow, we're one step closer to all-electric air transport starting in 2022," says magniX chief executive Roei Ganzarski.

The shape of things to come? A magniX electric motor on test

All makers are keenly aware of the need to reduce CO2 emissions - commercial flights account for 2.5% of global greenhouse gasses. But as air passenger numbers double - even with battery-powered aircraft, alternative fuels and lighter materials, the goal of reducing overall CO2 emissions in the aviation sector remains as challenging as ever.

Aerospace

More from the BBC on aerospace and defence:

The sector has also seen significant business changes recently. Canadian-based manufacturer Bombardier has quit the commercial airliner business.

Airbus has taken over its C-Series regional jets, Bombardier has put its Northern Ireland factories up for sale and is talking about the sale of its remaining regional jets business to Japan's Mitsubishi.

Meanwhile, two of the US's major defence giants, United Technologies Corp (UTC) and Raytheon, have proposed a $121bn (£96bn) deal - combining the makers of missiles, electronic warfare systems, and engines for Airbus and the F-35 fighter jet.

After France's Rafale and its competitors, what fighter will come next?

When it comes to defence, notable newcomers include Boeing's KC-46 tanker and a PAC JF-17 fighter jet, a joint development between Pakistan and China. Japan is putting its military capabilities on show with its Kawasaki P-1 maritime patrol aircraft.

Yet much interest will centre on fighters, as European nations work out their visions for a next-generation combat plane. The big question is whether Europe can unite around a single design or whether countries will end up developing different sixth-generation fighter aircraft.

But as it took about 10 years of negotiating and talking in the 1970s, which led to requirements for fighters being firmed up in the 1980s - finally leading to Eurofighter Typhoon, Sweden's Gripen and France's Rafale in the 1990s - this year's show is unlikely to give us any quick answers.