Carney gives Facebook currency cautious welcome

- Published

Bank of England Governor Mark Carney gave Facebook's proposed digital currency Libra a cautious welcome in a major speech on Thursday.

He said it could substantially lower costs and increase financial inclusion, but needs regulation.

Mr Carney also announced that non-banks will be able to hold Bank of England accounts.

And he highlighted climate and sustainability concerns.

Mark Carney has given a swift and positive reaction to Facebook's plan, unveiled just last week, and one that will no doubt please Mark Zuckerberg and the rest of the Libra members.

However, while Mr Carney said he has an open mind, he is not offering an open door.

Unlike social media, where regulation is struggling to catch up after its mass adoption by billions of users, Mr Carney promised to make sure regulation to protect against risks including data privacy and money laundering is ready in advance.

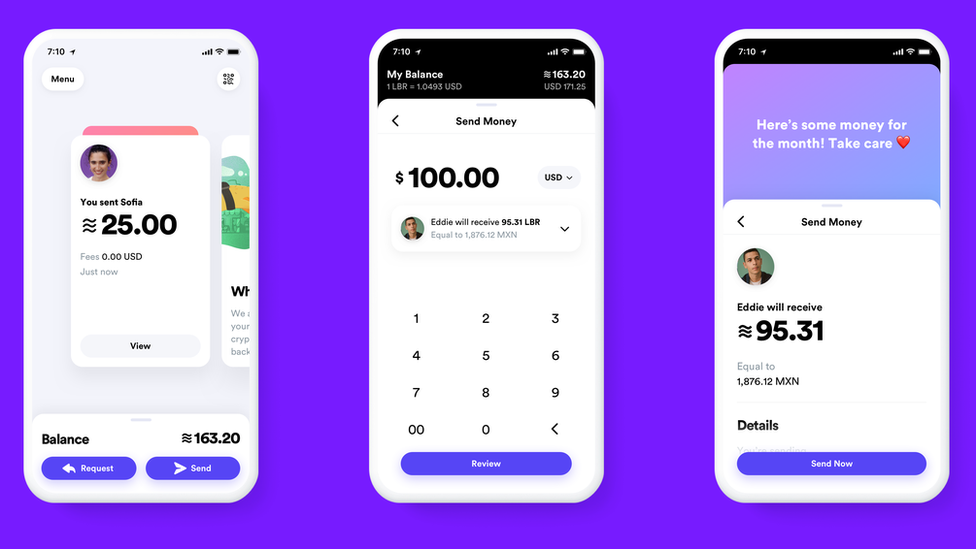

Libra is intended to be a currency that can be transferred via social media with its value based on a basket of real life currencies rather than the so-called crypto currencies whose value is not linked to existing exchange rates.

Libra, said Mr Carney, could be systemically important - and will be regulated accordingly.

The Libra Association said it was "committed to fostering a secure network" with anti-money laundering and anti-fraud programmes. It added that the association would not hold personal data.

This is a significant speech in many ways and may be looked back on as the time the fusty old bank of England really donned its digital trousers.

Bank of England accounts

Less headline-grabbing than Facebook but arguably more important was the announcement that the Bank of England will allow non-banks to have an account with them.

All the commercial banks we as customers bank with have their own account at the Bank of England where they store their reserves.

Allowing non-banks - for example payment companies like Square and Worldpay - to have their own account could make payments faster, cheaper, more reliable and more available to people outside the traditional banking system.

When I asked Bank officials what the existing High Street banks thought of this - there were some wry smiles - one said "I'm sure they will have a point of view and will want to express it".

The Bank will also lay some of the groundwork for an open platform for small business financing, Mr Carney said.

Climate concerns

The governor said the most important future risk was that posed by climate change.

This is a favourite subject of his and the Bank of England will be among the first regulators in the world to include the cost of future climate change (floods, droughts, crop failures, property damage) when it assesses whether financial institutions are strong enough to survive a crisis.

Mark Carney has just over six months left in the job.

With this speech he laid out a way to future proof the financial system he has overseen for nearly a decade.

- Published18 June 2019

- Published19 June 2019

- Published18 June 2019