Cannabis-laced beer and dog treats excite big firms

- Published

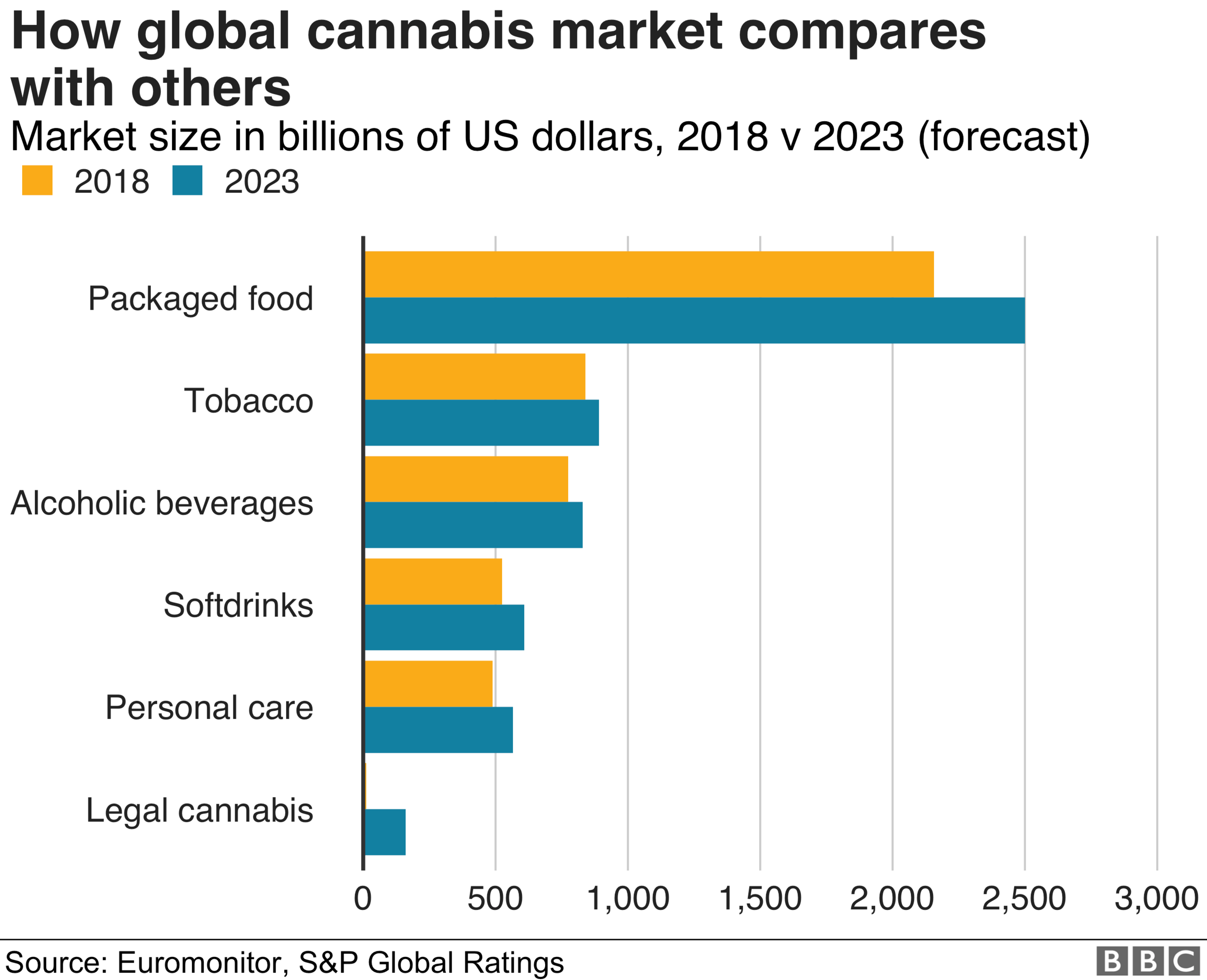

Big companies are scrambling to grab a share of the $150bn (£119bn) global cannabis market, eyeing products as diverse as beer and dog treats.

That's according to a report by Standard & Poor's, external which predicts further expansion as legal cannabis becomes acceptable.

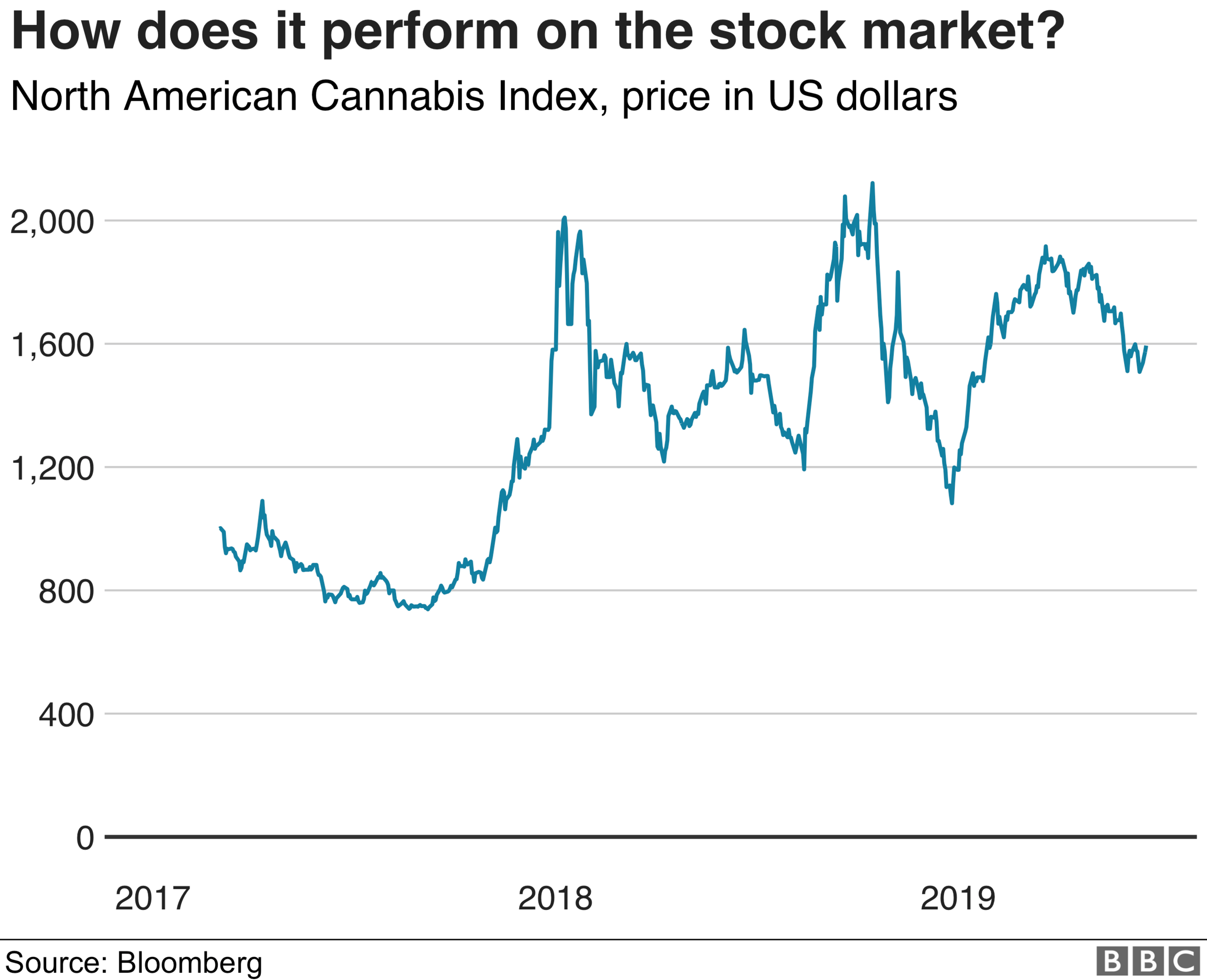

The report by the ratings agency says growth may be volatile, because of the changing regulatory framework.

But it points to growth in sectors such as healthcare, alcoholic beverages, soft drinks, tobacco, beauty and healthcare.

Indeed, two of the biggest investments in the sector have come from Altria, owner of Philip Morris cigarettes, and Constellation Brands, owner of Corona beer, which have each invested more than $1bn in such products.

So what's going on?

Cannabis, a family of plants, contains compounds which include tetrahydrocannabinol (THC) - which affects the mind and mood - and cannabidiol (CBD), which scientists are investigating as a medical treatment.

Companies are seeking options for growth at a time when their existing businesses are facing pressure.

Take alcohol. Younger drinkers are drinking less, the report says, and turning instead "to coffee shops and recreational cannabis for an experience".

But it's not just alcohol where growth is possible. "The makers of alcoholic and non-alcoholic beverages, health and beauty care products and cigarettes are among companies considering selling cannabis products," the report says.

Is it legal?

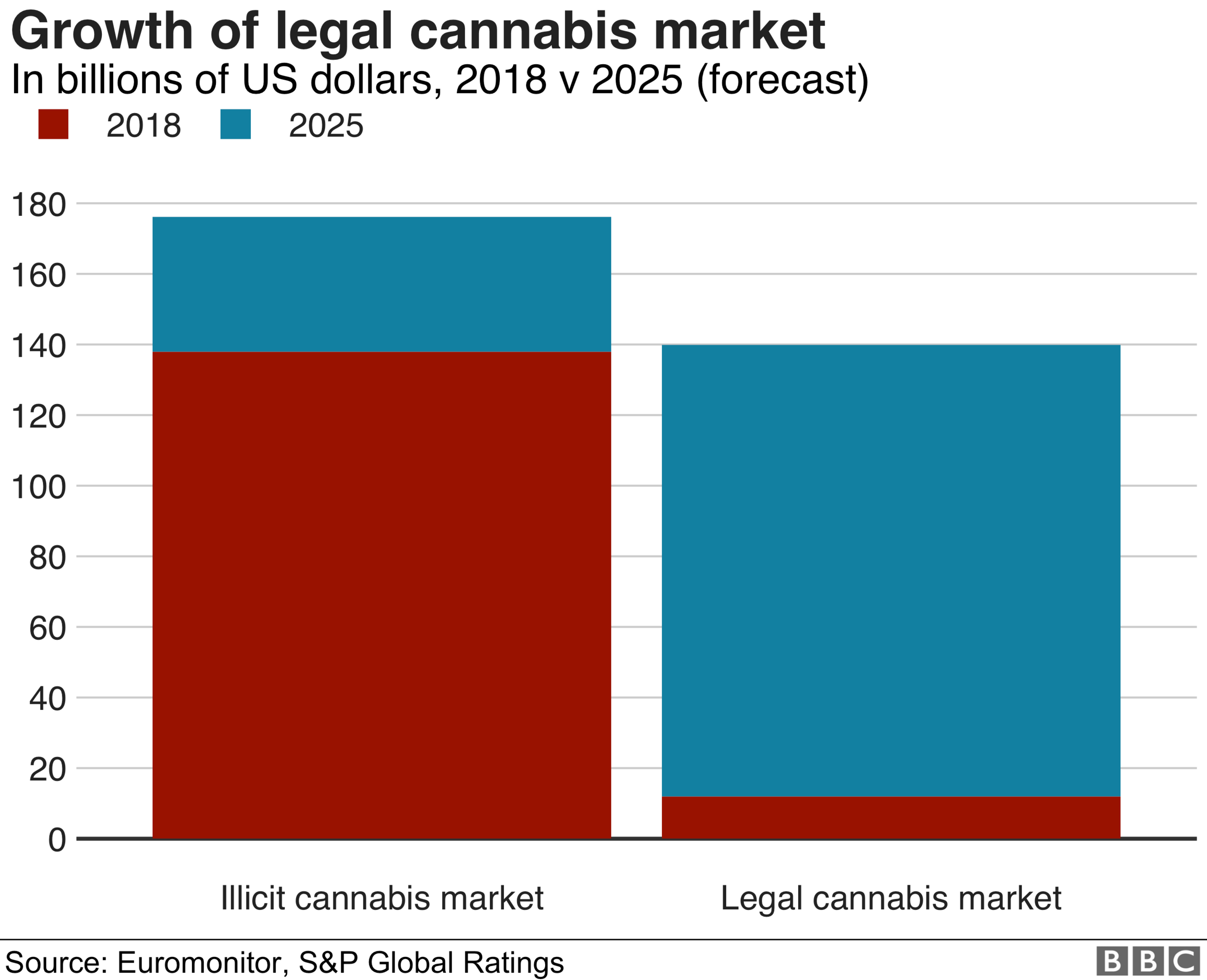

The report cites Euromonitor data showing a total market of $150bn - some 90% of which is illicit.

Euromonitor expects the legal cannabis market to grow to about $166bn by 2025.

"Large consumer product companies will attempt to capitalise on this growth, either through their own branded products or joint ventures with smaller partners that have the deep expertise with cannabis that they lack," the report says.

But it warns: "Regulatory issues may result in growth being volatile."

The outlook for growth assumes legalisation in new markets, notably the US, where the current illicit market is estimated at close to $50bn annually, the report says.

Most growth is expected in Canada, the US, western Europe and parts of South America.

"Although the push for legalisation so far is less pronounced in western Europe and South America - where only Uruguay has legalised it - Canada legalised cannabis in certain forms in October 2018 and will also legalise edible cannabis," the report said.

All but three US states have "okayed some form of medical cannabis use", it added.

But for legal cannabis products to reach their full potential, consumers will have to "shy away from illicit products".

Where will the growth come?

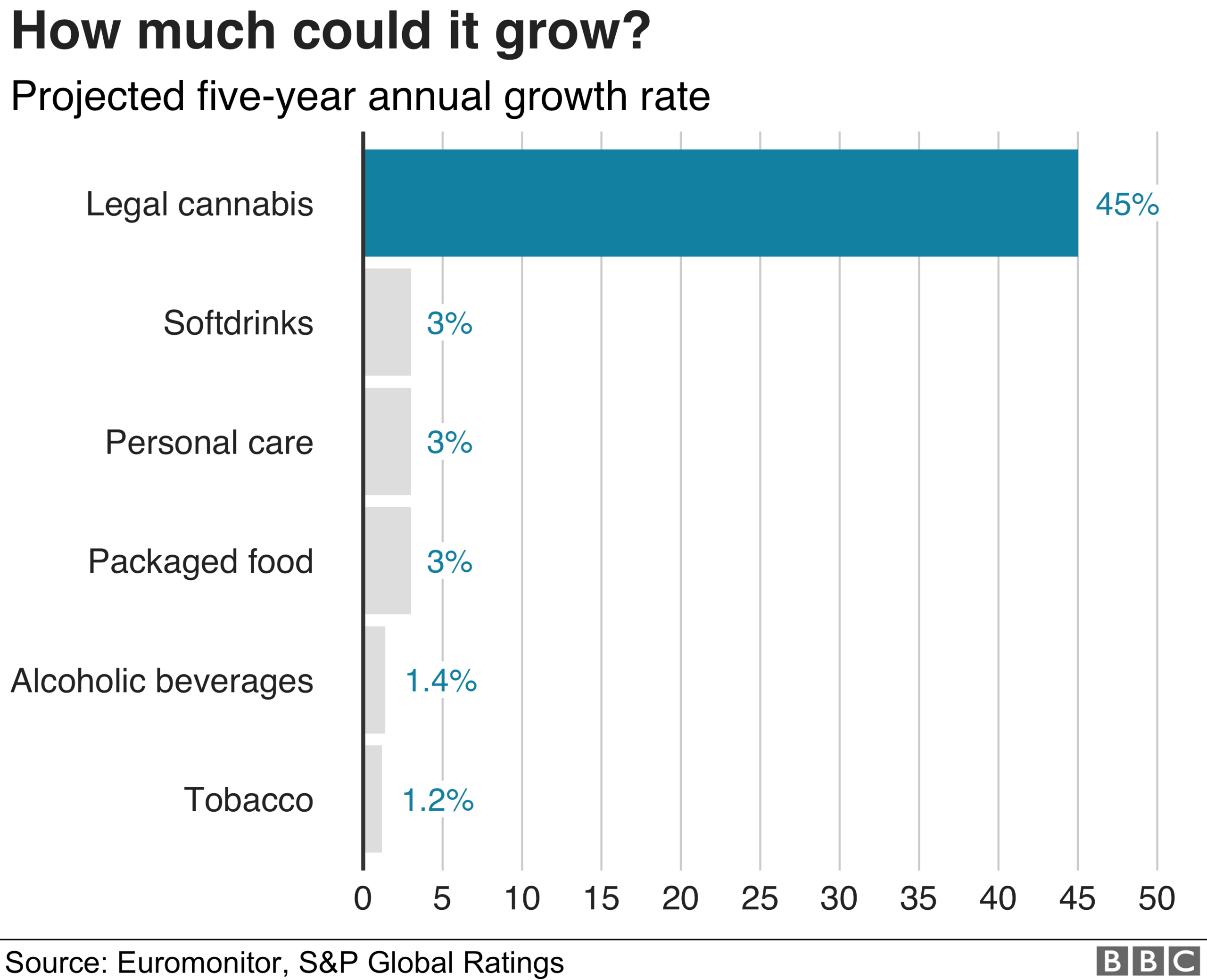

The report estimates that the growth in legal cannabis will outpace other consumer goods sectors, such as packaged food, soft drinks, tobacco and alcohol in the coming years.

For instance, it says that in the cigarette sector - where Altria paid $1.8bn for a 45% stake in Cronos Group, a Canadian cannabis company - there could be expansion.

Sales of traditional cigarettes are expected to fall in the US by up to 4.5% annually as the new generation of products, such as e-cigarettes, becomes more popular.

While these products may be the target for growth for cigarette companies initially, the report expects more of a focus on products from the cannabis family.

In anticipation of changes in the beer and spirits market, Constellation Brands has taken a stake in Canopy, another Canadian cannabis producer, which S&P's analysts say will provide growth opportunities for the company as beer and spirits sales slow.

Lawn and garden company Scotts Miracle Grow has invested $1bn buying companies that help users grow plants with little soil. "While hydroponics products are not solely dedicated to growing cannabis, we believe this is the primary purpose," the S&P analysts say.

The also point to the revenue-sharing arrangement that Authentic Brands Group - owner of clothing company Aeropostale and Spyder ski brand - has with medical marijuana company Tilray to market consumer cannabis products.

Who will be the winners?

"The early stages of wide cannabis use in consumer products is likely to produce many losers because of, to be blunt, the greed factor," the report says.

"Cannabis is still in the start-up phase of the industry life-cycle, with growth, shakeout, maturity and eventual decline to follow," it adds.

It gives the example of e-cigarettes where, they say, one of the first brands, blu, did not win because Juul developed a more appealing product.

Some companies are standing back at present, such as those in the soft drinks sector.

This is because they are finding scope for growth in areas such as flavoured and carbonated water and energy drinks.

The other issue at play is reputation risk. "Brand strength remains important to beverage giants like Coca-Cola and Pepsi and associating cannabis with a global brand could destroy brand equity if a negative social stigma were to attach to the core brands," the report adds.

- Published20 April 2019

- Published7 March 2019