Young, mega-rich - and demanding to pay more tax

- Published

Liesel Pritzker Simmons and husband Ian Simmons run an investment firm focussing on social enterprises

Liesel Pritzker Simmons is fabulously wealthy. But this member of one of America's richest families is also uneasy about it.

"It's time for us who are blessed with unusual financial success or luck to contribute more to our common good and common future," she told the BBC. "The best way that we in this fortunate bubble can contribute is that we want to be taxed more."

Ms Pritzker Simmons accepts it's a rather unorthodox view. But this week she, and 17 other super-rich individuals, set out their reasons in an open letter, external.

America's economic and social ills have created a crisis for the young, the poor, and the environment, they said. We don't have all the answers, but we can help: Impose a wealth tax on us - it's our moral and patriotic duty to hand over a bigger slice of our fortunes.

With her husband Ian, an heir to a family fortune himself, they discussed going public with people they knew held similar concerns.

Investor George Soros, Facebook's co-founder Chris Hughes, and Disney heiress Abigail Disney, were among those signing up. "There could have been more", Mr Simmons said. "We just wanted to pull in enough names to get the conversation going."

They are not wedded to a particular proposal, but one suggestion was this: Add a tax of two cents per dollar on assets after a $50m exemption, and one cent per dollar tax on assets above $1bn. It would generate nearly $3tn in revenue over ten years, they said.

Newspaper columnists and Twitter's angry brigade came out in force to criticise and mock this "billionaires club with a conscience" and bunch of privileged misguided do-gooders.

'Don't be afraid of us'

"This is an uncomfortable conversation. We recognise that," said Ms Pritzker Simmons, whose family built their fortune on the Hyatt hotel group. She's no desire to become a campaigning figurehead. Nor are any of them after a "pat on the back".

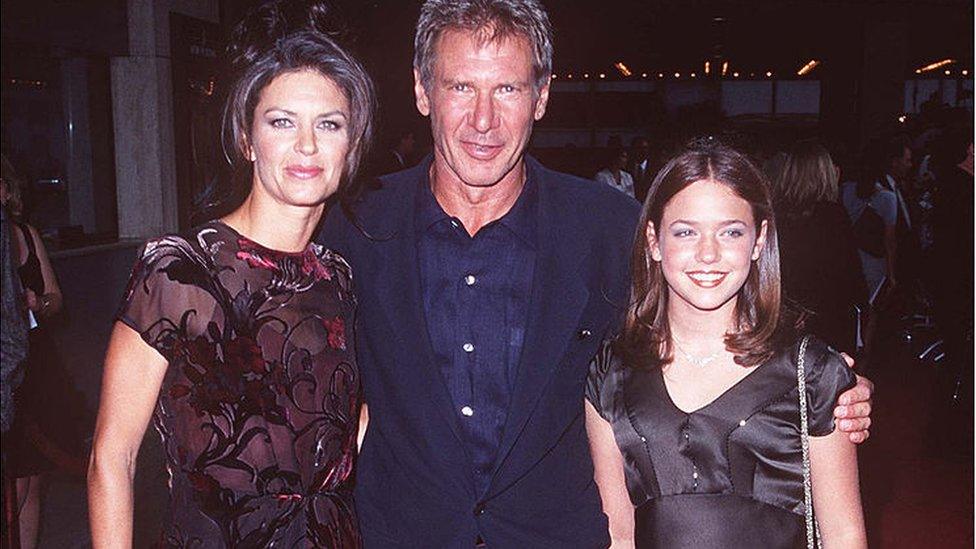

Anyway, she's had her share of headlines already, starting as a celebrated child actor in the Oscar-nominated A Little Princess and then as the daughter to Harrison Ford's US President in Air Force One. (A young Jodie Foster, he called her).

There was then a bitter court battle in which she successfully sued the family estate over her inheritance, reportedly securing $500m. Now 35 years old, she describes herself as "quite a private person", running an investment firm with her husband that focuses on social and environmental enterprises.

So why go public now? The idea of a wealth tax is gaining credence in the Democratic Party, and with the presidential debates underway it was felt now was the time to intervene.

Ms Pritzker Simmons said: "We just wanted to go on the record and say: please don't be timid about tax reform because you're afraid that this class of people is going to get upset.

"There's a healthy group of us who absolutely are in favour of it [a wealth tax], and we wanted to make that really clear to politicians and future politicians, as well as the American people."

In recent years, members of the mega-rich class have individually voiced worries about the wealth imbalance, including Warren Buffett. But the signatories hope their letter will prompt a group momentum.

Already the Swiss-born US-based billionaire Hansjoerg Wyss has added his name to the letter, and the property and insurance magnate Eli Broad has written of his support., external

Fixing the system

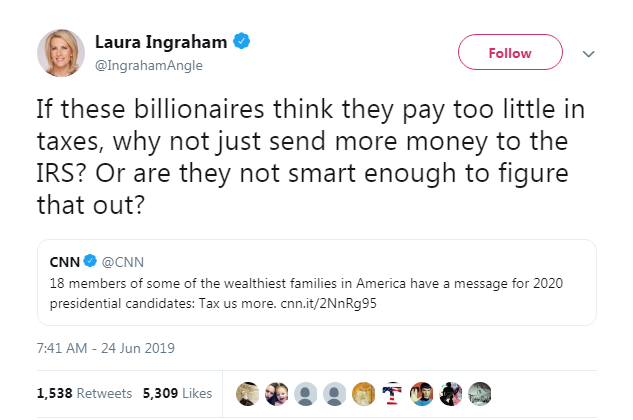

But they are not going unchallenged. Conservative US television talk show host Laura Ingraham was among the first out the blocks with a tweet that summed up the counter-view of many.

"If these billionaires think they pay too little in taxes, why not just send more money to the IRS? Or are they not smart enough to figure that out?" she tweeted her near-three million followers.

That misses the point, says Mr Simmons, 44. Writing a cheque to the Treasury is just philanthropy, and you can't address the challenges facing society based on the whim of rich people giving money away.

A young Liesel Matthews (her stage name) with Air Force One co-stars Harrison Ford and Wendy Crewson

"I don't think philanthropy is going to fix systemic wealth inequality, and nor do most economists who study inequality," he said. He's not dismissing philanthropy. He and his wife do their bit.

"But the good intentions of the few are not a substitute for good rules for everyone. Having a few of us write a few more cheques to the Treasury is not going to create universal childcare or take a revolutionary approach to the climate crisis or retire student debt."

Nor do they want the extra money ring-fenced for specific projects. "It's up to our government - that's what tax is for," Ms Pritzker Simmons said. "There are things that I personally care about, but [ring-fencing] betrays the purpose of a tax that benefits everybody."

She's convinced they're tapping into a new mood among voters: "We've watched a couple of generations of trickle-down economics, and it's not working. There is a change in mood, but it's based on solid data that shows things are not working."

Donald Trump - who once proposed a one-off wealth tax to tackle America's debt - points to Wall Street's record-breaking stock markets as evidence things are, in fact, working. "It's not a very compelling argument to the half of Americans who have absolutely no exposure to the stock market," she said.

She says voters - Republican and Democrat - are increasingly demanding action, which is why people who say Congress would never pass a wealth tax are wrong.

And while the rich can hide or undervalue assets, that's not an argument for doing nothing. As she puts it: "Are you really going to leave 50 cents on the table because you can't get the dollar."

America's top tier is not going to suffer after paying a bit more into the system, she said. "We will continue to have an incredibly fortunate life. If this [a wealth tax] is considered a hardship, then I think we're pretty lucky."

- Published24 June 2019