Funding Circle shares dive on growth warning

- Published

Samir Desai is chief executive and co-founder of Funding Circle

Funding Circle, which allows people to lend money to small businesses, has seen its shares dive after it halved forecasts for revenue growth.

The peer-to-peer lender said the "uncertain economic environment" had damaged demand for loans.

As a result, the company now expects revenues to grow by 20% this year, down from its previous forecast of 40%.

The news rattled investors, and shares in Funding Circle were nearly 30% lower by Tuesday afternoon.

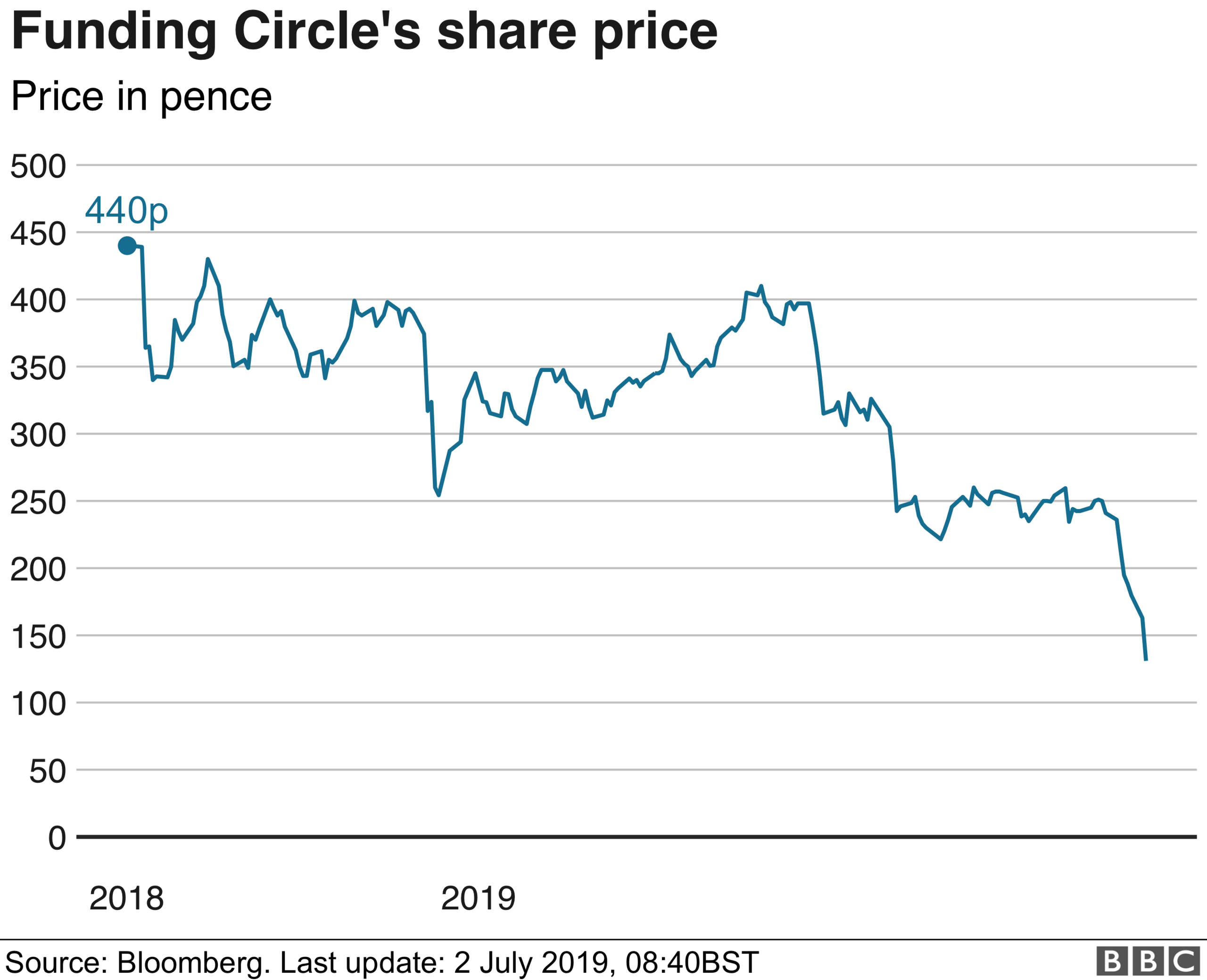

The firm listed on the London Stock Exchange late last year. However, the shares have fallen a long way from the flotation price of 440p and on Tuesday were trading at about 120p.

"The uncertain economic environment has reduced demand from small businesses and led us to proactively tighten lending criteria," said Funding Circle's chief executive, Samir Desai.

Funding Circle draws on a pool of funds collected from individuals and firms, which is then lent to small businesses vetted by the company.

Because it cuts out banks, Funding Circle was billed as a disruptive force in lending.

But in April, the company's shares took a hit after it announced plans to wind down a fund that financed a number of small business loans.

The company has yet to turn a profit, but on Tuesday Funding Circle said it expected the annual loss for 2019 to be lower than in 2018.

"We remain confident in our aim to become the world's largest small business loans provider, helping millions of businesses to create jobs and support economic growth," Mr Desai said.

Funding Circle also said it was "pausing" plans to expand into Canada in order to focus on its existing markets, mainly Britain and the US.

The disappointing news from Funding Circle, which is one of the UK's most prominent peer-to-peer lenders, comes as the sector attracts scrutiny from regulators and investors.

In June, the Financial Conduct Authority announced plans to limit the amount private investors could put into peer-to-peer lending firms.

The decision followed problems at Lendy, which crowdfunded loans before falling into administration in May.

The disruptive business model that has left investors cautious

Peer-to-peer lending was going to be the next big thing in small-business lending, filling the gap left after the financial crisis a decade ago when many banks sharply curtailed their activity.

The idea was pleasingly simple, and also spoke to individual's desires to support entrepreneurs and make money while doing so.

Funding Circle and other companies set up exchanges that matched lenders - often members of the public - with small businesses that needed money. It was hailed as a disruptive business model that would make life hard for the big banks, and tech investors swing behind it, making Funding Circle one of the first, and most lauded of Britain's "unicorns" - private companies valued at more than $1bn.

All the while though, critics have sniped.

Peer-to-peer lenders would never be able to do the kind of due diligence that banks' small business departments had done for years - and they would inevitably be left with the dross that had been passed over for bank loans.

Some investors carped that they had been matched with dud companies, while regulators have periodically issued warnings about the need for greater scrutiny of borrowing companies.

This morning's unscheduled trading update from Funding Circle seems to flesh out some of those fears - a downturn has led the company to tighten its lending criteria. The share price neatly sums up investors new found caution - it floated on the London exchange just 10 months ago, at 440p a share. It now trades below 130p.

- Published3 October 2018

- Published22 October 2018