'Grave concern' as sales of low emission cars fall

- Published

- comments

Sales of low emission cars in the UK have fallen for the first time in more than two years, the industry has said.

The decline comes as overall sales of new cars continued to fall, dropping 4.9% in June from the year before.

The Society of Motor Manufacturers and Traders said, external the fall in alternatively fuelled cars, such as hybrid electric vehicles, was "a grave concern".

It said efforts to sell such cars were being undermined by confusing policies and "premature" removal of subsidies.

The SMMT said sales of plug-in hybrid cars in June had halved since the same month a year earlier, while hybrid electric vehicle sales were down 4.7%.

This meant that the alternatively fuelled car sector saw overall sales fall for the first time since April 2017.

In last year's Budget, subsidies for plug-in hybrids were scrapped, and reduced for battery electric vehicles.

"Another month of decline is worrying but the fact that sales of alternatively fuelled cars are going into reverse is a grave concern," said Mike Hawes, SMMT chief executive.

"Manufacturers have invested billions to bring these vehicles to market but their efforts are now being undermined by confusing policies and the premature removal of purchase incentives.

"If we are to see widespread uptake of these vehicles, which are an essential part of a smooth transition to zero emission transport, we need world-class, long-term incentives and substantial investment in infrastructure."

A Department for Transport spokesperson said: "The plug-in car grant has supported the purchase of 180,000 new cars with over £700m, including 100,000 plug-in hybrids, and the government is now focusing on the cleanest, zero emission models.

"That focus has paid off - with registrations of battery electric vehicles up over 60% this year compared to the same period in 2018."

When will the tipping-point for electric sales arrive in Britain?

Analysis by Tom Burridge, Transport Correspondent

Driving-up sales of fully electric vehicles is the top priority for the Department for Transport, hence its decision to scrap grants for hybrids last year which will have contributed to the decline of hybrid sales.

Privately officials admit that the charging infrastructure for electrics is not where it should be.

The government says it is working with local authorities across the UK to address that.

Charging points on streets with no off-street parking is a particular challenge.

Another reason given for why sales of all low emission cars has not yet sky-rocketed in Britain is the up-until-now relatively low number of models on the market.

That is set to change over the next year or so with plenty in the pipeline.

And manufacturers have another reason to act. They could face fines if their new cars aren't green enough once European Union regulations kick-in in 2021.

Much has been said of the government's target of no new diesels and petrols by 2040.

But a more interesting question is: when will the tipping-point for electric sales arrive in Britain?

Experts inside and outside of government talk about 2025.

Norway has already reached its electric tipping point. High taxes for polluting vehicles and financial incentives for electrics mean for many there it's cheaper to buy and run an electric car.

Getting, at least close, to price parity in Britain will also be key.

'Continuing confusion'

Karen Johnson from Barclays Corporate Banking said that while the dip in overall car sales was "no surprise", the fall in alternatively fuelled vehicles "will be more of a shock, and should make policymakers sit up and take note".

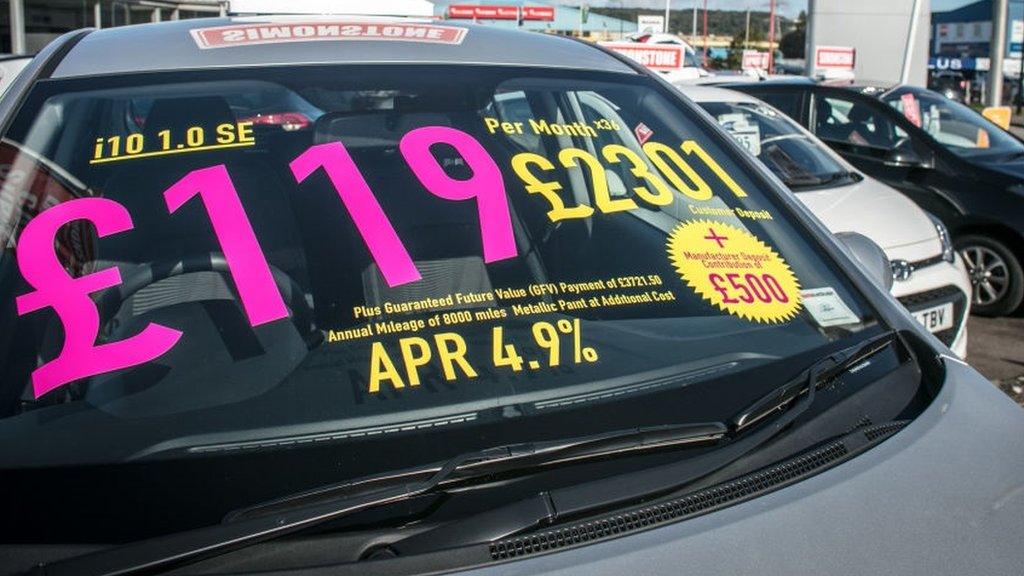

"There are two main factors hitting new car sales. One is the broader economic environment that is affecting consumer and business confidence across the retail sector, with big-ticket items particularly affected. The other is the continuing confusion around fuel types and the impact of new regulation on the future value of vehicles," she said.

"People are having to guess what the next policy move will be and this is affecting the used car market, with some book values down in part due to fears about future prices if further regulatory changes are introduced. This has a knock-on effect on appetite for new vehicles."

- Published27 June 2019