Government-owned bank 'forging signatures' in repossession cases

- Published

Brenda and John Wright believe there is a discrepancy in the signatures on the statements of truth used to evict them

Representatives of a government-owned bank are suspected of forging signatures on court documents in repossession cases, the BBC's Victoria Derbyshire programme has been told.

In the US, such practices - on a very large scale - led to billion-dollar fines and millions in compensation.

The allegations relate to UK Asset Resolution and loans from Northern Rock, Bradford & Bingley, Mortgage Express, also Lloyds Banking Group.

The companies strongly deny the claims.

The signatures, of bank officials and legal representatives, are found on documents such as statements of truth and witness statements submitted to the courts as part of repossession proceedings.

'Hand over the evidence'

Adam Brand, a handwriting expert witness in forgery cases, says he has seen dozens of examples provided by online action group the Bank Signature Forgery Campaign. In those cases, he considers it highly likely that different people have been signing under the same name.

Conservative MP Charlie Elphicke, who sits on the Treasury Select Committee, said it must investigate.

And if proven, it could constitute contempt of court.

"You can be jailed for it," he said.

"We need to know how widespread this is."

He said there was "enough evidence now to suggest this may be not a one-off but a systemic practice".

"Both Mortgage Express and Lloyds need to cooperate, fully - and hand over the evidence," he said.

Brenda and John's story

In 2014, Brenda and John Wright - now both in their 70s - were evicted from their rented flat in Southport, Merseyside.

There had been a dispute between the bank and the flat's owner over some mortgage arrears and they were served a notice of repossession.

Ms Wright said they "could have had it all paid off within 10 months" but their offer to pay more rent to help clear the arrears had been declined.

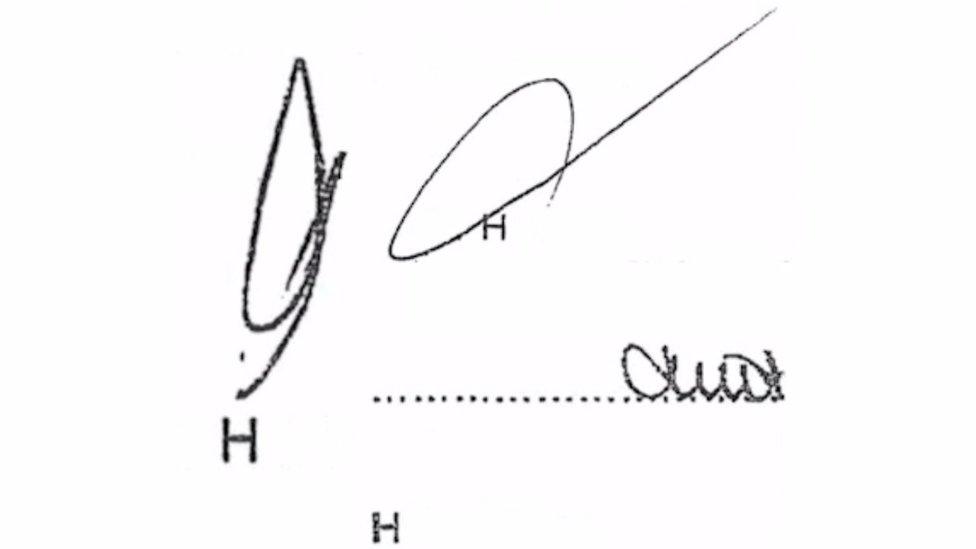

Following their eviction, the couple said they saw a "discrepancy" in the signatures on documents from legal representatives for Mortgage Express, which appeared to suggest different people had signed over the same name on statements of truth used to evict them.

Each of these signatures was attributed to the same person on court documents

BBC News has shown them to handwriting expert Adam Brand.

He said the "whole movement and the fluency" of the signatures looked different.

UK Asset Resolution [UKAR] said in a statement that it "completely rejects the allegation that it has had any involvement in the practice of systemic signature forgery".

A cross-party group of MPs from the All Party Parliamentary Group on Fair Business Banking has now backed the Bank Signature Forgery Campaign.

Its founder, Julian Watts - who believes he is also a victim of forged signatures - is looking for evidence he believes will show the practice has occurred routinely in the UK, which banks strongly deny.

In the US, banks were fined $25bn (£19bn) in 2012 and had to compensate millions of people for being repossessed illegally.

Thousands of documents were found to have been signed under one name, Linda Green.

Julian Watts claims the practice has happened routinely in the UK, which banks strongly deny

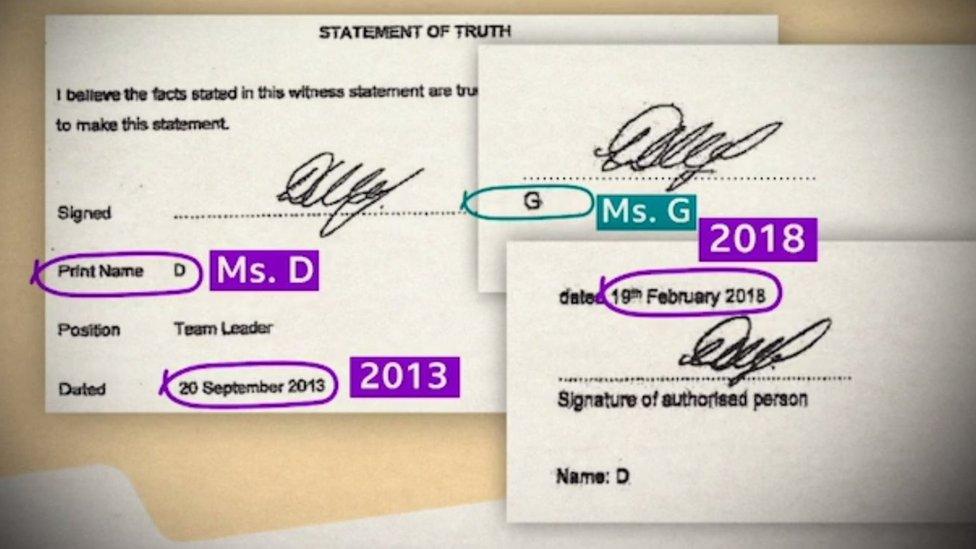

Mr Watts said the signature used in actions by Mortgage Express to evict John and Brenda Wright had also been used, under a different name, to evict another tenant, in Gloucester, at about the same time.

And, he said, he had now been sent evidence the same signature had been used over different names in 2018 - five years later.

"The likelihood that these different people have such a similar signature is tiny," he said.

Similar signatures in appearance were used under two different names, Ms D and Ms G

UKAR, which rejects the allegations, said that "treating customers fairly is a priority".

It said it repeatedly asked the BBC to show evidence of the practice, but it had refused to do so.

We did not share names of the signatories due to concerns over privacy.

A spokesman for Lloyds said: "We recognise the impact that repossessing a home can have on our customers and are fully committed to doing everything reasonably possible to support mortgage customers in financial difficulty."

It said it did not have enough details to respond to wider allegations of the use of forged signatures, but strongly denied one case in which the BBC provided details.

Follow the BBC's Victoria Derbyshire programme on Facebook, external and Twitter, external - and see more of our stories here.

- Published29 March 2019