US labour market booms in June

- Published

The US labour market boomed in June, creating many more jobs than expected, according to the latest report from the Bureau of Labor Statistics., external

It showed that 224,000 jobs were created in June, many more than the 160,000 that economists had forecast.

The figures, a rebound from poor jobs data in May, eased concerns the economy was heading for a recession.

The professional and business services sector was the biggest contributor to employment, adding 51,000.

Large numbers of jobs were also created in healthcare, transportation and warehousing.

Despite the strong job creation in June, wage growth was relatively modest at 0.2%, keeping the annual rate at 3.1%.

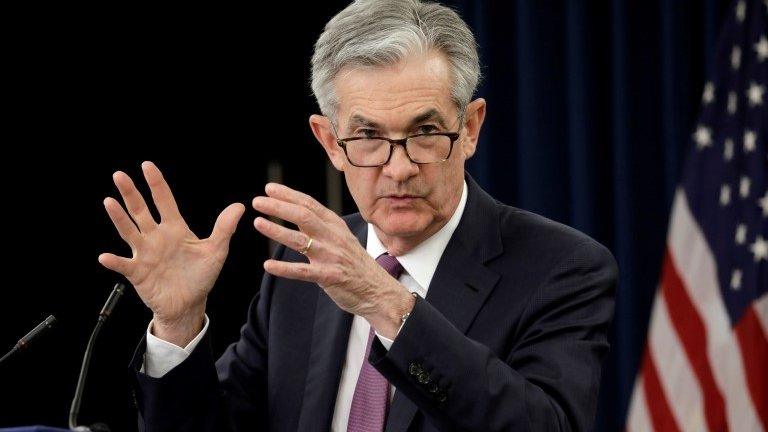

The jobs data is closely watched by economists who analyse how it might affect interest rate decisions at the US Federal Reserve.

Some are betting that the Fed might lower interest rates following its next meeting which starts on 30 July.

Last month the Fed indicated that interest rates might head lower due to subdued inflation and the effects of the trade war between the US and China.

'Fall out of bed'

"These are good numbers, but a rate cut in July is still all but inevitable," said Luke Bartholomew, investment strategist at Aberdeen Standard Investments.

"Employment growth remains a bright spot amid a fairly mixed bag of US data and yet markets have come to expect a cut now so will fall out of bed if they don't get one."

Andrew Hunter, senior US economist, at Capital Economics also forecasts a rate cut, although not until September.

"Employment growth is still trending gradually lower but, with the stock market setting new records and trade talks back on (for now at least), the data support our view that Fed officials are more likely to wait until September before loosening policy," he said.

The US has posted some poor manufacturing data recently, prompting concerns that the economy was heading for a downturn.

But Doug Duncan, chief economist at Fannie Mae, said the numbers suggest "that what has been seen in the manufacturing sector doesn't appear to indicate we may be heading into a recession... the warning signs people saw in manufacturing might not be so strong".

- Published3 November 2020

- Published19 June 2019