Does cutting corporation tax always raise more money?

- Published

The claim: Cutting the rate of corporation tax in the UK always increases the amount of revenue it raises.

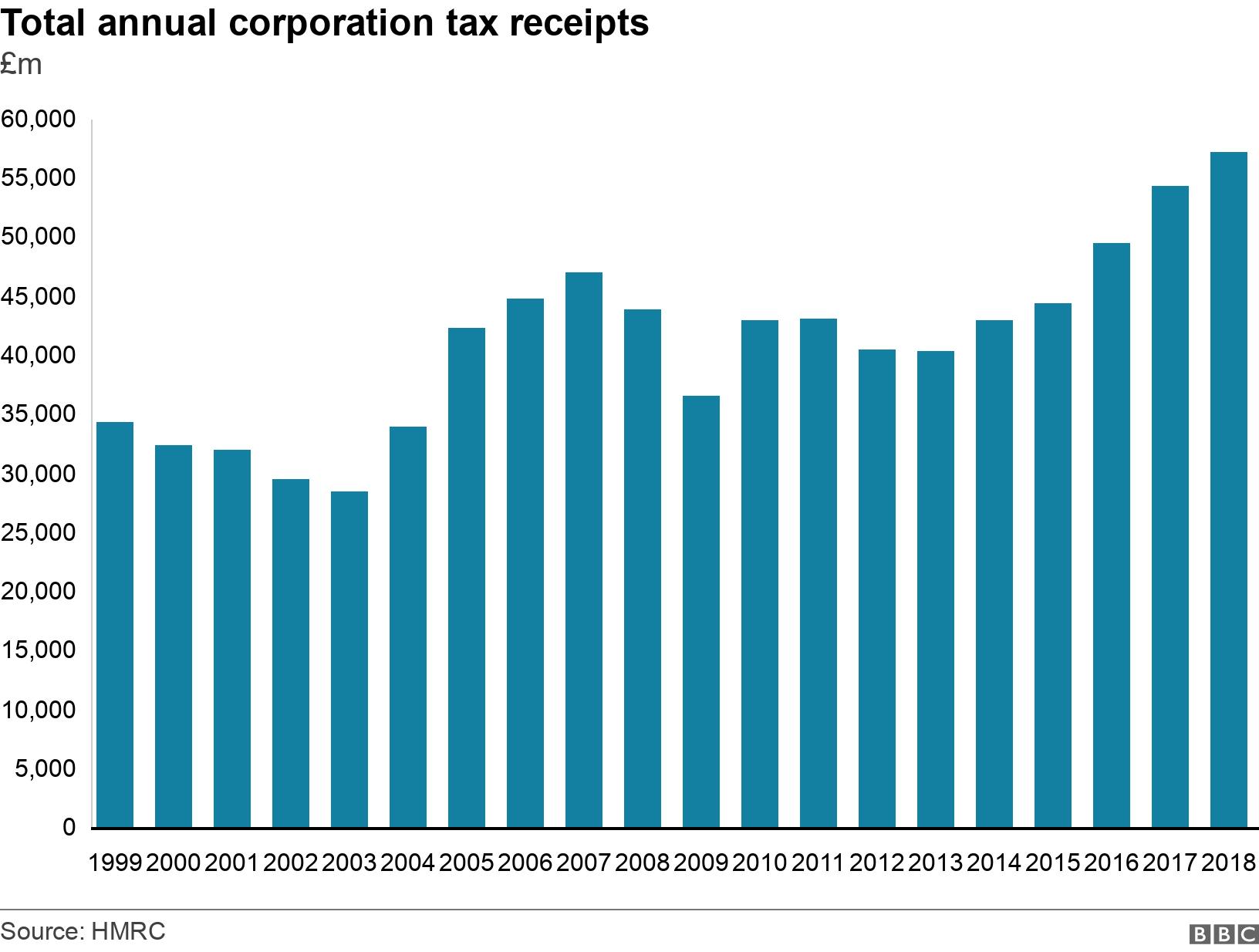

Reality Check verdict: No it doesn't. Although there have been increases in revenue following recent cuts in corporation tax, the amount raised in the two years following the rate cut in April 2008 fell.

Boris Johnson, one of the candidates to replace Theresa May as Conservative leader and prime minister, told party members in Darlington that cutting the rate of corporation tax always increased the amount of revenue raised.

The corporation tax rate, which is the tax companies pay on their profits, has been cut from 28% in 2010 to the current rate of 19%. It is due to fall again to 17% next year.

Revenue has been rising, despite these cuts in the rate. The theory behind this is that reducing the tax attracts companies to the UK and encourages firms to invest in their businesses, which means more money is eventually paid to the government.

But there are other things going on here - the period since 2010 has been a time of gradual recovery from the financial crisis, so you would expect company profits, and hence the corporation tax take, to have been rising.

So since 2010 there have been examples of revenue rising following a corporation tax cut, although the Institute for Fiscal Studies (IFS) says, external that the amount raised would have been higher still if the cuts had not been made.

Let's look at another example - the 2007 Budget announced that the main rate of corporation tax would fall from 30% to 28% from April 2008.

It will surprise nobody to learn that revenue from corporation tax fell sharply in 2008-09 and 2009-10 as the financial crisis hit company profits.

But just looking at tax rates and revenues without considering what is going on in the economy and the overall tax system is misleading.

More worthwhile assessments would need to look at the longer term effects of a cut in corporation tax on the profitability and behaviour of companies.

HMRC produces a ready reckoner, external which estimates that a one percentage point cut in the tax would cost £3.1bn in 2022-23.

But the government has also done modelling, external to find out what effect things like changes to wages and consumption in the long term could have on the government's tax take.

It concluded that over a 20-year period they could reduce the losses to the exchequer from the cut to corporation tax by between 45% and 60%.

And after changes to the rate of corporation tax for 2020-21 from 18% to 17% were announced in the 2016 Budget, the Office for Budget Responsibility estimated, external that this would reduce revenue by £945m.

So there is considerable doubt about the precise long-term effects of a cut in corporation tax, depending on what you take into account.

However, no authority suggests that it will always increase revenue.