Lloyds now receiving over 190,000 PPI queries a week

- Published

- comments

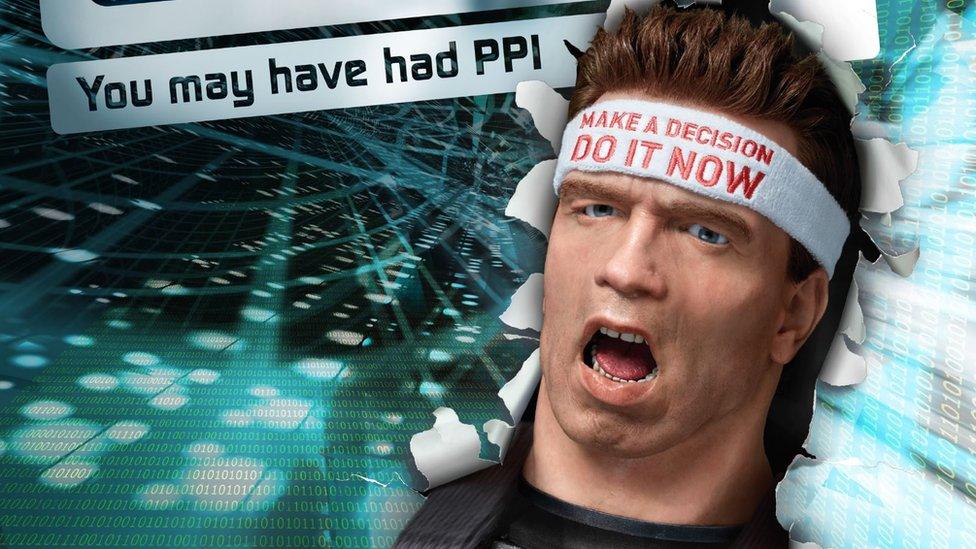

An advertising campaign featuring an animatronic head of Arnold Schwarzenegger has been reminding consumers to make claims

Lloyds Banking Group has seen its profits impacted by a last-minute rush in people putting in payment protection insurance (PPI) claims.

Loan customers who were mis-sold PPI have until 29 August 2019 to claim for compensation.

Lloyds said it had set aside an additional £550m for future claims due to a "significant increase in claims".

In total, £1.1bn has been earmarked for PPI compensation. Lloyds expects claims to rise to 5.8 million by the deadline.

Pre-tax profits fell 7% in the six months to 30 June, from £3.1bn to £2.9bn like-for-like.

As many as 64 million PPI policies were sold in the UK from as long ago as the 1970s. They were designed to cover loan repayments if borrowers fell ill or lost their job, but many pushed to people who didn't want or need them or who could not use them.

Lloyds' chief financial officer George Culmer said: "It's obviously disappointing to see an increase in PPI claims. On one hand, we were happy to see the time bar as it meant more customers would come forward, and we're glad that it's having the desired effect.

"However, the extent at which it's happening has caught us by surprise. We're getting upwards of 190,000 requests a week, with only 10% being converted into claims."

Mr Culmer said that usually the bank would receive 70,000 information requests a week about PPI claims.

However, requests went up to 150,000 a week in the second quarter of 2019 and to almost 200,000 in July.

The Financial Conduct Authority (FCA), which set the claims deadline, has been running an advertising campaign since 2018 with an animatronic head of Arnold Schwarzenegger encouraging consumers to "do it now", to persuade people to make a claims for compensation if they were mis-sold PPI.

Despite the profit fall, Lloyds said its outlook for 2019 was in line with expectations as it had cut costs to offset the impact of the PPI claims.

Donald Brown, senior investment manager at Brewin Dolphin, said: "Net income and profits may be down, but against the current economic backdrop it's a resilient set of results for the half-year."

- Published27 July 2019

- Published24 July 2019

- Published24 June 2019