US shares recover as Trump renews Federal Reserve attack

- Published

Mr Trump brushed off worries in the financial markets

US share prices recovered after earlier heavy losses, that were sparked by fears about a trade war and the health of the global economy.

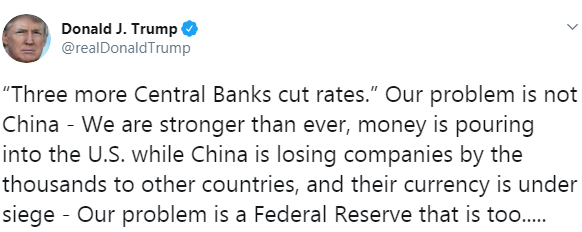

India, Thailand and New Zealand cut interest rates overnight, prompting a fresh Twitter attack on the US Federal Reserve by President Donald Trump.

The uncertainty sparked another fall in the oil price, down almost 3%.

Gold briefly topped $1,500 an ounce, a price not seen since April 2013, as demand for haven assets rose.

All three major Wall Street markets had been trading down about 1.5% during the morning, with the Dow Jones index dropping 2% at the start of trading. But at the close, the Dow and S&P 500 were almost flat, while the Nasdaq added 0.3%.

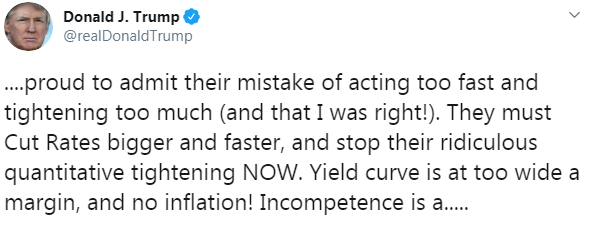

Mr Trump again lashed out at the US central bank, demanding more economic stimulus as the 2020 presidential elections approach, and accusing the Federal Reserve of posing more of a threat than China.

He tweeted: "Our problem is a Federal Reserve that is too..... proud to admit their mistake of acting too fast and tightening too much (and that I was right!)."

And speaking to reporters at the White House later, he brushed off concerns about falling share prices.

"I would have maybe anticipated even more" market reaction. "Ultimately it will go much higher than it ever would have gone because China was like an anchor on us."

His comments come amid growing fears that trade tensions between the US and China could deepen over the next few months. Weak industrial output data from Germany, Europe's biggest economy, also unsettled investors.

"(Markets) are moving lower on global growth concerns. And coming into question is the broader fundamental strength of economies around the world, " said Mike Loewengart, vice president of investment strategy, at E-Trade Financial.

Peter Cardillo, chief market economist at Spartan Capital Securities, added: "It's all about the fear factor over the trade war and the impact of the trade war on growth.

"Things are just falling out of bed. You have gold soaring this morning. Obviously, investors are running for safety."

- Published2 August 2019

- Published31 July 2019

- Published31 July 2019