General Electric: Madoff investigator alleges $38bn fraud

- Published

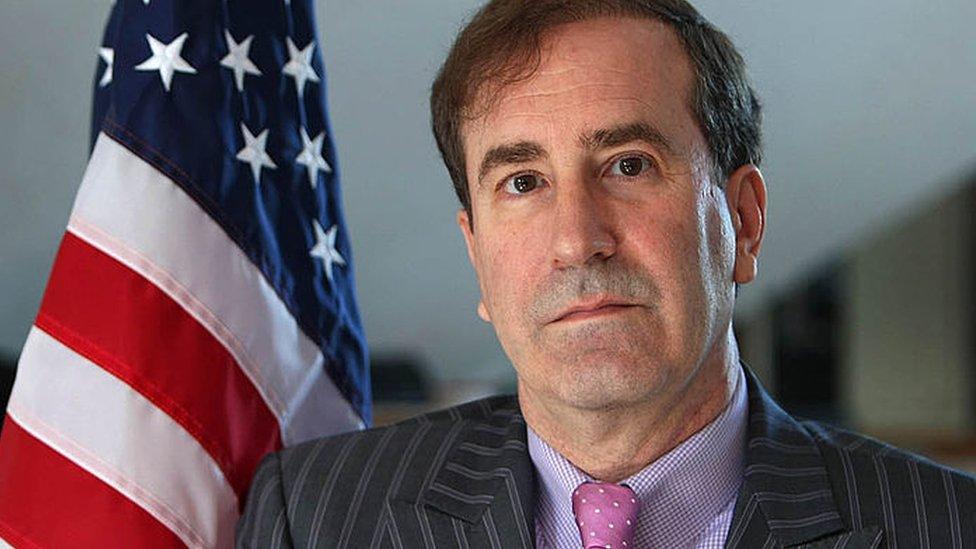

Harry Markopolos alerted regulators about Bernard Madoff's Ponzi scheme in the early 2000s

A private financial investigator who flagged warnings about Bernard Madoff's $65bn Ponzi scheme is now targeting one of America's blue chip companies.

In a 175-page report Harry Markopolos claimed General Electric (GE) was hiding an accounting scandal.

He accused GE of concealing $38.1bn in potential losses and alleged the company's cash situation was far worse than disclosed.

GE called it "meritless, misguided and self-serving speculation".

Chief executive Lawrence Culp also accused Mr Markopolos of "false statements of fact" and said he had not checked his facts with GE before publishing.

Mr Markopolos's analysis of GE's financial position, external, called General Electric: A Bigger Fraud Than Enron, claims: "The $38bn in accounting fraud amounts to over 40% of GE's market capitalization, making it far more serious than either the Enron or WorldCom accounting frauds."

The report highlights the conglomerate's exposure to long-term care insurance in the US and its oil industry services business.

Mr Markopolos's referencing of two of corporate America's most notorious frauds in the report was seen as potentially serious, as both led to criminal prosecutions.

In the past two years GE has announced more than $40bn in writedowns

GE's share price fell 15% on Thursday following news of the report and an appearance by Mr Markopolos on the CNBC television network. The stock closed down 11%, GE's worse one-day fall in 11 years. As a sign of faith in his company, Mr Culp bought $2m worth of GE shares, according to reports, external.

Mr Markopolos disclosed that he had given an advance copy of his report to an unnamed hedge fund, and would receive a percentage of the profits from any share price movement.

Some analysts dismissed the report, with John Hempton, co-founder of the Bronte Capital hedge fund calling it "silly". However, Reuters noted that there are Wall Street analysts who have long been concerned about claims of GE's low cash flow, charges and asset writedowns, and alleged opaque financial reports.

In the past two years GE has announced more than $40bn in writedowns and accounting charges. The company has also disclosed that its accounting is being investigated by the Securities and Exchange Commission and the Department of Justice.

'Financially motivated'

Mr Culp told reporters in the US that Mr Markopolos' report contained factual errors and constituted "market manipulation - pure and simple", because the investigator stood to profit from short-selling tied to its release.

Earlier, GE issued a robust response to Mr Markopolos, external: "We remain focused on running our business every day and... will not be distracted by this type of meritless, misguided and self-serving speculation."

The company said it "stands behind its financials" and operates to the "highest-level of integrity" in its financial reporting.

"Mr Markopolos openly acknowledges that he is compensated by unnamed hedge funds. Such funds are financially motivated to attempt to generate short selling in a company's stock to create unnecessary volatility."

He is best known for alerting regulators in the early 2000s to signs that money manager Bernard Madoff's investment firm was a Ponzi scheme, a deception in which unusually high returns for early investors are generated with money from later investors.

Madoff was arrested in 2008 and later sentenced to 150 years in prison for the fraud.