No-deal Brexit 'could hit house prices'

- Published

- comments

UK house prices could drop by 6.2% next year if the UK leaves the EU without a deal on 31 October, according to accountants KPMG.

However, if a deal is reached, KPMG predicts that house prices will rise by 1.3%.

London will probably see a fall in prices with or without an exit deal this year and next, it said, with sharper declines if no deal is reached.

However, the low supply of new housing stock could prop up prices over time.

"Overall, while a no-deal Brexit could dent property values in the short term, it may make less impact on one of the fundamental factors driving the market: the stock of regional housing," said the report., external

"Housebuilders are expected to reduce the supply of new housing in some regions in the short term as a response to a deteriorating economic outlook.

"So, while there will be fallout from the initial economic shock following a no-deal Brexit, the market is expected to recover most ground in the long run," it said, assuming the economy recovers.

Given that the housing market is hard to predict, KPMG said prices could see steeper falls - of perhaps 10-20% - in a no-deal scenario.

"Transactions volumes will likely fall much more than prices - making government housing delivery targets impossible to achieve and slowing new building across the sector," said Jan Crosby, UK head of housing at KPMG.

Assuming no agreement is reached, KPMG says Northern Ireland will be the hardest hit next year, with average price declines of 7.5%, followed by London at 7%. The least-hit will be Wales and the East Midlands, with 5.4% declines apiece.

This year, most regions will see changes of less than 2%, KPMG says, with the exception of London, down 4.8%, and Northern Ireland, down 2.2%.

If a deal is struck, prices in London and Northern Ireland are still predicted to fall this year, by 4.7% and 1.2%, while most other regions will be largely unchanged. Scotland and the North West will see gains of 1.4% and 1.6%.

In event of a no-deal Bexit

6.2% fallif UK leaves the EU

7.5%fall in Northern Ireland (highest)

7%fall in London

5.4%fall in East Midlands and Wales (lowest)

And next year, all regions will gain aside from London's predicted 0.2% slide. The average increase will be 1.3%.

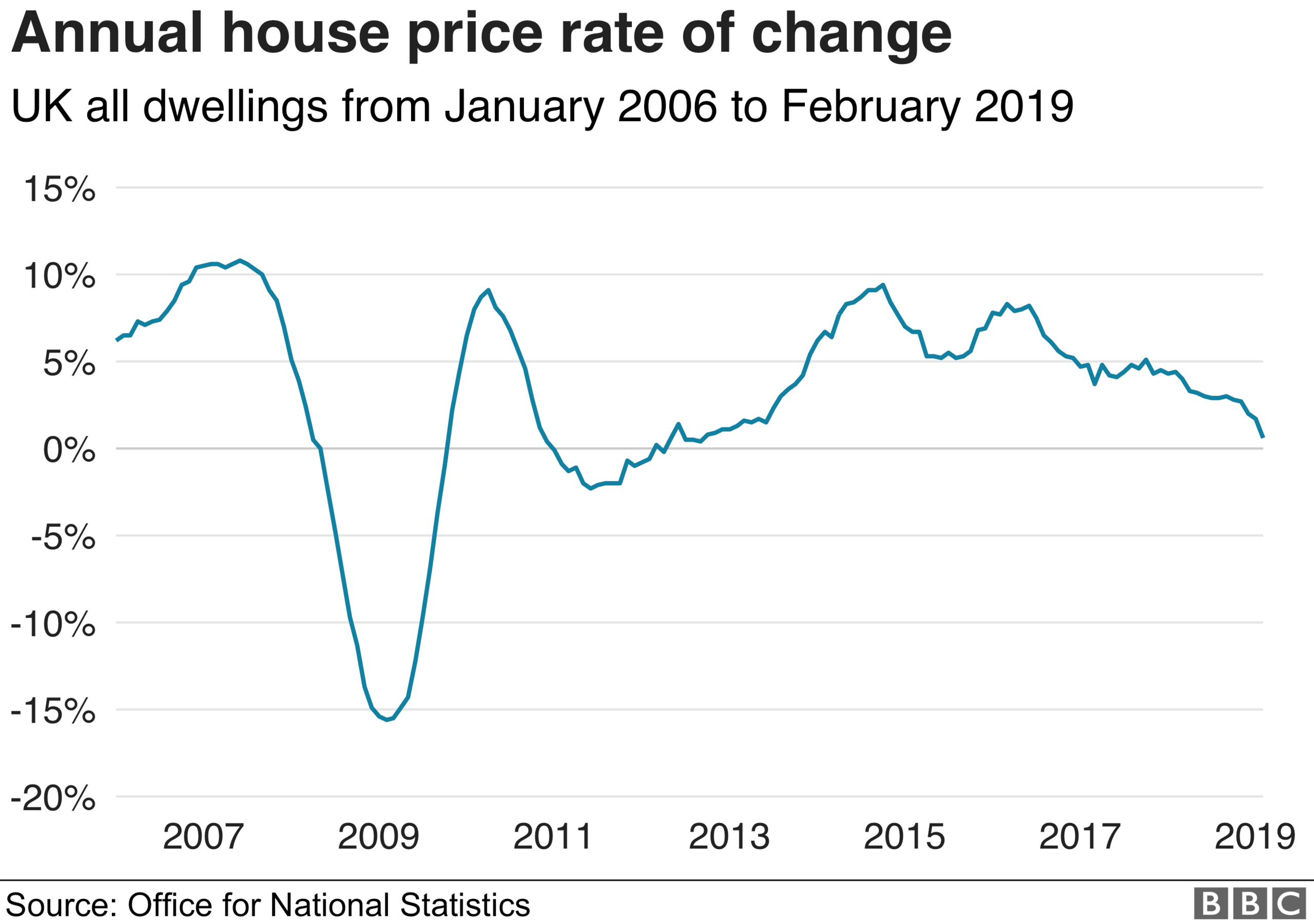

KPMG noted that the UK housing market is healthier than it was at the time of the last housing crash - when prices fell by 15% in 2008. House prices are lower as a percentage of earnings in most regions outside London and the South East.

In addition, compared with the aftermath of the 1991 recession - when housing prices dropped 20% over about four years - mortgages are much cheaper. Back then, the Bank of England's base rate was about 14%.

Where can you afford to live? Try our housing calculator to see where you could rent or buy

This interactive content requires an internet connection and a modern browser.

- Published27 August 2019

- Published9 July 2020