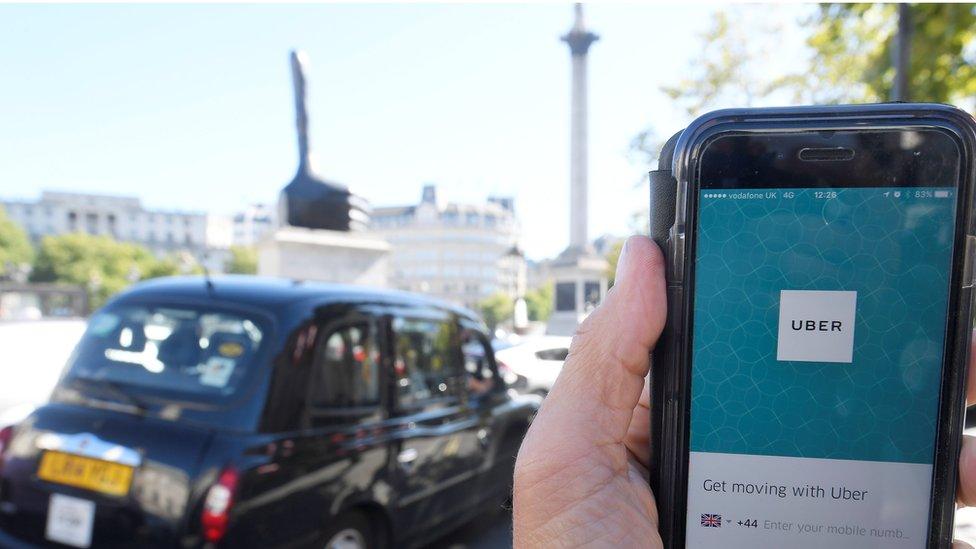

Uber: Will it get its London licence back?

- Published

Taxi booking firm Uber will soon hear whether its licence to operate in London will be renewed, and if so, by how long.

As things stand, its private hire licence will expire on Wednesday.

Transport for London (TfL) will decide whether to award another licence, which can be for up to five years.

The company lost its licence in 2017 over public safety concerns, after which a judge granted a 15-month extension which is due to end.

What are we expecting to hear and when?

TfL will probably announce its decision before Wednesday's deadline. There are three possible options:

It could grant Uber a five-year licence

It could offer a shorter agreement with conditions attached

It could decline the company the right to operate.

If TfL does decide against allowing the company to operate, Uber has 21 days to appeal against TfL's decision and can continue to operate while any appeals are continuing.

A five-year agreement is unlikely, says Richard Kramer, an analyst at Arete Research.

"TfL likely wants to preserve leverage over companies to review their compliance on the many problems at Uber," he said. Recent licences have also been shorter than the five-year maximum, he said.

In July, Indian ride-hailing company Ola got a 15-month agreement for its entry into the London market, while ViaVan got a three-year licence renewal.

Why did Uber lose its licence in the first place?

In September 2017, TfL said it declined to renew the licence on the grounds of "public safety and security implications".

TfL's concerns included Uber's approach to carrying out background checks on drivers and reporting serious criminal offences.

The UK is a top market for Uber

Uber's use of secret software, called "Greyball", which could be used to block regulators from gaining full access to the app, was another factor, according to TfL.

At the time, Uber rejected TfL's claims that it endangered public safety and said Greyball had never been used in the UK for the purposes cited by TfL.

What has Uber done to try to get its licence back?

The company says it has made "wholesale" changes to the business since the licence loss.

It now reports crimes directly to the police instead of logging criminal complaints with TfL, which caused delays.

Among other changes, drivers can now only use the app in the region in which they hold a private hire licence, while their working hours are more tightly regulated.

A licensed driver on the app has to now take an uninterrupted six-hour break after 10 hours of taking passengers or travelling to pick them up.

The firm also made changes to its app in London to "make it clearer" to passengers that its drivers are licensed by TfL and that it accepts ride requests before allocating drivers.

It has also hired a new chairman of the UK business, former Bank of England advisor Laurel Powers-Freeling, described as "impressive" by Chief Magistrate Emma Arbuthnot in her ruling approving Uber's extension.

Mayor of London Sadiq Khan backed TfL's decision not to renew Uber's licence to operate in the capital in 2017

Are people still critical of the company?

James Farrar, chair of the United Private Hire Drivers branch of the IWGB union, says he's not in favour of the company losing its licence, but he would like it to pay its workers more and share data with TfL to show what is being paid after expenses to keep wages above the minimum.

"The problem here has always been the failure to regulate," he said.

The New York City Taxi and Limousine Commission set a minimum hourly wage, external after expenses of $17.22 (£13.80) for drivers last year. Mr Farrar said a similar rule in London would protect drivers' wages, and he would like Mayor Sadiq Khan to intervene.

A question put last week to Mr Khan about the licence renewal , externalis still awaiting a reply, according to the London Authority's website.

Both Uber and TfL declined to comment ahead of the decision.

How's Uber doing?

"Uber continues to lose share to Lyft in the US, faces the threat of further labour regulation which could bring rising driver costs in many markets and has limited scope for increasing the percentage it takes of the fare further after already making significant changes to charge riders more and pay drivers less," said Arete Research's Mr Kramer.

"As a business, burning cash but with slowing growth, it faces more challenges than just its licence in London, which is a top five market for them."

Uber's losses widened to $5.2bn in the three months to 30 June, from $878m in the quarter last year. Total revenue rose 14.4% to $3.2bn, but fell short of average analysts' estimates of $3.4bn.

Uber's costs rose 147% to $8.7bn in the quarter, including a sharp rise in spending for research and development.

The company floated on the New York Stock Exchange earlier this year and its shares have lost about a quarter of their value since then.

Uber, which admitted ahead of its Wall Street listing that it may never make a profit, is trying to convince investors that growth will come not only from its ride services, but also from other logistics and food delivery services.

- Published22 September 2017

- Published8 August 2019

- Published9 May 2019