Thomas Cook bosses face scrutiny over collapse

- Published

Thomas Cook employees such as Ella Waine, pictured in her uniform, react to the company's collapse

Thomas Cook's bosses will face scrutiny as part of an investigation into the tour operator's collapse.

Business secretary Andrea Leadsom asked the official receiver,, external which oversees liquidations, to look at whether bosses' actions "caused detriment to creditors or to the pension schemes".

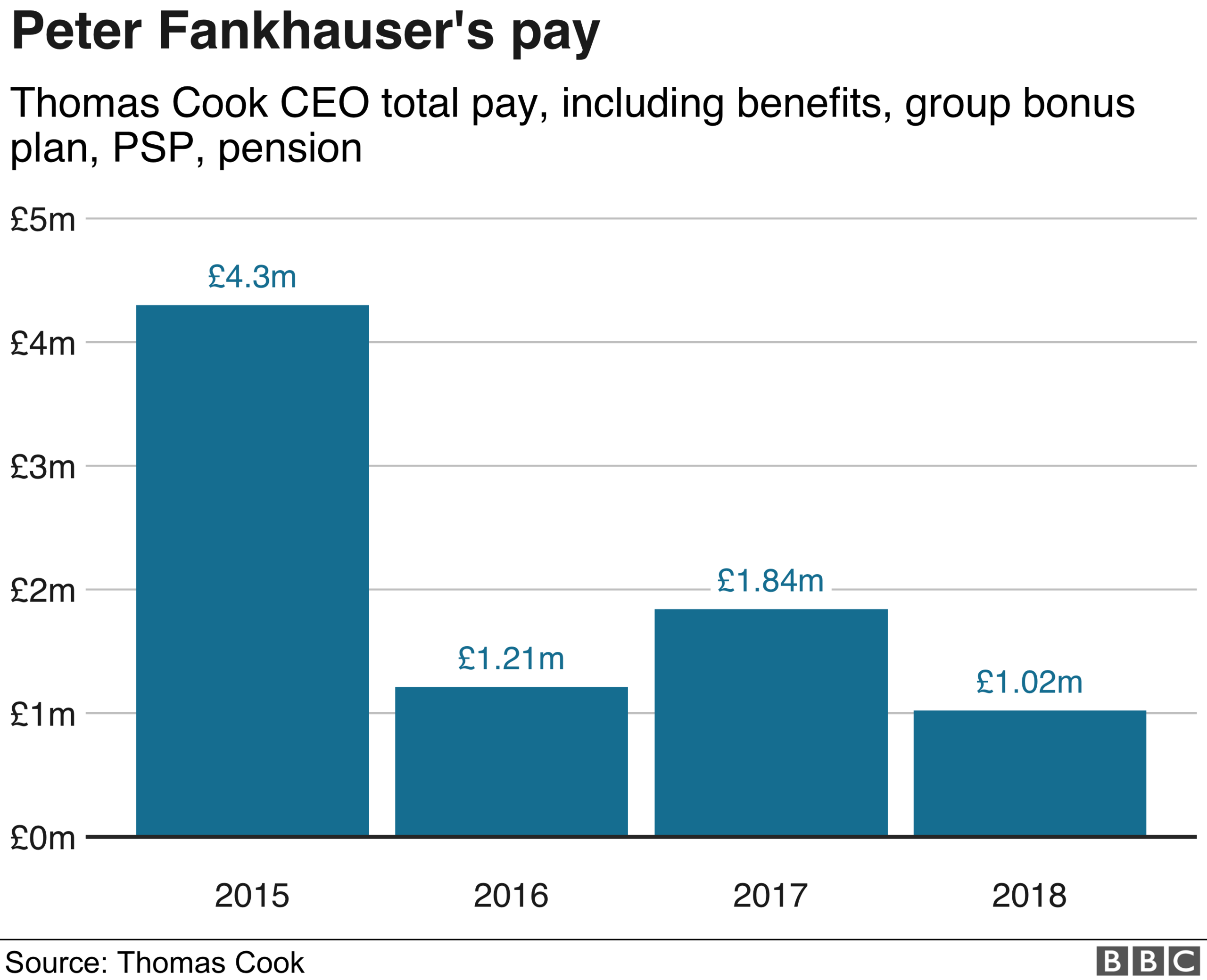

The request came amid criticism over executive salaries at the firm.

Top directors at the holiday company have been paid a combined £20m in salaries and bonuses since 2014.

Why are the directors under scrutiny?

Prime Minister Boris Johnson questioned whether directors should pay themselves "large sums of money" as their businesses go "down the tubes".

"I think the questions we've got to ask ourselves now [are]: How can this thing be stopped from happening in the future?

"How can we make sure that tour operators take proper precautions with their business models where you don't end up with a situation where the taxpayer, the state, is having to step in and bring people home?"

Mrs Leadsom said the official receiver's inquiry would look into the conduct of the firm's top directors.

"I ask that the investigation by the official receiver looks, not only at the conduct of directors immediately prior to and at insolvency, but also at whether any action by directors has caused detriment to creditors or to the pension schemes," she wrote in her letter to the Insolvency Service., external

The service has the power to disqualify people from serving as company directors for up to 15 years if it finds them guilty of misconduct and can pass information to criminal enforcement bodies in the most serious cases.

Labour's shadow chancellor, John McDonnell, has said Thomas Cook bosses should pay back any bonuses they received.

"I think they need to really examine their own consciences about how they've brought this about and how they themselves have exploited the situation," he told the BBC.

Thomas Cook chief executive Peter Fankhauser said he was "deeply sorry" about the firm's collapse and said the company had worked "exhaustively" to salvage a rescue deal.

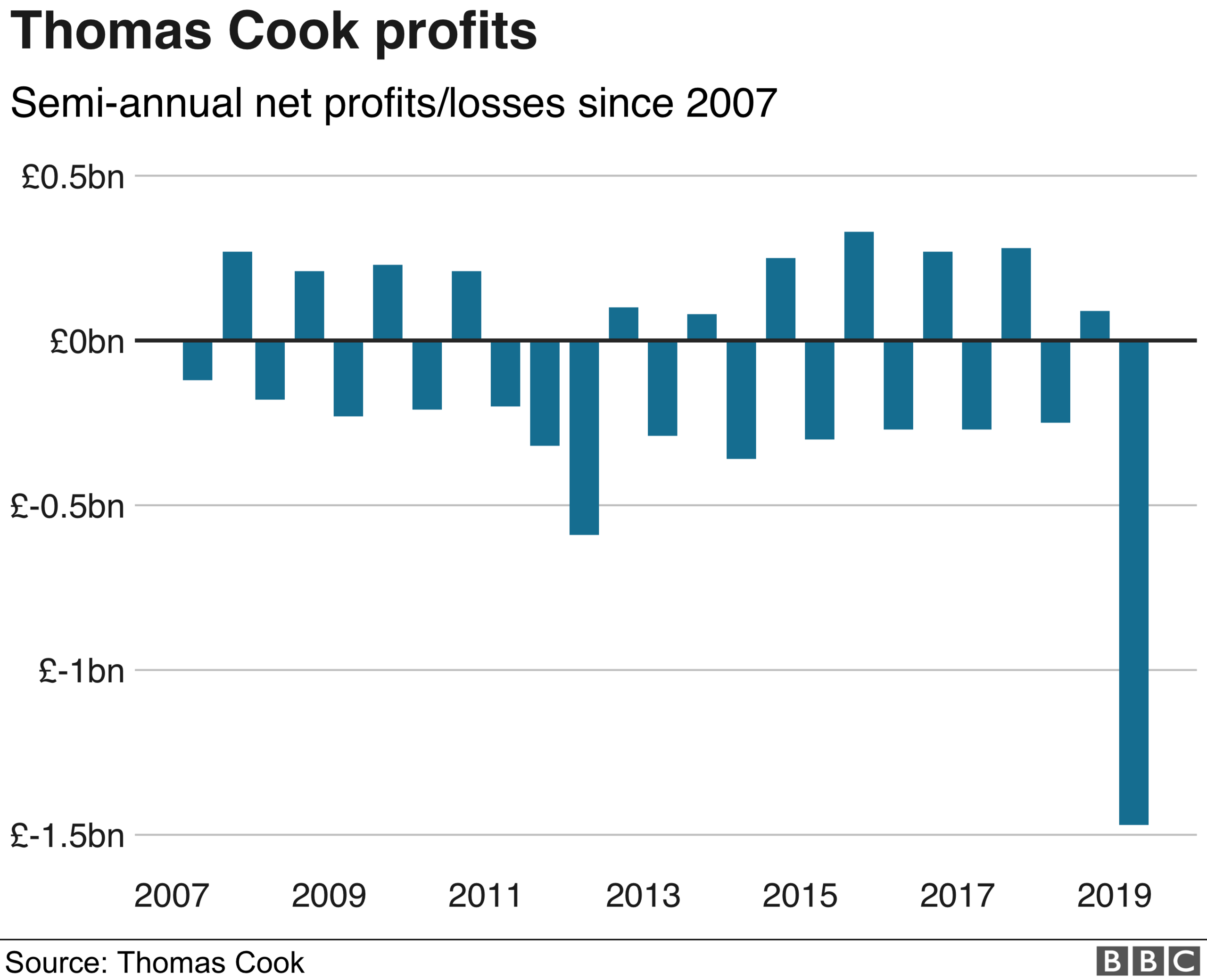

The company went into liquidation on Monday under the weight of a £1.7bn debt pile. As the result, the government is having to fly home around 155,000 customers from 18 countries.

Some 22,000 jobs worldwide are at risk too, 9,000 of them in the UK.

The Insolvency Service must look into every company collapse to see if directors have been up to no good, but the inquiries can take years.

Business secretary Andrea Leadsom would like something quicker with Thomas Cook; public outrage at the company's rapid collapse and the attendant chaos for holidaymakers is running hot.

If Mrs Leadsom is expecting Peter Fankhauser, the chief executive, or Frank Meysman, the chairman, on a stake, she should not hold her breath. It's hard to see how an investigation could show that they or the other directors deliberately drove the company into the ground.

It might well find that they built up too much debt, and failed to grasp the severity of the challenges to trading posed by weaker sterling, travel bookings' move online and some untimely heatwaves. But that is a world away from a calculated attempt to enrich themselves while pushing the company into insolvency.

While Mr Fankhauser and his predecessors were well rewarded for what was, in the end, a failure, the company's investors voted in favour of their remuneration at successive meetings.

There might, however, be a case for an investigation along different lines, something which is hinted at in Mrs Leadsom's letter. She has asked the Insolvency Service to look at directors' conduct "immediately prior to and at insolvency".

There could be grounds to look at the timeliness of the board's announcement to the stock exchange about the progress of its financial restructuring talks. How soon did directors know they would need to find an extra £200m, and when was the market told?

How will holidaymakers get home?

All Thomas Cook holidays are now cancelled, while the tour operators' planes are grounded.

Customers can seek compensation via the government's Air Travel Organiser's Licence scheme (Atol) scheme, or from their credit card or insurance companies.

Customers seeking information can visit the CAA's special Thomas Cook website.

Those scheduled to return to the UK within the next 48 hours or who are having problems with their accommodation or need special assistance can ring 0300 303 2800 in the UK or +44 1753 330 330 from abroad.

Thomas Cook planes were grounded at Manchester Airport

Customers will be on special free flights or booked onto another scheduled airline at no extra cost, with details of each flight to be posted on a dedicated website as soon as they are available.

The Department for Transport added that a "small number" of passengers might need to book their own flight home and reclaim the costs.

The CAA is also contacting hotels accommodating Thomas Cook customers, who have booked as part of a package, to tell them that the cost of their accommodation will be covered by the government's Air Travel Trust Fund and Atol.

What about Thomas Cook's international operations?

For now, Thomas Cook's Indian, Chinese, German and Nordic subsidiaries will continue to trade as normal.

This is because, from a legal standpoint, they are considered separate to the UK parent company and are not under the jurisdiction of the UK's Official Receiver.

They do, however, share services - such as aircraft and IT - with their parent company and will need to strike rescue deals in the coming weeks to keep trading.

If they fail up to a further 450,000 customers could be affected.

What went wrong?

Thomas Cook had secured a £900m rescue deal led by its largest shareholder, Chinese firm Fosun, in August, but a recent demand from its banks to raise a further £200m in contingency funding had put the deal in doubt.

The holiday company spent all of Sunday in talks with lenders trying to secure the additional funding and salvage the deal, but to no avail.

Thomas Cook has blamed a series of issues for its problems, including political unrest in holiday destinations such as Turkey, last summer's prolonged heatwave and customers delaying booking holidays because of Brexit.

While the company was closing shops to try and cut costs, it still had more than 500 outlets, meaning it faced high costs compared to online competitors.

In another sign of its slow progress in mending its finances, it only stopped dividend payments to investors in November.

- Published23 September 2019

- Published24 September 2019

- Published23 September 2019

- Published30 September 2019

- Published23 September 2019