Are speculators pushing the PM towards no deal?

- Published

- comments

Is there a conspiracy between so called "disaster capitalists" who have made big financial bets which will come good if the UK leaves the EU without a deal - and a government that is determined to leave on 31 October - do or die?

There has been a lot speculation, that er… speculators who help fund the Conservative Party are set to win big on their bets against the pound and UK assets if the UK leaves the EU without a deal.

The current strain of this theory runs something like this - you Conservatives deliver a no-deal Brexit from which we will profit and we promise to bankroll the party in the coming election and beyond.

There are always plenty of fans of compelling and dramatic narratives like this - but they don't usually include the former chancellor of the exchequer and the former permanent secretary to the treasury - Nick (now Lord) Macpherson.

Philip Hammond said: "Johnson is backed by speculators who have bet billions on a hard Brexit - and there is only one option that works for them: a crash-out no-deal that sends the currency tumbling and inflation soaring."

Lord Macpherson then backed him in the following tweet.

Boris Johnson's own sister Rachel, when trying to explain her brother's do or die approach to leaving on 31 October, said one explanation could be influence "from people who have invested billions shorting the pound and the country in the hope of a no deal Brexit".

What should we make of the clear implication/insinuation that Boris Johnson is being influenced by financial gamblers who stand to make a packet out of no deal?

What we know to be true is that Tory party finances which had begun to struggle under Theresa May are reported to have bounced back under Boris Johnson.

John McDonnell claimed in the House of Commons that backers of no deal had donated £726,000 this year alone - some from hedge funds.

But most of it was not from hedge funds and to put the sums in context, in the first six months of the year, donations to the Tory party totalled more than £9m.

Party officials say the recent uptick in donations is because Johnson is better at shaking the hat - not because he's agreed to seek no deal to enrich a small minority of donors.

The claim that these no deal-backing hedge funds are betting against British companies that will falter come 1 November is also hard to find evidence for. The way most hedge funds work is that they take two positions - one long, one short.

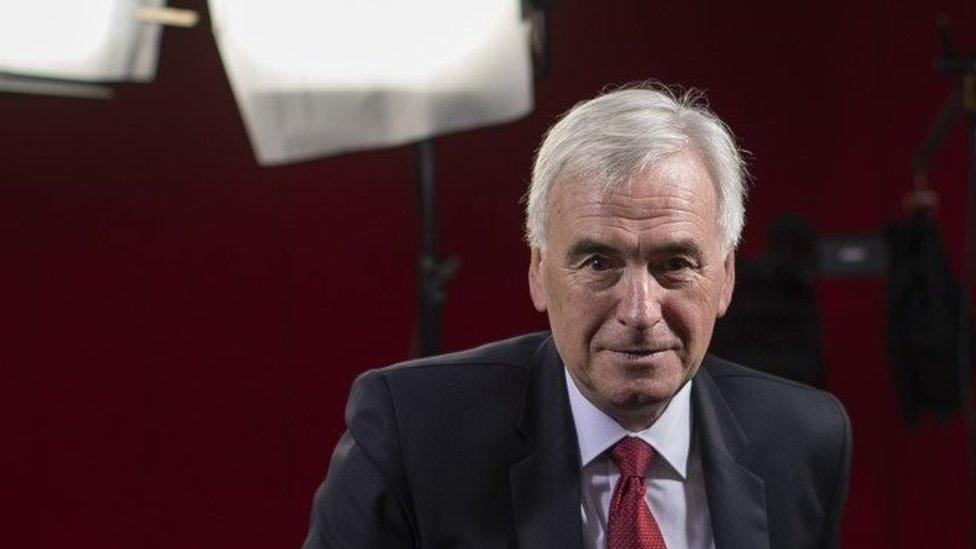

Shadow chancellor John McDonnell has raised the issue of no-deal Brexit "profiteering"

For example, if you think, say, Barclays will do better than, say, Metro Bank over the next few months or years, you back Barclays and you bet against Metro. You make money as long as Barclays goes up more than Metro OR - if they both fall - that Barclays falls less than Metro Bank.

This is not a bet against British banks - it's a bet on two companies' relative performance.

As for the currency, companies of all types make bets against the pound for different reasons. The main reason is as a form of insurance. If I am a US-based multinational that makes, say, 30% of my money in sterling, that contribution will be hit if the pound falls (as most expect will happen after a no-deal Brexit). By taking a bet against sterling, that hit will be offset by the return on that bet and my income will be insured.

But there are hedge funds who place out-and-out bets on currencies. One of them is run by Crispin Odey who made £300m when the pound plunged following the UK referendum result in 2016. He is a no-deal backer, doesn't deny he will prosper if that happens, and contributed £10,000 towards Boris Johnson's campaign.

He described claims that he was trying to influence Johnson as nonsense, insisting he had absolutely no influence over Johnson.

'Bonkers'

Another hedge fund boss who wished to remain anonymous said the idea that a small group of financiers was pulling the strings to achieve a no deal was ridiculous. Not least, he said, because it would be "bonkers" to bet that a currency that was already at a 30-year low against the rest of the world would go that much lower.

"Most hedge funds are waiting for the moment to buy," he told me, adding that he was certain that Johnson was sincere in his wish for a deal.

They would say that wouldn't they, I hear you say. But it's also worth remembering that for every person who has bet against the pound, there is someone who has taken the other side of that bet. These are usually big international investment banks, the bosses and partners of which often make political donations of their own.

Hedge funds make money by betting the market is wrong - that the price of something is not reflecting what is really going on. It's no secret that many pollsters are hired by hedge funds to conduct political research on which they bet. Paying for better information is not the same as nobbling the result.

The general unease about speculators getting involved in politics is understandable.

As one bank chairman told me: "When hedge fund owners start backing individuals or parties we should worry. It creates at best a perception of conflict of interest. At worst a genuine conflict."

The widespread acceptance of this current conspiracy theory demonstrates that this rings true for many. But, as yet, there has not been enough evidence produced that a few shadowy financiers are pulling the strings of a no-deal Brexit puppet.

- Published30 September 2019