'Ten years with my insurer meant a £2,000 hike'

- Published

- comments

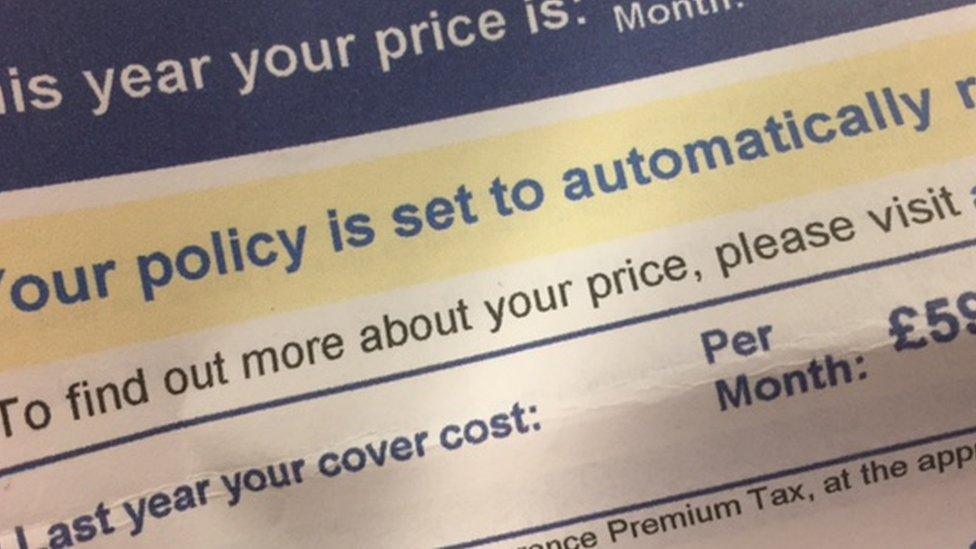

Diane saw her annual home insurance premium shoot up

Diane's reward for staying with the same home insurance provider for 10 years was a rise in her annual premium from £1,500 to £3,500.

The 76-year-old, from Kent, said: "Being a pensioner, I don't like changing." She ended up looking in the phone book, calling around for a deal.

She is an example of the six million people who pay on average £200 too much on premiums.

The City regulator has found consumers are overpaying by £1.2bn a year.

Competition in the home and insurance market is not working and loyal customers are being penalised, the Financial Conduct Authority (FCA) says.

It is considering bans on automatic price rises and making firms move consumers to cheaper deals, but said "the ball is now in the industry's court".

"This market is not working well for all consumers," said Christopher Woolard, executive director of strategy and competition at the FCA.

"While a large number of people shop around, many loyal customers are not getting a good deal. We believe this affects around six million consumers.

"We have set out a package of potential remedies to ensure these markets are truly competitive and address the problems we have uncovered. We expect the industry to work with us as we do so."

Mr Woolard said the review did not reveal the insurance industry was breaching the rules on a wholesale basis. But he said it was clear that changes needed to be made, and some in the industry would accept this.

He said in many cases - as was the case for Diane - it was much easier for consumers to renew a policy, sometimes just by ticking a box, than it was to switch away to a cheaper deal.

The FCA said that more than one in 10 people were paying very high prices for their insurance. One in three of them were vulnerable in some way, perhaps elderly or lower paid.

The regulator found, external that some insurers targeted price increases at those less likely to switch.

Possible FCA remedies include:

Banning or restricting practices such as raising prices for consumers who renew every year, or requiring firms to automatically move consumers to cheaper equivalent deals

Stop practices that could discourage switching - including restricting the way that firms use automatic renewal

Make firms be clear and transparent in their dealings with consumers - including improvements to the way they communicate with their customers

The FCA intends to publish its final report on possible remedies in early 2020 after further consultation with the industry and consumer groups.

Paying a poverty premium

By Kevin Peachey, personal finance reporter

You have never had a problem with your insurer or bank so you have stayed with them for years.

What the FCA's, and other reviews, have shown is that this is an expensive option - for home and motor cover, overdrafts and more.

Loyalty does not pay.

Those unable or uncomfortable with searching for a better deal online, or haggling, pay more. There is also a nod in this FCA report to the poverty premium - you get a worse deal if your finances are less "resilient" or you struggle with handling money.

Many of the same people will be among the eight million who an independent report estimated would be left behind if the UK became a cashless society.

Undoubtedly, they will feel like the financial victims of the advances in technology which have changed the way we live our lives.

'Bold ideas'

Huw Evans, director general of the Association of British Insurers, the industry's trade body, said his members accepted that the home and car insurance markets could work better for consumers who do not shop around at renewal.

But he added: "This is not an issue unique to insurance. It is important that any unintended consequences are carefully considered to ensure that a fair and balanced approach is achieved for all customers."

The consequences could be more expensive premiums for those shopping around, but the FCA said that, while it was keen to maintain a level of competition, the variation in prices to cover the same level of risk was too great.

Gillian Guy, chief executive of Citizens Advice, said "it's great to see the FCA acknowledging that the insurance market isn't working".

But she cautioned that the FCA's report set out proposals only. "The FCA must now follow through on these bold ideas to stop loyal insurance customers being penalised," she said.

Citizens Advice said it should not be left to the consumer to find the best deals. Rather, the market should be set up to ensure everyone is treated fairly. However, its advice to people searching for the lowest prices is:

Shop around

Ensure you opt out of auto-renewals

Make a note of insurance expiry dates

Use comparison websites

- Published31 October 2018

- Published28 September 2018

- Published3 November 2017

- Published8 May 2018