Cash deserts cry out for free-to-use ATMs

- Published

Tourism hotspot Rochester, in Kent, is one place that has made a request

A scheme aimed at funding free-to-use ATMs in so-called cash deserts is facing overwhelming demand from communities across the UK.

More than 100 areas have applied for a new cash machine, but the initial funding only covers 50 new ATMs.

Criteria for successful bids include a lack of nearby ATMs, a safe location being found, and no Post Office access.

The system, which is only fully launched on Thursday, is being run by Link, which oversees the ATM network.

Critics have described the "request an ATM" service as a "tiny bandage on a massive wound" caused by Link cutting fees paid to operators.

Industry figures show there were 52,358 free-to-use machines operating in the UK at the end of 2018. Another 11,002 pay-to-use machines were also in place.

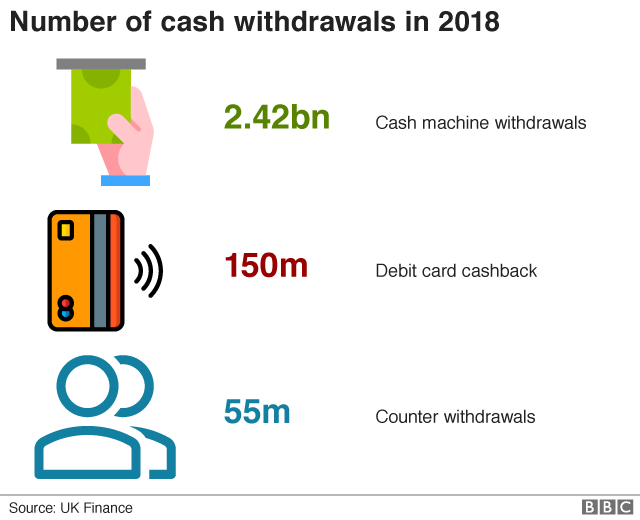

A total of 2.4 billion withdrawals were made from these machines last year, with £193bn of cash being taken out.

But consumer groups and campaigners have raised concerns about the falling number of cash machines in the UK, denying some areas access to cash and causing difficulties for vulnerable people and businesses.

In response, Link launched the scheme at the start of October, which now has its own dedicated online portal, external, with a £1m pot of funding from banks and building societies to install ATMs in areas that need one.

Selby, North Yorkshire, is another community making a claim

That pot of money would only finance 40 to 50 machines, but Link said more could be levied from its members - the banks.

So far, 86 areas in England, 16 in Scotland, nine in Wales, and two in Northern Ireland have applied to the scheme.

Among them are Rochester in Kent, which attracts tourists owing to its links with Charles Dickens and its picturesque High Street, coastal community Cullen in Moray, and the military base at Catterick, North Yorkshire.

John Howells, chief executive of Link, said "It is great that we've had so much interest so far. Many of the applications show there are locations around the country where there is a cash access problem. We've already visited 10 of these locations and will be working hard to listen to every community that has got in touch.

"We want to hear from more communities that think they have an issue. Where there is a problem, Link will take action."

But independent operators say the reason why many communities have lost free-to-use ATMs is down to the actions of Link.

When the request service was launched, Peter McNamara, chief executive of independent ATM operator NoteMachine, said Link had forced two cuts in the fees that banks pay the operators each time their customers use a non-bank machine.

As a result, he argued, many cash machines had become uneconomic and were being taken out or switched from free-to-use to charging consumers.

Do you live in an area without a cash machine? How has it affected you? Share your experiences by emailing haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also contact us in the following ways:

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Text an SMS or MMS to 61124 or +44 7624 800 100

Please read our terms of use and privacy policy

- Published2 October 2019

- Published18 September 2019

- Published8 March 2019