WeWork investor Softbank: My judgment was not right

- Published

Softbank chief executive Masayoshi Son

The boss of Softbank has admitted poor judgement in relation to its investment in WeWork after reporting its first quarterly loss in 14 years.

Japan's technology giant wrote down the value of its investments in the US-managed office firm as well as Uber.

Softbank recently agreed to rescue WeWork in a $10bn deal.

But after revealing the loss, chief executive Masayoshi Son said: "My judgement around WeWork was not right in many ways."

Softbank reported a loss of 704bn yen (£5bn) in the second quarter to 30 September, most of which was due to writing down the value of its investments in WeWork and Uber, which floated this year.

Analysts had expected Softbank to report a loss of 48bn yen.

Softbank was an early investor in WeWork through its Vision Fund, sinking $13bn into the US company.

The managed office firm was valued at nearly $50bn at the start of the year, but it was forced to pull its flotation in September, following a lack of interest from investors and concerns over WeWork's corporate governance.

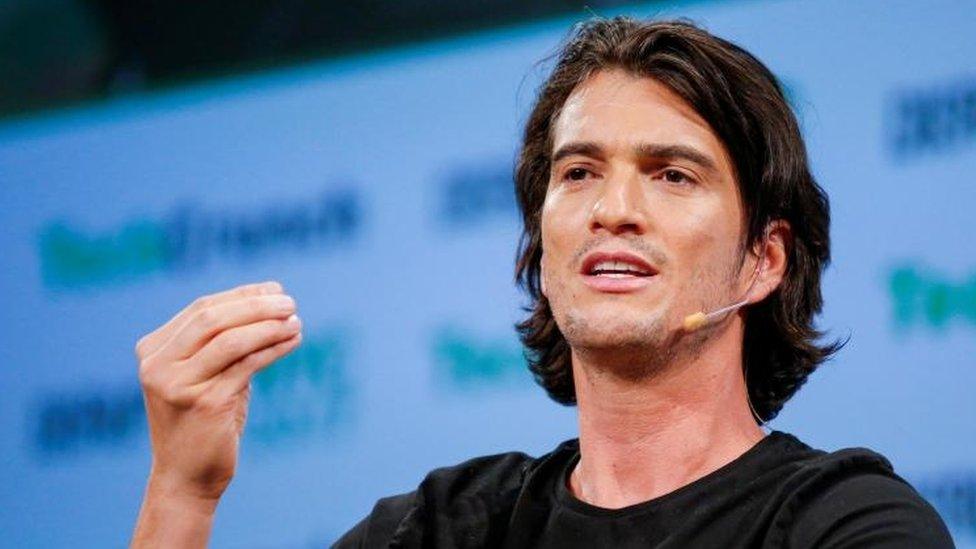

In particular, investors raised questions about WeWork's co-founder and former chief executive, Adam Neumann.

WeWork is now valued at $8bn.

As part of the deal in September, Softbank handed Mr Neumann a package worth $1.7bn to cede control of the business, including a $185m consulting fee.

Mr Son said on Wednesday: "I overestimated Adam Neumann's good side. I should have known better.

"I turned a blind eye to Adam Neumann's bad side on things like corporate governance. I have learned a harsh lesson from my experience with Adam Neumann."

Mr Neumann retains a stake in WeWork and will stay on at the company as "an observer".

Mr Son said that although Softbank was in "the rough sea", WeWork was "not a sinking boat".

- Published23 October 2019

- Published30 September 2019