Cambodia's bicycle firms face bumps in the road

- Published

Workers fully assemble each bike and then detach the wheel for shipping from the factory

Made in Cambodia is a common label on clothing from shirts and skirts to cycling shorts, but these days there's a good chance the bicycle itself will also have been made there.

The south east Asian nation is making the most of shifting global trade patterns to diversify its economy, and it is now listed as the fifth-largest exporter of bicycles in the world after China, Taiwan, the Netherlands and Germany.

But concerns over democratic freedoms mean there could be bumps in the road ahead.

At the Bavet Special Economic Zone, right on Cambodia's border with Vietnam, and just 50km north west of Ho Chi Minh City, the industry is gearing up to make the most of growing demand.

Inside a factory belonging to Taiwanese-owned firm Speedtech, bicycle frames hang from hooks like meat carcasses at a market.

A Speedtech factory worker examines frames before they head to the chemical wash

Workers, some in protective goggles or welding masks, are engrossed in their tasks along the production line, ignoring the biting scent of spray paint. The starting salary of $350 (£268) a month compares well with the garment industry, but the air is humid and heavy, and when the monsoon downpour arrives in early afternoon there's a whoop of delight but no pause in production.

When Speedtech first arrived at Bavet in 2013 it was only doing final assembly, says vice-general manager, Aliette Tong. Now the workers weld and paint frames too. The factory can turn out up to 2,000 bicycles a day if the demand is there, he adds.

A worker moves a crate of newly-welded bicycle frames between vats of acid wash

But the industry still has shallow roots.

At Speedtech everything other than the frame is imported from Malaysia, Indonesia, Japan or China, explains Mr Tong. Even the steel used to make the frame is imported from China.

"In this period, parts makers are more are interested in Vietnam," he says.

Rivals is a season of in-depth coverage on BBC News about the contest for supremacy between the US and China across trade, tech, defence and soft power.

Moreover, the finished bicycles are exported, not from Cambodia's main port at Preah Sihanouk, which is a gruelling nine-hour drive to the west, but via Ho Chi Minh City's Cat Lai port, four to five hours east of here, even though that entails additional customs processes at the border.

China's loss

What prompted Speedtech to move its operations from Vietnam to Cambodia in the first place, alongside two other Taiwanese-owned manufacturers, A & J and Smart Tech, was a decision by the European Union in 2005 to impose anti-dumping measures on Vietnam, making Vietnamese exports more expensive.

Global Trade

A similar pressure is now growing on firms manufacturing in China. President Trump's trade war has pushed up the cost of their products in the US. And at least three manufacturers are yanking production out of China to open factories in Cambodia instead.

One of them, Shanghai General Sports, has registered to operate at a site near Cambodia's capital, Phnom Penh. Already, US-based bicycle brand Kent International has pledged to move around 60% of its cycling manufacturing to the new plant by 2022.

"It will take a long time for Cambodia to get to the efficiencies of China, if ever," says Kent's chief executive, Arnold Kamler, but at least for now the lower productivity and the added transport costs in Cambodia are less of a problem than rising costs in China.

Democratic deficit

Now the greatest danger for Cambodia's cycle makers is that the country could face new tariffs on its own exports.

Cambodia currently enjoys tariff-free access to the EU under what is known as the Everything But Arms arrangement (EBA) designed to support low income countries. But in February the EU could cancel that preferential access, when it publishes the results of a review into Cambodia's political situation.

Cambodia's exports are predominantly in the garment and textile sector

Since the end of the devastating Khmer Rouge regime more than three decades ago, the country has been ruled by one party under the same leader, Hun Sen, who is increasingly seen as an authoritarian figure.

Over the last two years critics have been jailed, the main opposition party dissolved and radio stations closed, in what the EU described as a "deterioration of democracy, respect for human rights and the rule of law."

In Washington there have also been calls for a review of the US's preferential trade relationship with Cambodia.

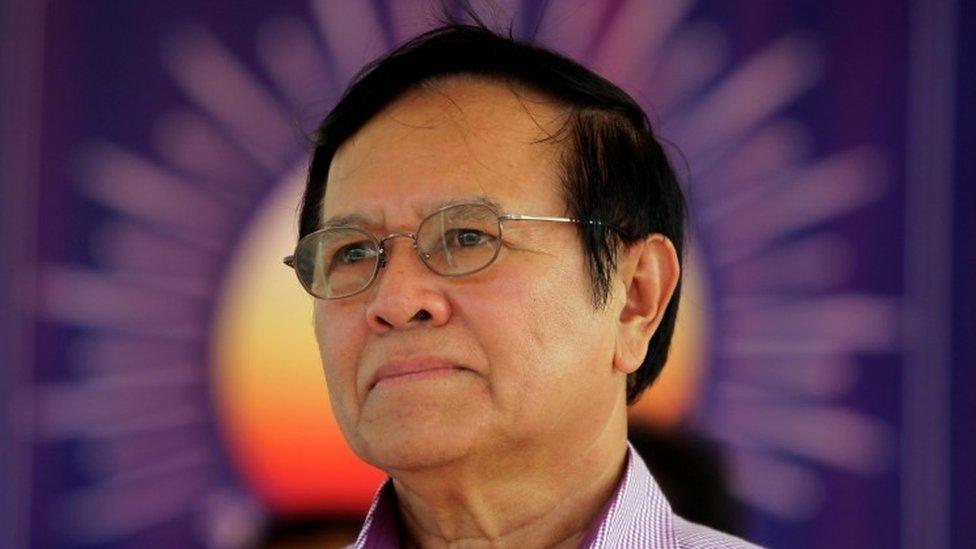

Cambodia's prime minister, Hun Sen, has been in power for more than three decades

When the subject of Cambodia's trade status comes up, the polite, chatty manager at Speedtech, Mr Tong goes quiet for a moment. Prices are likely to rise if preferential status is lost, he admits.

Short term solution

Mr Kalman has said that, external Kent will stick to producing in Cambodia whatever happens to its trade status since costs are rising rapidly in China.

But others may not.

Robert Margevicius, the executive vice-president for US-based Specialized Bicycles, which uses Speedtech in Cambodia as well as suppliers in Vietnam and Taiwan, warns the "volatile" situation over trade risks putting the brakes on Cambodia's exports.

"Any issues with [the EU] or if the US turns on Cambodia for political dissonance, it could be an unstable foundation for the bicycle industry," he says.

Cambodia's bicycle producers weld together mostly imported components

Manufacturers could migrate back to Vietnam, he believes, especially once the EU-Vietnam free trade agreement comes into effect next year. "Cambodia could be a short-term solution until things heat up in Vietnam," Mr Margevicius says.

Crucially, Cambodia needs to start making more components domestically, for the bicycles to continue to count as Cambodian-made. If too many parts and materials come from China the final product will end up subject to the same punishingly high tariffs as Chinese bicycles.

Moun Channheak, from Cambodia's Ministry of Commerce says the government is doing its utmost to support a sector that employs thousands of people and exports around $400m worth of finished bicycles a year.

Speedtech supplies finished bicycles for western brands including children's bikes

"We gained success with bicycle exports to the EU and other countries but we need to invest in components manufacturing," he says. "We need investments in Cambodia instead of importing material."

It may be hard to attract that investment while the country's trade status remains in flux, points out Mr Margevicius.

One thing he will say for Cambodia though is the progress that has been made so far, in the quality of the work and the shift towards higher specification designs.

"What I have found about Cambodian workers is that they are craftspeople," Mr Margevicius says. "They take pride in their work."

- Published24 October 2019

- Published10 November 2019

- Published8 November 2019