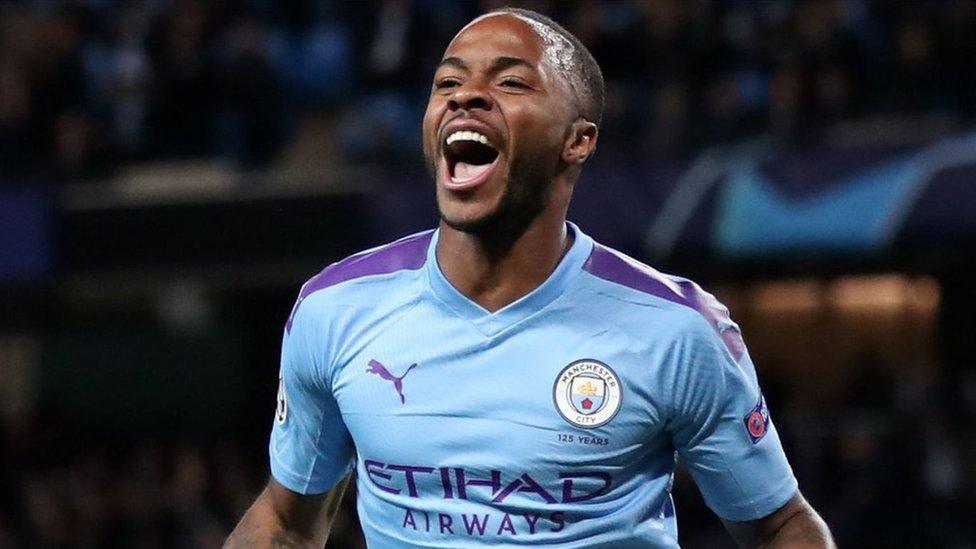

Manchester City investment from US breaks global sports valuation

- Published

The parent company of Premier League champions Manchester City has announced a £389m investment from US private equity firm Silver Lake.

The deal breaks a record in global sports valuations, making holding company City Football Group (CFG) worth £3.73bn ($4.8bn).

The US private equity firm is buying around 10% of CFG's worldwide business.

City are currently third in the Premier League, and have qualified for the Champions League last 16.

CFG has a stake in seven football clubs across the world, including in the US, Australia, Japan and China.

'Premium sports content'

Group chairman Khaldoon Al Mubarak said: "We and Silver Lake share the strong belief in the opportunities being presented by the convergence of entertainment, sports and technology and the resulting ability for CFG to generate long-term growth and new revenue streams globally."

Silver Lake, which is best known for technology investing, said its investment would "help drive the next phase of CFG's growth in the fast-growing premium sports and entertainment content market".

Egon Durban, managing director of Silver Lake, will represent the US backers on the CFG board as part of the deal, first reported in the FT, external.

Earlier this year Joe Tsai, co-founder of China's online giant Alibaba, bought a controlling share in the Brooklyn Nets basketball team, which gave it a $2.35bn valuation, the highest for a US sports team.

Manchester rivalry

Earlier in November, Manchester City announced it had brought in a record £535.2m last season.

It was City's 11th successive year of revenue growth and closed the gap on local rivals Manchester United, the Premier League's richest club.

The figure is projected to rise again next year given Man City have qualified for the knockout stages of the Champions League.

Payments from a £45m-a-year Puma kit deal will also start to take effect.

Media rights

Will Walker-Arnott, senior investment manager at Charles Stanley, told BBC Radio Four's Today programme: "Silver Lake is a US private equity firm which is better known for investing in technology stocks such as Alibaba and Skype.

"But more recently it has been getting into sports rights and got invested in the Ultimate Fighting Championship."

He says the firm has probably been drawn to Manchester City because of its lucrative media rights.

"We've got a lot of large broadcasting firms like BT, Sky and Amazon all bidding for [Premier League football] rights," he said.

There is one "question mark" hanging over the lofty valuation, however.

"Manchester City are being investigated by Uefa for possible breaches into financial fair play, so [Silver Lake] are obviously looking over that," Mr Walker-Arnott said.

Earlier this month the club's appeal to the Court of Arbitration for Sport (CAS) asking for Uefa's probe to be halted, was rejected.

The club is at risk of being banned from the Champions League and will now face judgement from Uefa's adjudicatory chamber.

- Attribution

- Published19 November 2019

- Attribution

- Published15 November 2019

- Published30 May 2019

- Attribution

- Published3 May 2019