General election 2019: Pound and shares surge

- Published

- comments

The pound and shares have surged after the Conservatives won a clear majority in the UK general election.

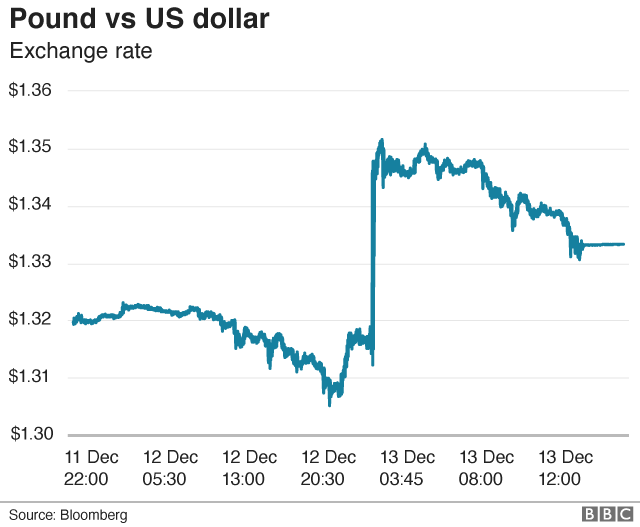

Sterling rose above $1.35 at one point - its highest level since May last year - on hopes that the big majority would remove uncertainty over Brexit.

The pound also jumped to a three-and-a-half-year high against the euro.

On the stock market, the FTSE 100 share index rose 1.1%, while the FTSE 250 - which includes more UK-focused shares - briefly hit record highs.

It closed 3.4% higher, while at the same time the pound traded at $1.33 and €1.20

Prime Minister Boris Johnson said the election result meant that the Conservative government "has been given a powerful new mandate, to get Brexit done".

Mr Johnson has pledged to take the UK out of the European Union by 31 January.

Politically sensitive shares saw sharp rises on UK markets. Shares in water companies such as Severn Trent, which faced the possibility of nationalisation under a Labour government, rose 9%, while UK housebuilders also saw big gains, with Barratt up 14% and Persimmon 12% higher.

Shares in banks exposed to the UK economy rose sharply. Barclays, RBS and Lloyds were up 6%, 8% and 5% respectively.

Neil Wilson, chief market analyst at Markets.com, said housebuilders had been undervalued and rose "on hopes that construction will benefit from the Conservative victory".

"We should also consider the potential risk that a Labour government could have posed to their profits being removed," Mr Wilson said.

While many FTSE 100 shares saw big gains, this was offset slightly by the rise in the value of the pound, which affected companies with big international operations. A rise in sterling cuts the value of companies' overseas earnings when they are brought back to the UK and converted back into pounds.

In contrast, the FTSE 250 index - which generally contains firms with more exposure to the domestic economy - jumped more than 5% at one point, before slipping back slightly.

The financial bookies had already installed Boris Johnson as the favourite but did not expect him to romp home by such a distance.

The pound moved sharply higher as soon as the exit poll was published and went on to post one of its biggest one-day gains against the dollar in years as Johnson's thumping victory removed one layer of political uncertainty.

Shares in politically-sensitive sectors such as house building and banking rocketed, as did water, rail and energy companies, as the threat of nationalisation under a Corbyn government evaporated.

Markets have given the prospect of a government with a functioning majority a round of applause but the euphoria may be short-lived.

Traders are already talking about the formidable challenge of completing a trade deal with the EU by this time next year, along with the prospect of a new Scottish independence referendum.

The election may be settled, but there are big political questions that are not.

Guy Foster, head of research at wealth manager Brewin Dolphin, said that "the potential for a smooth Brexit removes some of the downside risk for the UK economy".

"This should be positive for both business and consumer confidence, at least in the short term, with a gradual acceleration in GDP growth and confidence.

"However, a lot can change over the coming months as the finer detail of the UK's future trade relationship with the EU is negotiated.

"This is still, after all, just the beginning of the exit process. Even with the passing of the withdrawal agreement, the UK could still leave the EU without a deal at the end of 2020 if trade negotiations don't proceed successfully."

Sterling hit a 19-month high of $1.3516 at one point overnight, but then gave up some of its gains.

Andy Scott, associate director at financial risk adviser JCRA, said: "What will be interesting to see - assuming that Brexit will now follow a set course, at least [until] 31 January - is if economic data is given a significant boost from the perceived certainty, and [whether it] starts to influence sterling again.

"In recent months, the market has almost completely ignored the slowdown in the economy and the potential for monetary stimulus from the Bank of England, with election and Brexit expectations driving fluctuations in sterling's value.

"The performance of the economy is likely to be key to whether we see a further recovery in 2020."

WHO WON IN MY CONSTITUENCY? Check your result, external

NATIONAL PICTURE: The result in full, external

ALL YOU NEED TO KNOW: The night's key points

MAPS AND CHARTS: The election in graphics, external

LAURA KUENSSBERG: Same PM, new map

BREXIT: What happens now?

IN PICTURES: Binface, a baby and Boris Johnson

- Published13 December 2019

- Published6 December 2019

- Published26 September 2022