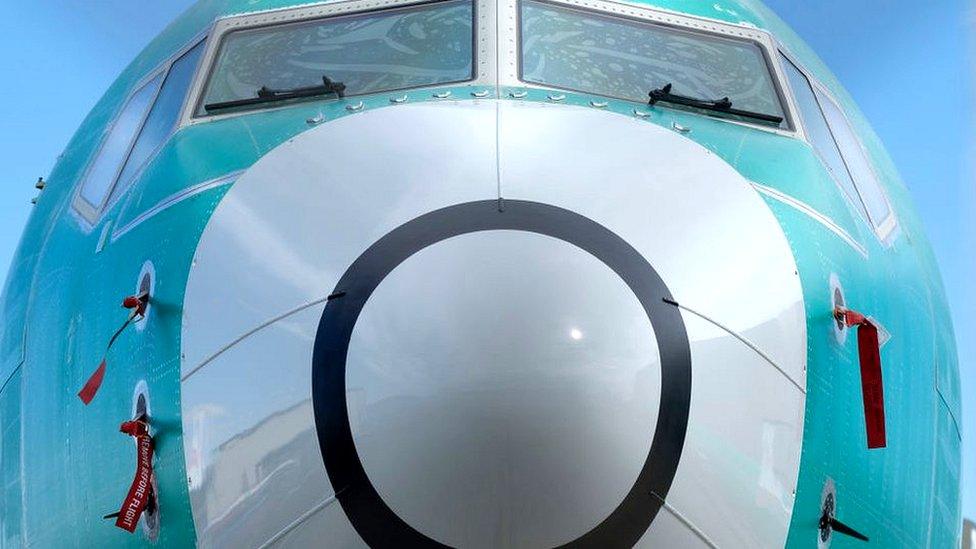

Boeing to temporarily halt 737 Max production in January

- Published

Boeing will temporarily halt production of its troubled 737 Max airliner in January, the manufacturer said.

Production of the jet had continued despite the model being grounded for nine months after two deadly crashes.

More than 300 people died when two 737 Max aircraft crashed in Indonesia and Ethiopia after reported problems with a new feature.

Boeing had been hoping to have the planes back in the air by the end of this year.

But US regulators made it clear that they would not be certified to return to the skies that quickly.

What will Boeing do next?

Boeing is one of the largest US exporters. The company said in a statement that it would not lay off workers associated with the 737 Max, but the stoppage is likely to affect suppliers and the wider economy.

"Safely returning the 737 Max to service is our top priority," the aircraft manufacturer said.

"We know that the process of approving the 737 Max's return to service, and of determining appropriate training requirements, must be extraordinarily thorough and robust, to ensure that our regulators, customers, and the flying public have confidence in the 737 Max updates."

What went wrong with the planes?

Last week a congressional hearing was told that US aviation regulators were aware, following the first crash in Indonesia in October 2018, that there was a risk of further accidents.

The Federal Aviation Authority's analysis suggested there could be more than a dozen more crashes over the lifetime of the aircraft unless changes were made to its design.

Boeing 737 crashes: What went wrong?

Despite that, the 737 Max was not grounded until after the second crash in Ethiopia in March 2019.

Boeing is redesigning the automated control system thought to have been the primary cause of the crashes.

The manufacturer said it had 400 of the 737 Max aircraft in storage and would focus on delivering those to customers. While many airlines around the world have the planes on order, delivery was halted to allow Boeing's engineers to develop software fixes.

The situation surrounding the 737 Max is extraordinary.

Nine months after the aircraft was grounded worldwide, it is still not clear when it will be certified to fly again. Regulators - criticised for allowing a flawed aircraft to fly in the first place - are now playing hardball.

For Boeing, being forced to shut down the production line is deeply embarrassing - and likely to prove costly. But it is a huge business, and it can at least redeploy many of its workers.

But if the stoppage goes on for long, suppliers could be badly hit.

Boeing sits at the top of a global supply chain, ranging from major businesses to small operators.

Here in the UK, for example, the company works across 65 sites, including a factory in Sheffield. But it draws on a network of some 300 suppliers.

For smaller firms in particular, losing 737-related work could prove serious - hitting revenues and potentially forcing them to lay off workers as well.

What has the reaction been?

Travel industry analyst Henry Harteveldt said the decision to suspend production was unprecedented and likely to have a "massive impact on Boeing, its suppliers and the airlines".

"It's really going to create some chaos for the airlines that are involved in this as well as the 600 or so companies that are part of the 737 Max supply chain and Boeing itself."

The suspension of the 737 Max has already cost Boeing around $9bn (£6.75bn). Boeing shares fell more than 4% on Monday amid speculation production would be suspended.

All Boeing 737 Max planes are currently grounded

The production freeze is expected to be felt across the plane's global supply chain.

Teal Group aviation analyst Richard Aboulafia described Boeing's options for managing the blow to its suppliers as "bad and worse".

He said the plane maker could either allow them to take a hit, or pay them to wait for when the 737 Max is finally cleared to fly.

US carriers operate the largest 737 Max fleets, though airlines around the world also use it.

"The Chinese carriers would [also] be quite badly affected. They're some of the biggest users of the Max," said Shukor Yusof, aviation analyst at Endau Analytics.

In fact, China's three largest carriers were among the first to press Boeing for compensation over the grounded planes.

Aviation analyst Chris Tarry told the Today programme: "The last thing any manufacturer wants is to stop the production line and it's going to take time to get it going again when the aircraft takes to the skies.

"If we look at it in terms of the volume of the impact on capacity growth in the industry, it is significant and it will take time to recover the production. Boeing's reputation will take time to recover from this as well."

How are other businesses affected?

Some suppliers, such as fuselage maker Spirit AeroSystems, are highly dependent on the jet, with half of its revenue attached to it, according to Mr Aboulafia.

So far, the supplier has only said it is "working closely" with Boeing to determine what impact the production suspension may have.

The move by Boeing is unlikely to affect passengers as airlines have leased additional aircraft to replace the 737 Max.

It's a different story for airlines, who have the added expense of leasing planes and managing their grounded aircraft.

In July, Boeing set aside nearly $5bn to compensate those affected.

However, that figure assumed that the 737 Max would fly again this year.

- Published11 December 2019