Worst year for retail in 25 years, says trade body

- Published

- comments

Retail sales fell for the first time in 25 years last year, according to the leading UK retail industry body.

The British Retail Consortium (BRC) said total sales fell 0.1%, marking the first annual sales decline since 1995.

Sales in November and December were particularly weak, falling 0.9%, the BRC said.

A separate report from Barclaycard found a rise in consumer confidence had failed to boost festive spending.

The payments firm, which processes nearly half of all UK debit and credit transactions, said that consumer spending growth had declined if inflation was taken into account.

Helen Dickinson, chief executive of the BRC, said: "Twice the UK faced the prospect of a no-deal Brexit, as well as political instability that concluded in a December general election - further weakening demand for the festive period.

"Retailers also faced challenges as consumers became both more cautious and more conscientious as they went about their Christmas shopping," she added.

Are these figures too gloomy?

The BRC's figures do not include the entire retail market. For instance, its survey excludes some fast-growing online retailers, including Amazon, which some experts reckon now account for some 20% of online sales.

However, its chief executive told the BBC Today programme she felt the figures did give "an accurate picture".

Ms Dickinson said: "These figures are not an estimate, they are full sales data from retailers that represent the majority of retail sales."

She added: "While it is not 100% of retailers in the country, some businesses that aren't included will also be compensated by those that have gone bust."

The BBC's business correspondent Emma Simpson says: "Figuring out what's going on in retail can be a bit of a jigsaw puzzle, and this is certainly a very large piece, particularly when it comes to reflecting how our biggest, traditional, chains are faring."

What is the difference between total and like-for-like sales?

Total sales figures look at all sales, while like-for-like data compares sales from shops that were open the previous year, stripping out the effects of expansion in a business.

Like-for-like retail sales climbed in December, but that was due to a relatively late Black Friday, the BRC said. Once November, was included to include this distortion, like-for-like sales dropped 1.2% compared with the previous year, it said.

Despite the drop in total sales last year, the volume of sales was still higher than in 2017.

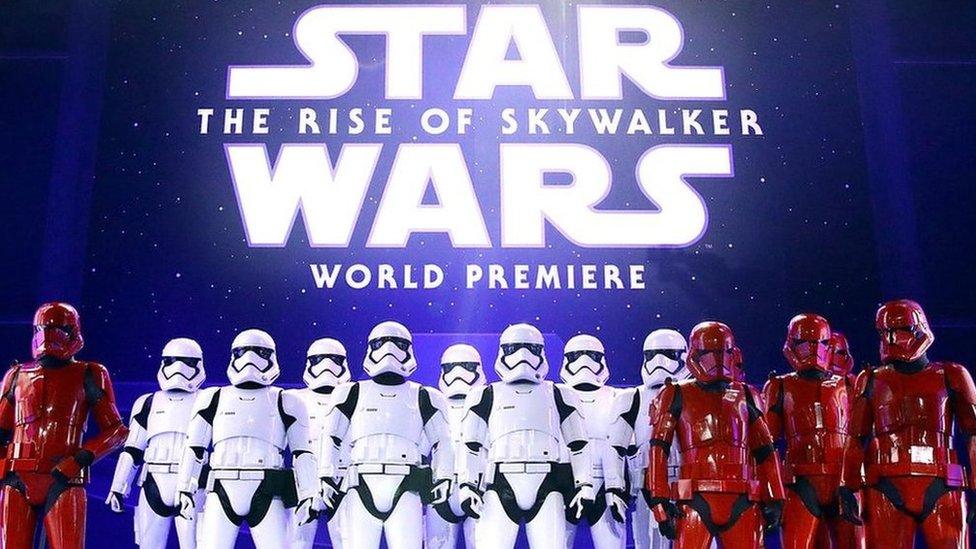

A rise in cinema ticket sales was one of the few retail bright spots

Payments company Barclaycard said in a separate report that supermarket sales contracted by 0.9% in December, while sales at specialist retailers such as toys and gaming stores fell 4%.

However, it picked out some bright spots, noting cinema sales rose by 19%, helped by blockbuster releases including Star Wars: The Rise of Skywalker and Frozen II. Spending in pubs and takeaways also rose over the festive period.

Which shops struggled last year?

It's been a tough year for High Street retailers with several shops either going into administration or announcing job losses in 2019.

Mothercare UK, Bonmarche and luxury jeweller Links of London all went into administration last year.

Harrogate's commercial property market is the toughest some experts can recall

Meanwhile, Philip Green's Arcadia retail empire, HMV and Debenhams both announced significant store closures.

Why are shops struggling?

Costs are rising, with business rates, rents and wages taking a bigger chunk of retailers' expenditure. And with footfall in decline, many shops are simply too big and frequently in the wrong locations.

Also, High Street retailers are under pressure from changing shopping habits, with customers spending one in every £5 online.

- Published29 December 2019

- Published23 October 2019

- Published11 September 2019