Bank of England policymaker hints at possible rate cut

- Published

Another Bank of England policymaker has floated the idea of cutting the central bank's main interest rate.

Gertjan Vlieghe told the Financial Times, external he will consider voting for a rate cut depending on how the economy has performed since the December election.

The rate is used by banks and other lenders who set borrowing costs.

It affects everything from mortgages to business loans and has a big effect on peoples' and firms' finances.

Mr Vlieghe is the third policy setter this week to suggest they may be willing to cut rates when the Monetary Policy Committee (MPC) next meets at the end of this month.

Mark Carney, the outgoing governor of the Bank of England, said in a speech on Thursday that it was prepared to take "prompt" action, external if economic weakness persists.

"With the relatively limited space to cut Bank rate, if evidence builds that the weakness in activity could persist, risk management considerations would favour a relatively prompt response," he said.

Meanwhile, Silvana Tenreyro, another member of the MPC, told an event hosted by the Resolution Foundation think tank: "If uncertainty over the future trading arrangement or subdued global growth continue to weigh on demand, then my inclination is towards voting for a cut in Bank rate in the near term."

All three committee members were careful to say that they would need to see more data before making a decision.

Another decision is due on 30 January.

The last time the committee met, in November, two members voted to cut rates.

Jonathan Haskell has said risks to the economy were "lingering" in a speech after his vote was cast. The other member to vote for a cut, Michael Saunders, hasn't yet commented officially about his vote, but is scheduled to make a speech on 15 January.

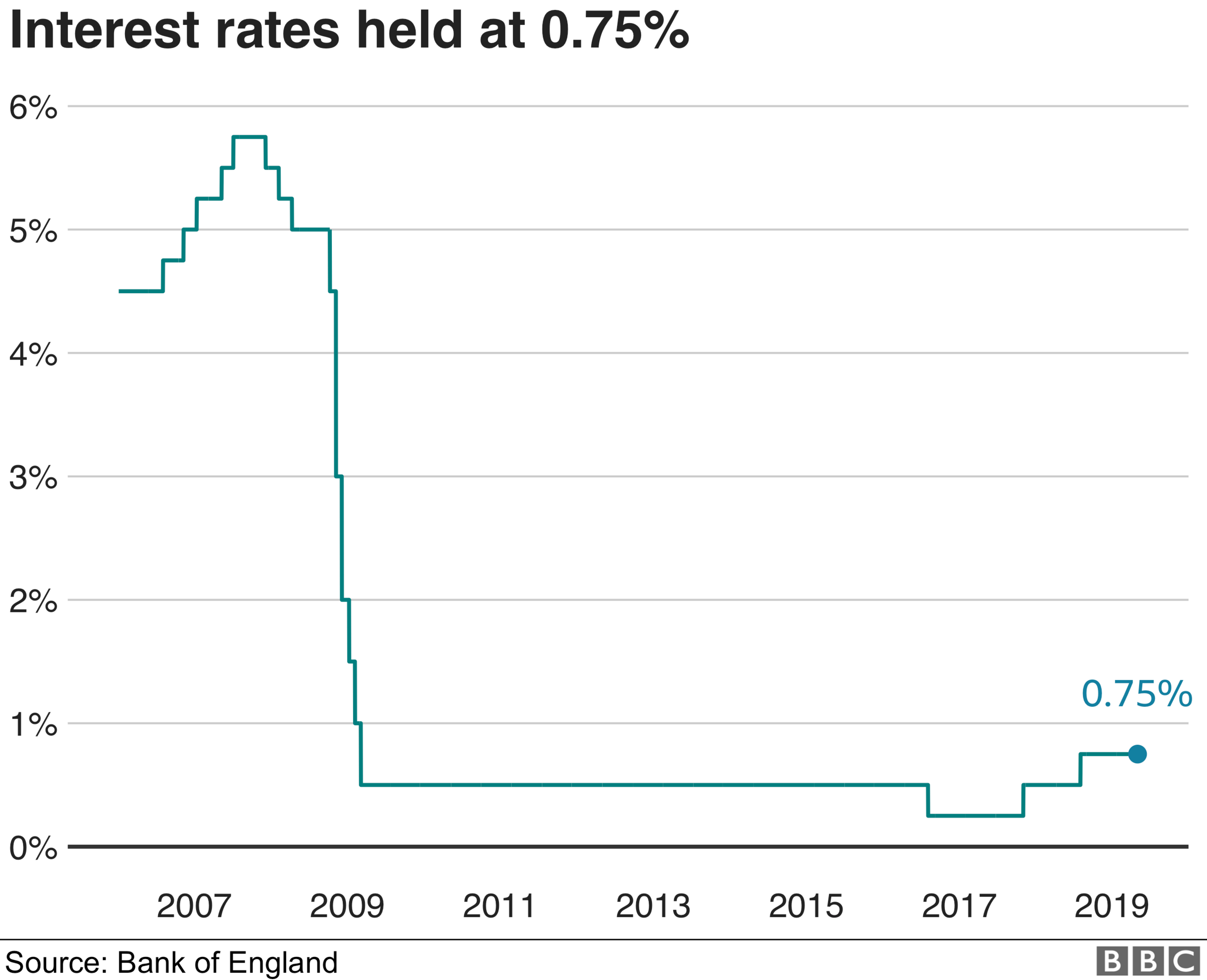

Currently, the rate is at 0.75%. Cuts and rises have been by 0.25 percentage points in recent years.

- Published7 November 2019

- Published27 September 2019

- Published19 September 2019