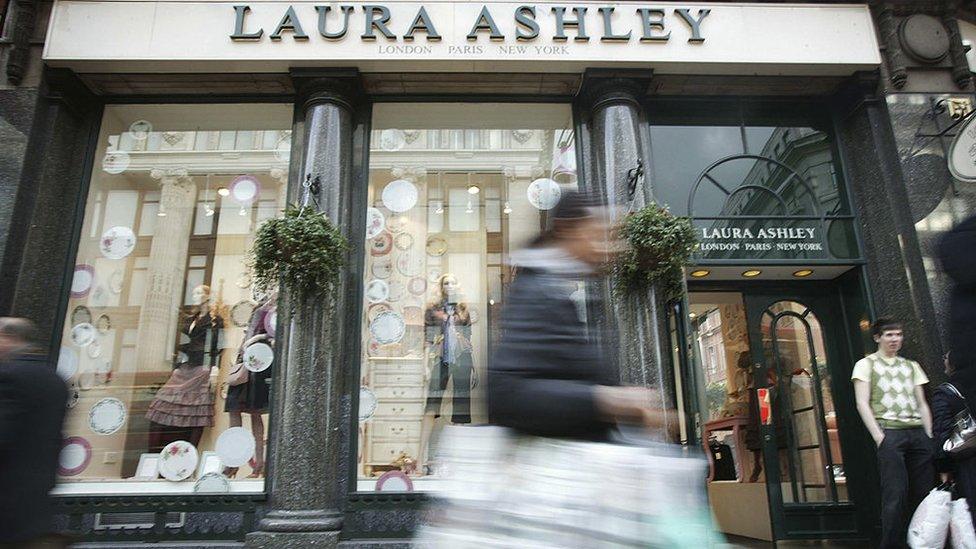

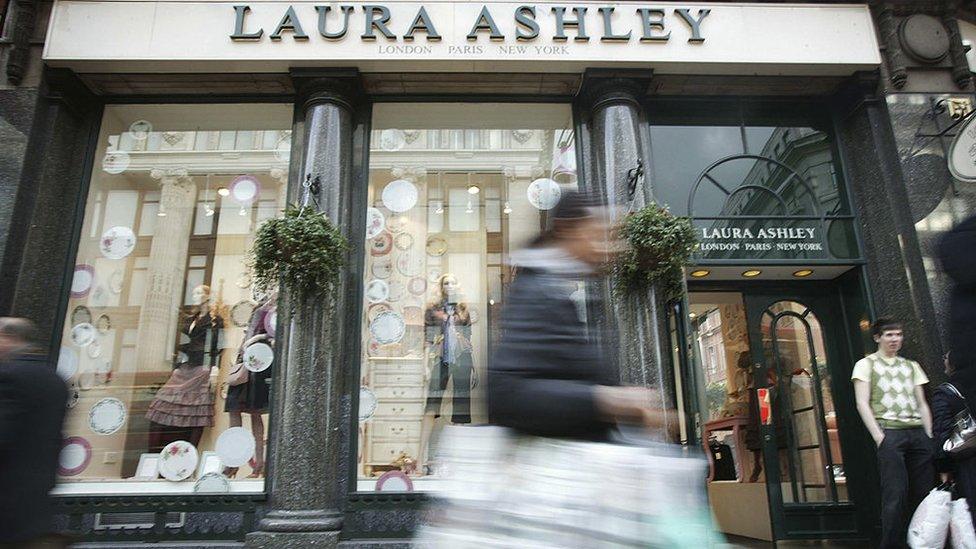

Laura Ashley agrees loan deal in fight for survival

- Published

Struggling retailer Laura Ashley has secured a loan to fund its day-to-day operations following speculation about its survival.

The fashion and home store had been in talks with US bank Wells Fargo about terms for drawing on a £20m loan facility.

Shares in Laura Ashley surged 45% on the news, rebounding from falls earlier in the week.

On Monday, the firm said trading was "challenging".

Sales fell by nearly 11% in the second half of 2019.

It said that its majority shareholder, the Malaysian group MUI, had been in talks with Wells Fargo about funds to allow it to continue trading.

The company's share price took a hit after the firm said it had seen a decline in the sales of larger, more expensive items and that customer deposit levels have shrunk. That in turn triggered a restriction on how much it could draw from the loan facility it has with Wells Fargo.

In an update to the London Stock Exchange, external, Laura Ashley said that it should be able to use the funds to "meet its immediate funding requirements". The group said, however, that the money was "not a cash injection".

Struggle to stay relevant

In December 2018, Laura Ashley earmarked 40 stores for closure, amid tough trading conditions on the UK High Street. Total group sales fell 10.8% to £109.6m in the second half of 2019.

Founded in 1953, Laura Ashley was a prominent name on the High Street and one of the world's leading clothing brands in the 1970s and 1980s.

But it has struggled to stay relevant, with the share price tumbling 90% over the past five years.

Independent retail analyst Teresa Wickham said that the brand was the first to tap into key trends some decades ago, but that it "had lost its way".

She added: "There's no clear strategy when it comes to Laura Ashley - it's quite difficult to know whether it's a furniture, homeware or clothing store.

"The brand needs to do some work to identify who their key customers are now. People are searching for vintage, genuine products - so there's certainly a market for the to tap into."

- Published17 February 2020

- Published17 February 2020

- Published27 January 2020