The tech boss who lost more than a billion

- Published

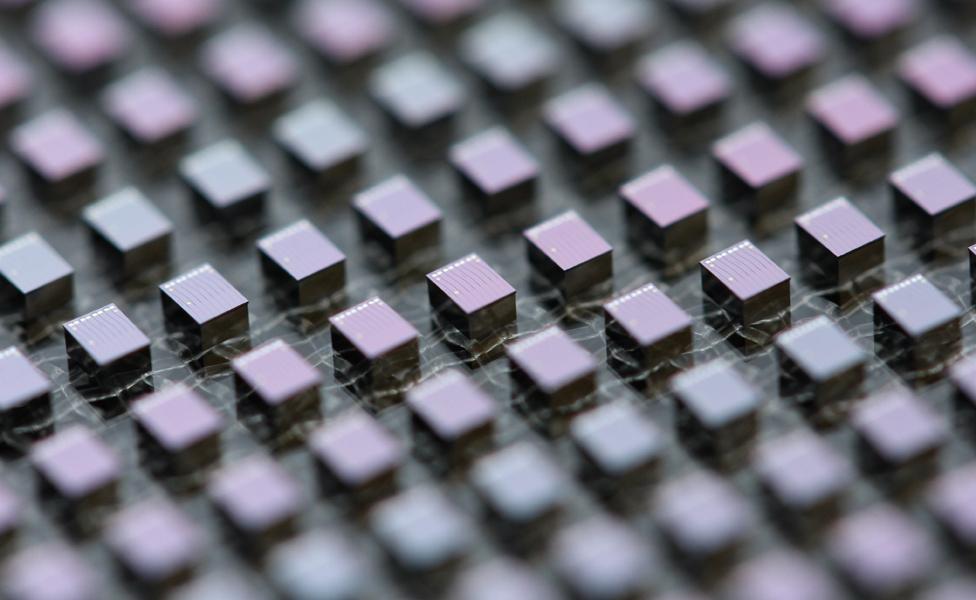

Andrew Rickman today runs Rockley Photonics, which specialises in designing and producing next-generation, optical computer chips

The BBC's weekly The Boss series profiles different business leaders from around the world. This week we speak to UK technology pioneer Andrew Rickman.

How would you feel if you lost more than £1.4bn ($1.81bn) almost overnight?

That was the situation faced by Andrew Rickman back at the end of 2000, when the dotcom bubble spectacularly burst, sending shares in his company Bookham Technology plummeting.

"It was like a nuclear winter," he says looking back.

Andrew had set up Bookham in 1988 in the kitchen of his home in Wiltshire, when he was 28. It grew to become one of the world's leading providers of optical components for the telecommunication and computer industries. In very simple terms, its technology allowed data to be transferred very quickly using lasers and glass fibres.

By the late 1990s its sales were booming as more and more homes and businesses were being connected to the internet, and mobile phone networks were being rolled out.

Andrew says his previous wealth was widely reported in UK newspapers

The good times were, well, so good, that after Bookham floated on the London Stock Exchange (LSE) in April 2000, within two months it had joined the FTSE 100 index., external This is the list of the 100 firms on the exchange with the largest market capitalisation - the combined value of all their shares.

Such was the surge of Bookham's share price that Andrew, who owned the largest stake in the business, became the UK's first technology billionaire. This sent the UK's tabloid newspapers into a frenzy, and the softly spoken, modest 40-year-old was suddenly a reluctant celebrity.

Journalists excitedly told their readers that he was richer than Queen Elizabeth II and Sir Paul McCartney combined. Looking back, he says he was "embarrassed" by all the coverage.

At the peak of Bookham's share price in the summer of 2000, Andrew was worth more than £1.5bn. Then the dotcom bubble burst, and before the end of the year Bookham's share price - and Andrew's wealth - had collapsed.

This thrust him back into the papers, which now gleefully reported his downfall., external

He predicts that his latest company - Rockley Photonics - could see billions of pounds in annual sales

"I didn't think particularly much about all the press coverage," says Andrew, now 59. "The money wasn't an issue, because it was only on paper. Being the first dotcom billionaire wasn't a reality to me.

"The thing that was difficult to deal with, as a human being, was the massive change of circumstances for the company and our technology. It was an emotionally difficult thing to handle for many different reasons."

The big problem for Bookham was that its cutting-edge optical equipment was expensive. And after the dotcom bubble burst, its customers - the firms building all the new networks - switched to using cheaper, simpler technology instead.

But before you feel sorry for Andrew, he still had some £50m in his bank account, and he was able to slowly build Bookham back up again. This involved delisting from the LSE, and moving the company to Silicon Valley to get around the then high price of sterling, and be closer to key customers.

Andrew eventually left the business in 2004, to start a new career as a technology investor. Then in 2013 he started his latest business - Rockley Photonics.

Andrew now employs a team which keeps a close eye on economic and industry trends

Based in Oxford, with a 150-strong workforce, it designs a product called silicon photonic chips. These are like standard microchips, but with one key difference - they beam light around the chip instead of sending an electronic current.

Although the photonic chip industry is still in its infancy, the advantage is said to be that they can process a lot more data, more quickly. Photonic chips are now increasingly being used in everything from data centres to sensor systems on autonomous cars, and in the latest mobile phones.

Andrew says that Rockley now has an annual turnover in the "tens of millions", but with the potential of increasing this to billions.

Veteran electronics journalist Peter Clarke says that Andrew "is one of a group of UK engineering visionaries that also carry the entrepreneurial gene".

"Rickman is smart in an intense, academic way, and a good advert for the UK higher education system." (He was educated at Imperial College in London, and the University of Surrey.)

More The Boss, external features:

Looking back on the dotcom bust, does Andrew think he should have predicted it?

"Hindsight is a great thing," he says. "I don't think many people were prepared for that sort of boom and bust, they never seem to be.

"The span of time between boom and busts tends to be sufficient for the collective knowledge to have gone into retirement. But we were one of very, very, very few firms in our area that survived.

"One thing I did learn at that time was to have an eye to a more analytical view of the world around us. So from that point on I've always had what I would describe as an analysis team... They sit there and they basically analyse the environment the whole time, so, if you like, they become a sensitive seismic monitor.

"And I'm not just looking for the disasters that are coming, I'm looking for the things that are going to explode [in a good way]."