Coronavirus: Opec plans output cut to support oil prices

- Published

Some of the world's biggest oil producers have proposed output cuts in a bid to support crude prices that have been hit by the coronavirus outbreak.

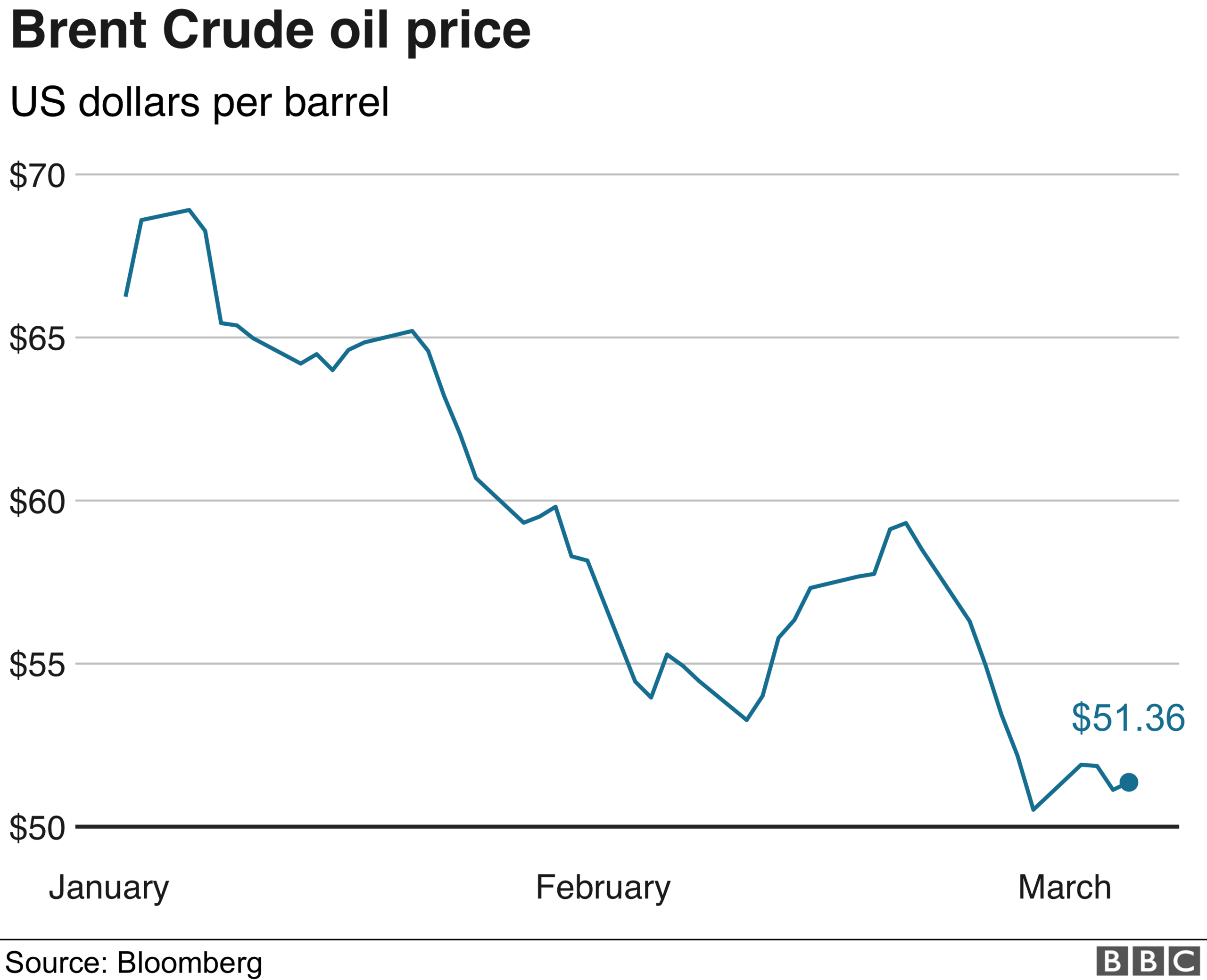

The price of oil has fallen by about a quarter since the virus began to spread internationally, with demand for fuel expected to decline.

Oil exporters' group Opec has now agreed to cut supply by 1.5 million barrels per day (bpd) until June.

It wants non-Opec states, including Russia, to contribute 500,000 bpd.

The proposal will be discussed at a meeting on Friday of a group known as Opec+, which includes Russia.

Following the Opec meeting, which took place at its headquarters in Vienna, the group said, external that the coronavirus outbreak created an "unprecedented situation" with risks "skewed to the downside".

Travel restrictions have been a central element in the official response to the health crisis, especially in China where it started, and in some of the countries the virus has spread to.

That has affected the movement of people and goods. In addition, many people have chosen to reduce their own travel even when official restrictions would not have forced them to do so.

This has hit demand for oil, which accounts for more than 90% of global transport fuel.

Less demand for travel means less demand for fuel

The International Energy Agency (IEA) - a rich countries' organisation - expects demand for crude oil to decline in the current three-month period, which would be the first quarterly decrease in more than a decade - that is, since the financial crisis.

At the time of its last oil market report in mid-February, the IEA was still expecting demand to increase for this year as a whole, but it slashed its forecast for how much it would grow. If its forecast turns out right it would be the weakest since 2011.

That's a forecast, but the impact on the cost of oil is already apparent. Opec is trying to turn that round.

When the group has been in that situation in the past, it has often responded with production cuts.

It is currently limiting its production in response to earlier price falls, in an agreement that is due to expire at the end of the month. Now, the group wants to cut further and for longer.

But Opec accounts for about a third of total global production, so it always faces the issue that it suffers the pain of cutting production while other producers get the benefit of the higher prices that may result.

The group is currently operating under an agreement, external with a number of non-members to limit production, an arrangement which has been in place since late 2016.

The most important, by far, of these is Russia. It is currently producing more oil than any Opec member including Saudi Arabia.

Opec members would like Russia and the other nations in Opec+ to commit to further production cuts now. So far, Russian officials have been unwilling to commit to more cuts.

The rise of shale oil production in the United States adds to the challenge Opec faces in seeking to manage prices.

The US is now the world's biggest producer and shale oil producers can respond quickly with additional production if prices rise.

So if Opec+ does make some progress, it is likely to stimulate more US production which tends to limit the upward move in prices.

- Published24 January 2021