Coronavirus: US jobless claims hit 6.6 million as virus spreads

- Published

Coronavirus: Millions of Americans unemployed

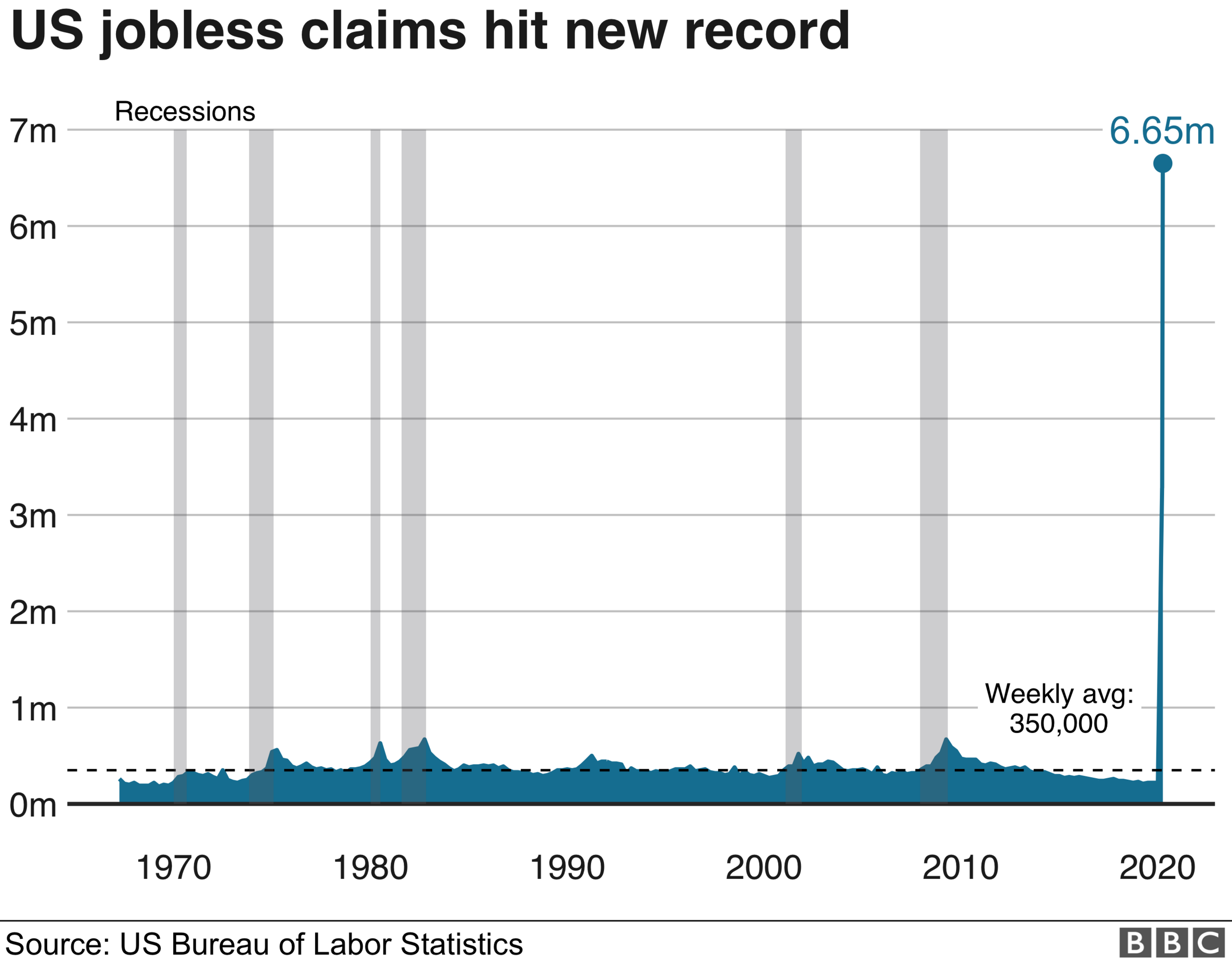

The number of Americans seeking unemployment benefits has hit a record high for the second week in a row as the economic toll tied to the coronavirus intensifies.

More than 6.6 million people filed jobless claims in the week ended 28 March, the Department of Labor said.

That is nearly double the week earlier, which was also a new record.

The deepening economic crisis comes as the number of cases in the US soars to more than 236,000.

With the death toll rising to more than 5,600, the White House recently said it would retain restrictions on activity to try to curb the outbreak.

Analysts at Bank of America warned that the US could see "the deepest recession on record" amid forecasts that the unemployment rate could hit more than 15%.

The outlook is a stark reversal for the world's biggest economy where the unemployment rate had been hovering around 3.5%.

However, more than 80% of Americans are now under some form of lockdown, which has forced the closure of most businesses.

Analysis:

By Michelle Fleury, New York business correspondent

This is the highest number of new unemployment claims in US history.

But what is so terrifying is not just the magnitude but also the speed with which American firms have shed workers.

Roughly 10 million Americans lost their jobs in just the last two weeks. To put that in context, 9 million jobs were lost in the 2008 financial crisis.

There were several reasons for this week's historic increase.

More states ordered non-essential businesses to close to contain the virus. According to economists, a fifth of the US workforce is now in some form of lockdown.

And a government relief package signed last week expanded unemployment benefits to help more people, such as the self-employed and independent contractors.

Some fear the true number could be even higher since many people couldn't even get through to file a claim.

Given these are weekly figures, this data is the closest we have to real-time information showing just how catastrophic the pandemic is for the American economy. And it points to a bruising couple of months ahead.

More than 3.3 million people filed claims two weeks ago, eclipsing the previous record of 695,000, set in 1982 and bringing the two-week total to about 10 million.

The most recent figure was worse than many economists had feared.

"I don't usually look at data releases and just start shaking," said Heidi Shierholz, former chief economist at the US Department of Labor and now policy director at the Economic Policy Institute. "This is a portrait of disaster ... It's like nothing we've ever seen before. It represents just incredible amounts of grief and suffering."

Workers in accommodation and food services were hit hard again this week, the Department of Labor said.

But it added that states are reporting "a wider impact across industries".

"With this report there should be little doubt that ... US is already in deep recession and the global economy will be too", tweeted Mohamed A El-Erian, chief economic adviser to financial services firm Allianz.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The US recently passed a more than $2tn rescue bill, which funds direct payment for households, assistance for businesses and increased unemployment benefits.

It also made more people eligible to receive benefits, including workers whose jobs are suspended rather than cut. There is speculation the government may provide further relief.

Unlike other countries such as the UK, the US has not implemented a programme that pays firms to keep workers on the payroll - one reason the numbers are so stark, Ms Shierholz says.

"There's an attempt at it," Ms Shierholz said, pointing to the expanded eligibility. "But this concept of keeping workers on payroll through a downturn is not well socialised in the US. It's just not how we've done things in the past."

- Published27 March 2020

- Published2 April 2020

- Published24 January 2021