My Money: 'The alcohol bill has increased, but he's earned it!'

- Published

Claire's husband is off work during the pandemic, so he has plenty to time to play with their son

My Money is a series looking at how people spend their money - and the sometimes tough decisions they have to make. Here, Claire Millington, an auditor for PwC, from West Yorkshire in the UK, takes us through a week in her life, as the country goes through the coronavirus pandemic.

Claire (35) is mother to Alexander (4) and married to Luke. She lives halfway between Todmorden (pronounced Tod-m-dun not Tod-mor-den!) and Hebden Bridge.

Over to Claire...

I'm working full time from home now whereas my normal pattern would be two days at home and two days in the office. So, because of that and the fact that the munchkin is watching more TV than normal because he is not at preschool, we are spending a bit more on gas and electricity.

Childcare - we use the Government's Tax-Free Childcare system so whatever we pay in, the Treasury tops up by 20%. Our preschool charges a month's fees in advance so today I make the payment for 80% of the c£400 cost into my online Tax-Free Childcare account. It's a bit galling as the preschool is closed now, even to key worker children (we qualify due to the hubby's career) but I do understand that they will need the cash to tide them over until the Government's 80% furlough cash comes in.

Fortunately, we can afford to pay this as I am still working as normal, just from home, and the hubby is still on full employment, though he is currently stood down from his normal duties and is at home with us. While I'm pleased the staff are going to get paid, I know this is really difficult for some of the other parents who are really going to struggle this month. Hopefully there will be some sort of compromise/refund agreement once this is all over.

Total spend: £320

Isolation saving (£17) £12 train fare plus £5 lunch as when I am in the office I frequently forget to make lunch, or if I do I have a bad habit of rushing out the door to get munchkin to preschool and leaving it in the fridge!

Hooray for payday!

Another quiet day, me working from home with the odd break to relieve daddy daycare. In order to do some baking with the munchkin later on in the week, we made a socially-distant visit to our neighbours to buy some eggs. They have a fabulous small holding of goats, sheep and chickens and I think we are their best customers. Especially when the hubby is at home, we go through eggs like nobody's business!

Phone bill paid via direct debit. I eventually needed a new handset a couple of months ago so upped my contract to £23 per month from the £13 tariff I was on as I'd worked out that over the duration of the contract (24 months) I'd only be paying roughly the same as buying a new handset separately.

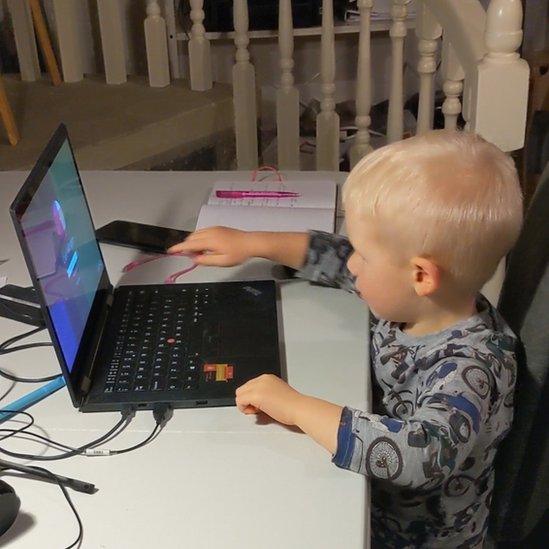

Alexander 'helping' his mummy with some work

Total spend: £26

Isolation savings: £0

The hubby has been taking the opportunity to finally build the compost heap (it's only been waiting for months…) so we needed a delivery from our local builder's merchants costing around £42.

It's a big one today as the mortgage payment of around £1400 comes out on the first of each month. It never fails to make me gulp but it's worth it. We love our house and are doing what our mortgage adviser recommended - pay off as much as you can as quickly as you can and if you can afford it, overpay when you can. This means we save massive amounts of interest over the life of the mortgage and should (fingers crossed) be mortgage-free by the time we are 50.

Total spend: £1,442

Isolation saving: £17 £12 train fare and £5 lunch.

My Money

More blogs from the BBC's My Money Series:

I do try to make sure that the majority of my bills are paid via direct debit (It's a condition of my current account and makes sure I don't miss a payment) and that they come out at the start of each month. That way I know that except for childcare and my phone bill, the rest of the cash is ours to do with as we please.

So today is a bill day of nearly £300 covering council tax, electricity, gas and water. As we have a septic tank our water costs are minimal each month as we don't pay for sewerage but we do save up a little each month to cover the cost of emptying the septic tank should it need it.

Total spend: £300

Isolation saving: £0

Claire and her son getting some daily exercise

Friday is normally the day for planning the meals for the week ahead, doing the food shopping, doing housework and generally sorting my life out while the munchkin is at preschool (I'm contracted to do four days a week and do try to be strict with myself and not do anything other than check the work phone for emergency emails from my team on a Friday).

Fortunately we had done our monthly big Costco shop for stuff such as toilet roll, kitchen roll, tinned food etc. before the lockdown started. This week it has been fresh food, meat and some treats as well as additional baking supplies as I have really enjoyed the cake-making with the munchkin. We are also trying to support our local small businesses, so where possible we are buying from the local butcher and grocer. This is slightly more expensive but as the butcher has award-winning produce (his Italian sausages are to die for) it's worth it.

There has also been a bit of an increase in the alcohol bill this week but looking at the hubby's face after a week of full-time entertaining our very active and demanding four-year-old I think he's earned it!

Normally the hubby lives and works away during the week so while my weekly food shopping bill has gone up, this is probably just offset by what he is not spending on food when he is away. I'll call that a net draw - no pain but no gain either.

Total spend: £150

Isolation saving: £0

Claire Millington

We are really lucky where we live that we have an acre of paddock (no horses though - my budget isn't quite up to that kind of hit!) so there is plenty of space in the garden and the paddock for the munchkin to run around and drive his toy JCB dump truck. We also look out onto Stoodley Pike (pronounced Studley) so it's really easy for us to get out and about in the fresh air for free.

Normally on a weekend we'd have taken a day trip out somewhere when the weather is nice but we are following the rules #stayhome.

We did treat ourselves to a takeaway given we'd done such a long walk and got back a little later than planned. Sadly our favourite local Indian has closed to protect their staff and customers but a member of our local community has stepped up to help bring local information together in one place by creating a community website so we were able to find one that was still open.

Total spend: £30

Isolation saving: Hard to judge as our day trips out can vary in cost. When we do go out I always pack a lunch and drinks but we often end up paying for parking and then a coffee and cake. I've gone with an average of £25.

Claire's son has been enjoying the wide open spaces near her house

I took the weekly readings from the smart meter which came out at £34.50 for gas and £20.39 for electricity. While this is slightly more than normal, probably not helped by all the additional cups of coffee I am making while working from home the additional two days, it doesn't seem massively different. Thankfully the weather has been reasonably good with only a couple of cooler days this week. Had this been in the depths of winter it would have been a different story.

Today was also the day I checked the digital banking to make sure all the direct debits for the bills had been paid. I was pleased to see that my gym has done what they promised and suspended all membership fees until they can reopen. So that's a £26 per month isolation saving, though I am having to make a special effort to do some of the free home workouts which is not as easy as people make out - I lack all enthusiasm when trying to do this in my living room!

I also make sure that the standing order I have into my son's account is made. This is £100 as a rule each month but then, towards the end of the month when I assess what money we can transfer to our savings, I may top this up with more if we can manage it. I want to make sure that he has funds for when he is older, either for university or for a house or even as funds to start a business. It may not be much but it does all add up over the years. As he has a higher interest children's saving account, assuming the rate of interest stayed the same at its current 3%, £100 per month for the next 14 years (until he is 18) could be worth around £20,000.

Total spend: £154.89

Isolation saving: £6.50. As the gym membership is per month I've divided this by four to get an average weekly saving.

Total spent this week: £2,447.78

Total weekly isolation savings: £65.50

How does Claire feel about her week?

While this week's spend might look horrific, it's worth noting that this is practically all our monthly spending in one week. With the exception of our weekly food shop, my phone bill and the cost of childcare, all our bills are paid in the few days after the start of the month. We then know that whatever money we have left is ours to do with as we wish - spend it or save it. That really helps give clarity and means we don't spend beyond our means.

With having to stay closer to home we have made some savings, and not commuting to Manchester two days a week has made a difference to travel costs this week. The additional costs for electricity, gas and food are noticeable but not actually as much as I thought they would be.

I am just so thankful that where we are we have fabulous outdoor space where we can keep the munchkin busy, ourselves exercised and make sure we can stop ourselves from going stir crazy! Here's to hoping that this all ends soon and that people can stay safe and well.

We're looking for more people to share what they spend their money on. If you're interested, please email my.money@bbc.co.uk, external or get in touch via our My Money (World) Facebook group, external, or if you live in the UK, please join our My Money (UK) Facebook group, external and we'll aim to contact you.

Related topics

- Published3 April 2020

- Published9 January 2020

- Published26 December 2019

- Published12 December 2019