Coronavirus: One in nine homeowners takes mortgage holiday

- Published

- comments

Lots of people are finding it difficult to meet the demands of their mortgage

One in nine mortgage holders in the UK has taken a so-called "payment holiday" as their finances have been hit by the effects of coronavirus.

Lenders have agreed that 1.2 million homeowners can delay repayments as jobs are cut and wages reduced.

Typically, this defers a mortgage bill of £775 a month, with borrowers given the option of delaying up to three months of repayments.

More are likely to take up the option, which should not affect credit ratings.

'Apply online'

Many frustrated mortgage holders have struggled to get through to their lender as phone lines have been so busy, leaving banks - who face their own staffing pressures - to prioritise the most vulnerable.

UK Finance, which represents banks and which compiled the figures, said payment holidays were best organised, if possible, by filling in a form provided online by most lenders.

Banks and building societies have offered up to three months of mortgage repayment deferrals for those struggling financially. This does not mean these bills are being cancelled, as they will still need to be paid at a later date.

For the typical capital and interest repayment mortgage, about £775 is being deferred each month.

EASY STEPS: How to keep safe

A SIMPLE GUIDE: What are the symptoms?

CONTAINMENT: What it means to self-isolate

HEALTH MYTHS: The fake advice you should ignore

MAPS AND CHARTS: Visual guide to the outbreak

The number of deferrals in place more than tripled in the two weeks between 25 March and 8 April, growing from 392,130 to 1.24 million. This is an increase of nearly 850,000, or an average of around 61,000 payment holidays being granted by lenders per day.

Were they all to take a three-month break, a total of about £2.6bn would have been deferred.

The total would have risen since then, and is likely to increase further.

"Payment holidays aren't always the right solution for everyone. We would therefore encourage any mortgage customers concerned about their financial situation to check with their lender so they can find out more information on the support available and how to apply," said Stephen Jones, UK Finance chief executive.

He stressed that people should not simply cancel their direct debit without talking to their lender as this could lead to charges and could affect their chances of borrowing in the future.

Robin Fieth, chief executive of the Building Societies Association (BSA), said: "We know that this is a difficult time for many homeowners with a mortgage, and building society staff have been working hard to offer individuals the right solution."

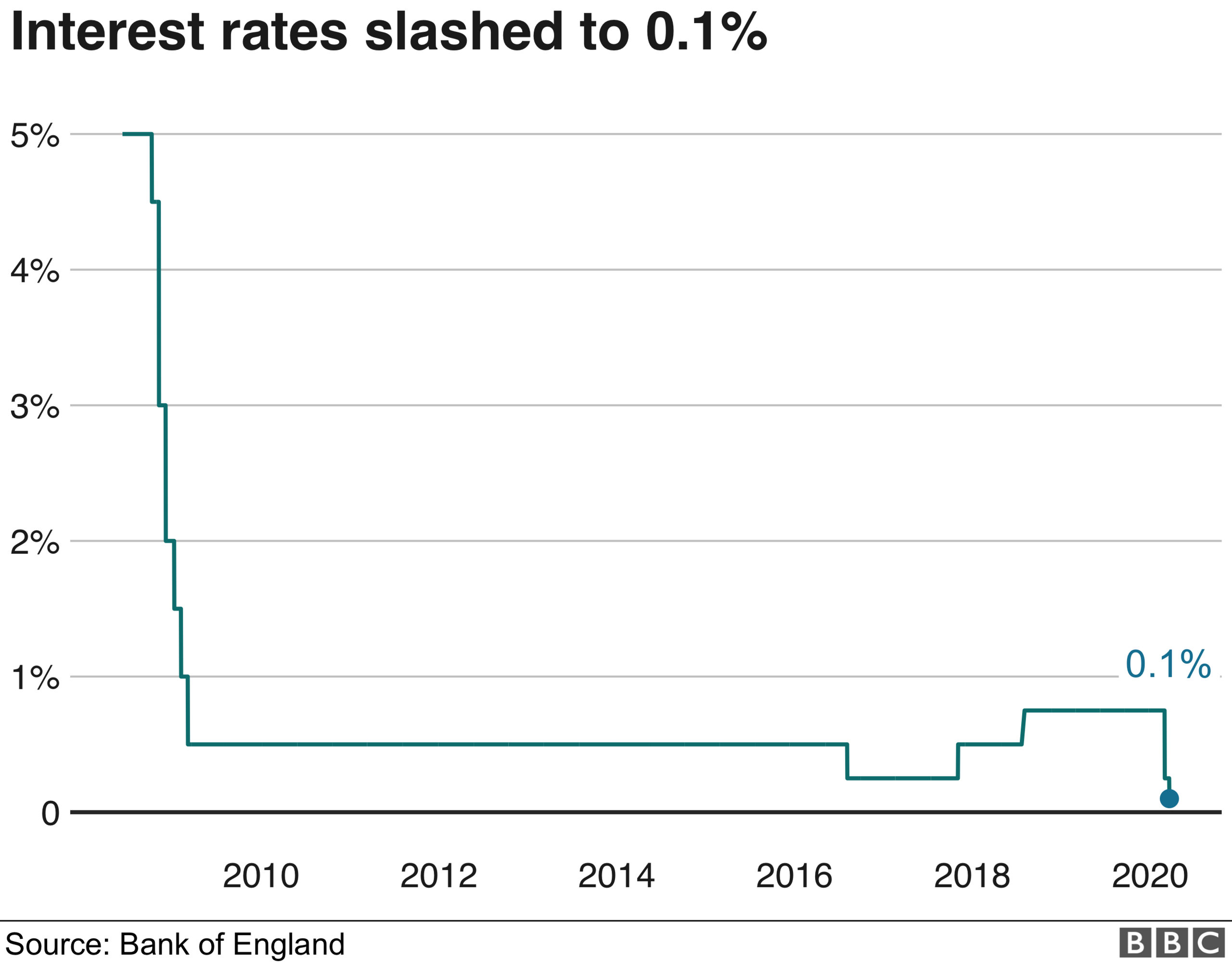

Some mortgages that track the Bank of England's interest rates have been getting cheaper after policymakers cut the base rate to its lowest-ever level in response to the coronavirus outbreak.

However, most homeowners are on fixed-rate deals and so would have seen no reduction in their current monthly mortgage bill. With incomes having been hit, this has put strain on household finances.

Some mortgage lenders, meanwhile, have been pulling out of offering new deals to people who cannot offer a large deposit, as much of the UK mortgage and housing market goes into lockdown itself.

That has ruled out first-time borrowers or existing homeowners with little equity in their home looking for a new deal.

- Published31 March 2020

- Published10 March 2020

- Published29 May 2020