Coronavirus: Six money-saving ideas for lockdown and beyond

- Published

Wages have been cut, work contracts have dried up, or that pay rise you were banking on has disappeared.

Finances are being stretched by the effects of the coronavirus outbreak.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

So what can you do to find, save, or free up some extra cash in these uncertain times?

We asked some experts for their top tips.

1. Use tech to shop around

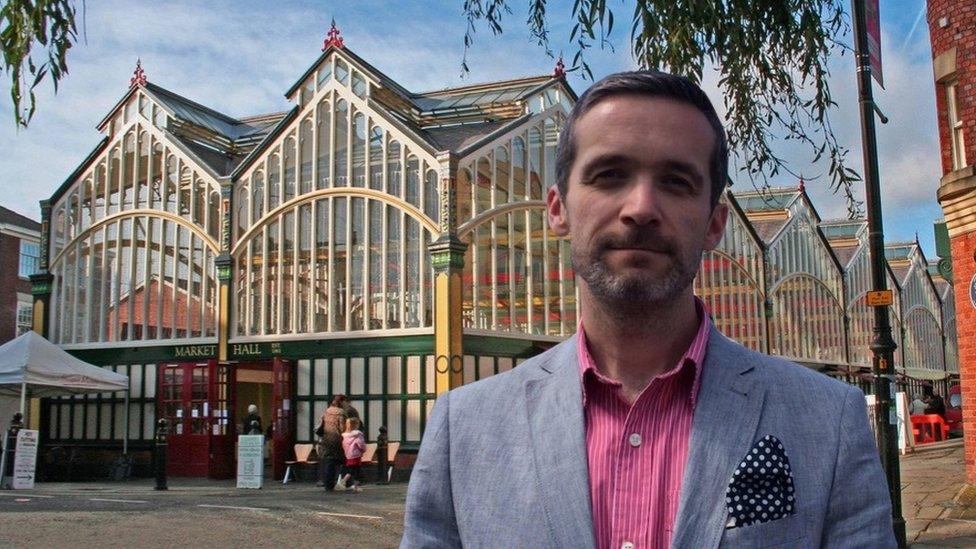

Money blogger Andy Webb says anyone who uses price comparison sites once a year for car insurance or energy bills should think about using online price search sites more widely.

There are various websites, easily found via a search engine, that track and compare prices at thousands of shops, as well as displaying reviews. For you, that can mean finding the cheapest price in a couple of clicks.

"Shopping around for the best price is really easy when you're doing it online," says Andy, who writes the Be Clever With Your Cash blog, external.

"There are some you can use day in, day out to save money on everything from TVs to trainers.

"An extra feature of these sites is the price history tool. You'll be able to see if the current price is higher or lower than usual - a handy guide to work out if the lowest price is actually the best price too."

2. Chase refunds for services you can't use

The gym membership is even more idle than you during lockdown, as are subscriptions to restaurant clubs and many other services.

"Know your rights and stick up for them," says Iona Bain, founder of the Young Money blog, external.

"Consumers who can no longer use products or services due to the lockdown are fully entitled to cash refunds - no ifs, no buts."

Gyms remain closed owing to the coronavirus outbreak

The regulator, the Competition and Markets Authority, will take complaints if you are unsuccessful.

"Be polite, patient but persistent, but know that ultimately there's a last resort that's got your back," she says.

She also suggests talking to your bank, insurers, utility companies, mobile network and landlord if you are struggling.

"Don't bottle up your problems or cancel any payments without consultation, as this will do more harm than good," she says.

3. Claim the benefits you are entitled to

Financial support from the government may be there for you, but you probably need to claim it.

There are benefits such as statutory sick pay, employment and support allowance, jobseekers' allowance, and personal independence payments.

There are also others that top up your income, such as universal credit, where the amount you receive depends on what you have already. Applying for universal credit can stop other benefits such as tax credits, so it is worth checking before you claim.

"Council tax support is available. If you're struggling to stay afloat look into any available grants. Talk to your energy and water supplier to see what help they can provide," says Lee Healey, of money advisers IncomeMax, external.

"There are schemes to help parents of children that normally receive free school meals. Students should contact their college or university to see what help is available."

Where to go for help

Turn2Us, external - a national charity offering benefits information, grants and support

Citizens Advice, external - help with benefits, consumer issues and other work and financial matters

Credit unions, external - locally based, regulated loan and savings membership organisations

Search for grants, external from a range of organisations

4. Clear the credit card quicker

Many people have been given payment breaks for rent, mortgages, or other debts - but they will come to an end fairly soon.

If you are struggling, talk to a debt adviser, but good budgeting will help millions of people to cope, says adviser Sara Williams, who writes the Debt Camel blog, external.

"A good approach is a money detox, external to reduce spending and simplify your finances - including tracking down unwanted direct debits, cutting utility bills and building a small emergency fund," she says.

"If your main aim is to clear a credit card or catalogue debt but you can't afford large payments, my tip is to set up a standing order for the current minimum payment (or round it up). This clears the card many years sooner and saves a lot of interest."

5. Review your rainy day savings

If you already have savings, don't just leave them in an old account, but check the best buy tables to see if a bank or building society will give you a better return, says Anna Bowes, from comparison service Savings Champion, external

By reviewing regularly over time, this can make a big difference to how much is in these accounts - even though interest rates are not very generous in general at the moment.

"Those who do have savings but have not reviewed them, or have left cash in their bank, could actually see an increase to their interest if they switch to one of the best paying accounts," she says.

"After this is over and hopefully your income recovers, remember to keep saving. Just a little bit each month can make a difference. There may be a luxury that you can do without, and save instead."

In financial terms, the current crisis is more of a downpour than a rainy day - a time when you may have to fall back on this sort of savings to avoid racking up huge debts.

"This situation illustrates the need for everyone to try and put away something," Ms Bowes says.

6. Return items - even if shops are closed

Helen Dewdney, who blogs under the name The Complaining Cow, external, points out you are entitled to return an item that you bought from a store if it is faulty, if it's not as described when sold, or has not lasted a reasonable length of time

But the store may be closed.

She advises having a record of informing the company of your complaint. You will need to do this in writing, not by phone, so that you have an evidence trail. Email customer services and explain the situation.

"Offer them the option of picking up the item safely and providing you with a replacement or to take it away for a repair. If the item is less than 30 days old then you are entitled to a refund. It would still be prudent to email the company and state that you want the refund," she says.

A SIMPLE GUIDE: How do I protect myself?

AVOIDING CONTACT: The rules on self-isolation and exercise

HOPE AND LOSS: Your coronavirus stories

LOOK-UP TOOL: Check cases in your area

TESTING: Can I get tested for coronavirus?

The material is for general information only and does not constitute investment, tax, legal or other form of advice. You should not rely on this information to make (or refrain from making) any decisions. Links to external sites are for information only and do not constitute endorsement. Always obtain independent, professional advice for your own particular situation.

- Published20 April 2020

- Published1 May 2020

- Published11 April 2020

- Published30 September 2021