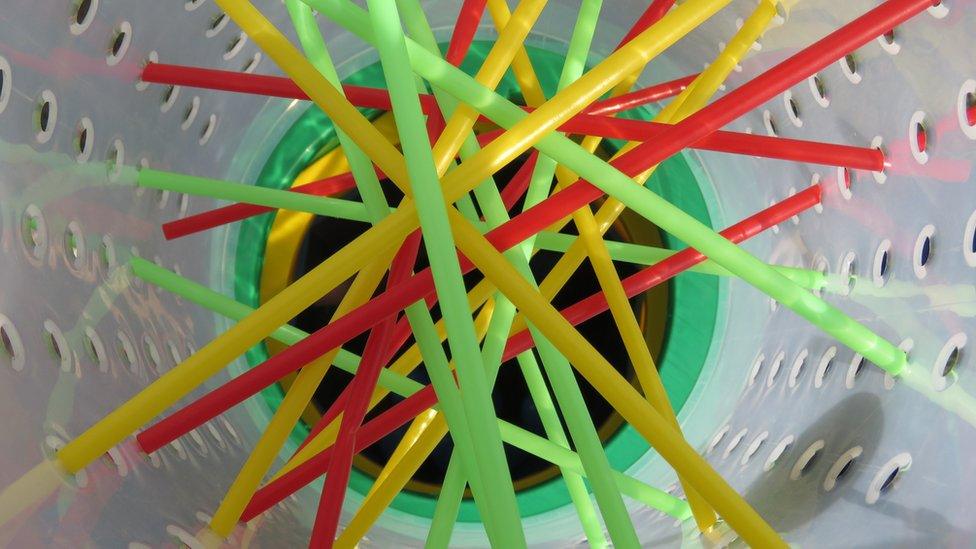

Chancellor in delicate game of economic Kerplunk

- Published

In the family game Kerplunk, a collection of marbles is balanced on top of a lattice of supporting rods.

Players of the game take turns to attempt to remove these supporting rods one by one without allowing the marbles to come crashing down.

That is precisely what Chancellor Rishi Sunak will attempt when he starts to remove the government furlough scheme - the most significant pillar of support for millions of businesses and workers.

Can he delicately and gradually remove it without the economy crashing down as unemployment rockets?

We expect that as soon as today, the government will give more detail on its plan that after July employers bear some of the cost of the Job Retention Scheme.

The JRS, or furlough scheme, is currently paying 80% of the wages of over 8 million workers to the end of October at an estimated cost to the taxpayer of £80 billion pounds.

Can't pay, won't pay?

It's expected that employers who wish to continue to have workers employed but not at work stump up around 20% of their wages with the government paying the other 60%.

It sounds fair - but here's the jeopardy. Those employers who can't or won't pay their share will not be eligible for the scheme. If they won't put their hand in their pocket - neither will the government.

Chancellor Rishi Sunak will start to remove the government furlough scheme

The BBC understands that the changes to the scheme will not be sector specific, which is important as while some businesses have slowly returned to work, others will be unable to under current workplace guidelines.

As long as the two metre social distancing advice is in place, large sectors of the economy - like pubs, restaurants, theatres, airlines etc will be unable to operate viably.

Government officials say that any easing of the two metre guidance will be "led by science" and not by the Treasury.

Balancing act

Can these businesses afford 20% of their previous wage bill if they have little or no income?

They may regrettably but understandably decide that they can no longer have those workers on their payroll and hundreds of thousands, possibly millions of furloughed workers will very rapidly become unemployed.

The Treasury will want to make the centre piece of their new changes a new flexibility to the furlough scheme - allowing workers to return part time while still being eligible for reduced government support till the scheduled end of the scheme at the end of October. This is something that businesses have called for and will be roundly welcomed.

But we are getting to the business end of this delicate economic balancing act.

The Treasury is hopeful that both business owners and taxpayers will see the new balance struck as fair.

But we are approaching a moment of truth when the Chancellor will hope his next move doesn't see the economy lose its marbles.