Coronavirus furlough scheme to finish at end of October, says chancellor

- Published

- comments

The UK's coronavirus furlough scheme will finish at the end of October, Chancellor Rishi Sunak has confirmed.

At the No 10 briefing, Mr Sunak also set out how employers will have to start sharing the cost of the scheme.

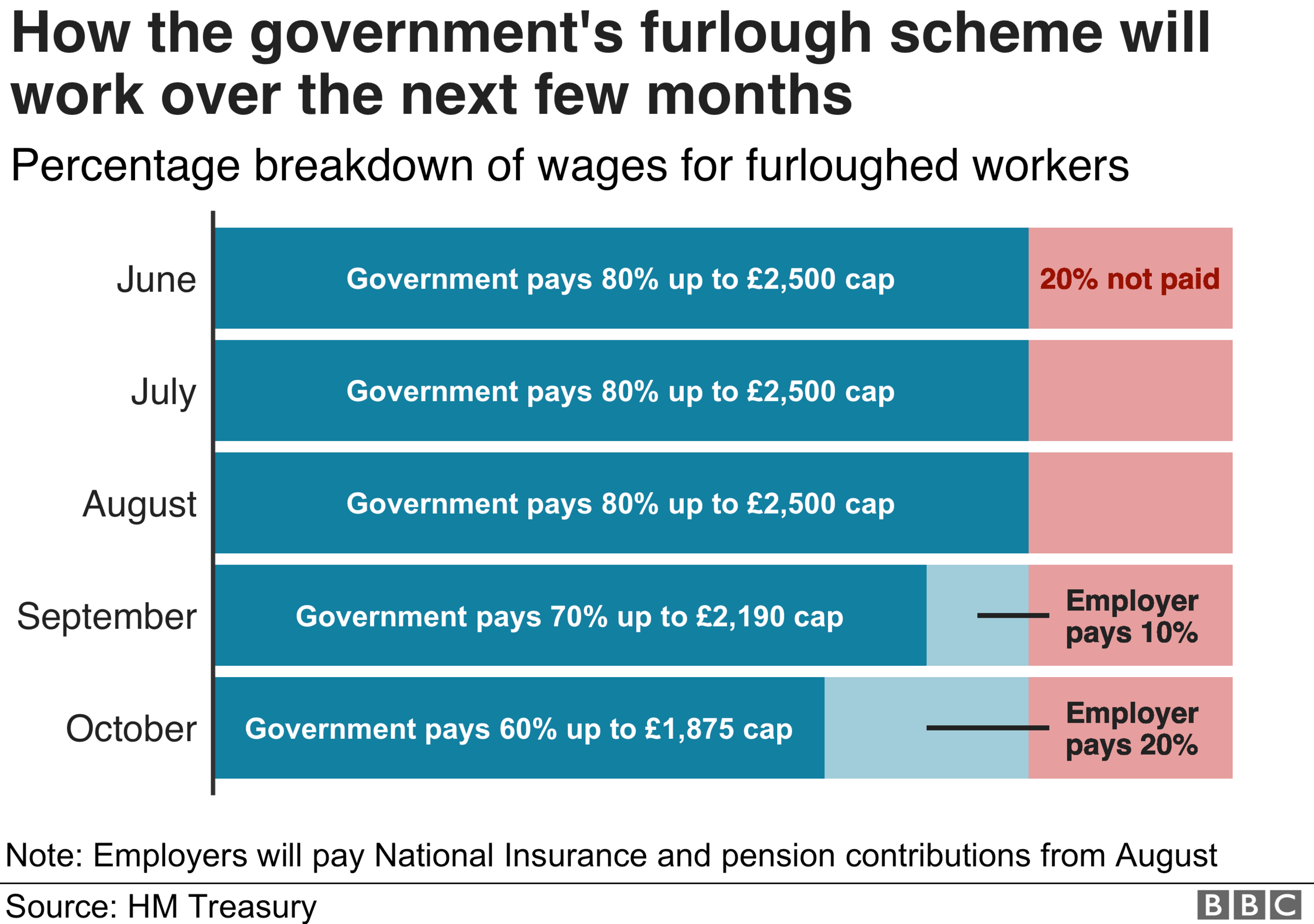

From August, employers must pay National Insurance and pension contributions, then 10% of pay from September, rising to 20% in October.

Also, workers will be allowed to return to work part-time from July, but with companies paying 100% of wages.

Mr Sunak said the Coronavirus Job Retention Scheme will adjust so "those who are able to work can do so".

Some 8.4 million workers are having 80% of their salaries paid for by the government - up to £2,500 a month - under the scheme, which was originally intended to last until the end of July.

Earlier this month, the chancellor extended the scheme until the end of October, but did not spell out how employers would start contributing.

Under Friday's changes, furloughed workers will continue to get 80% of pay until the end of October, but by then a fifth of their salary will have to be met by employers.

"Then, after eight months of this extraordinary intervention of the government stepping in to help pay people's wages, the scheme will close," Mr Sunak said.

Asked if he would "switch the furlough scheme back on" in the case of a second peak in cases and the reintroduction of lockdown measures, the chancellor said the scheme "as it stands in a national way, in the way that it is designed" will end in October.

"Eight months, as I said, is I think a generous and long period of time," he said.

The chancellor is attempting a delicate balancing act.

Slowly withdrawing very expensive government support programmes without crashing the economy.

Cash-strapped employers must decide if they can take on an increasing burden to keep workers for whom there may be little or no work.

The chancellor says the government can't go on meeting the full cost of the furlough scheme.

But the withdrawal is more gradual than many had feared and the government hopes that the support withdrawal will be mirrored by business demand recovering.

We may be about to find out how many real jobs are left in the post-coronavirus economy.

Employers' claims under the scheme have reached £15bn so far, however the scheme is expected to cost a total of around £80bn, or £10bn a month.

The Office for Budget Responsibility is set to publish detailed costings next week.

It comes as the latest UK-wide figures show another 324 people have died after testing positive for coronavirus in hospitals and the wider community, bringing the total to 38,161.

Some 131,458 people were tested for coronavirus on Thursday, with 2,095 more positive cases reported.

Restaurateur David Moore told the BBC he is "deeply, deeply worried" about the changes to the scheme.

Mr Moore, who owns London restaurant Pied a Terre, said it is unfair for hospitality firms to start paying towards wages when they do not have any revenues.

"It is massively disappointing and sheer lunacy to try to get an industry who hasn't had any revenues for what will be then probably five months, to ask them to start contributing," he told BBC Radio 4's The World at One.

He warned that some businesses could go bust as a result.

"Will we have any money coming through the door to help contribute? If we don't it is all too late, a lot of businesses are heading down the pan."

Labour's shadow chancellor Anneliese Dodds also warned about job losses.

"It is concerning that there is no commitment within these plans for support to only be scaled back in step with the removal of lockdown," she said. "Nor is there any analysis of the impact on unemployment of a 'one size fits all' approach being adopted across all sectors."

Chancellor Rishi Sunak says the next phase is about getting people back to work

How will the scheme change?

From 1 July, businesses will be allowed to bring furloughed employees back part-time, a month earlier than previously announced. The move is aimed to help support people back to work, the government said.

It will be down to individual firms to decide what part-time means. They will be able to set the hours and shift patterns staff will work when they return, but companies will have to pay wages while they are in work.

"Extending the job retention scheme and making it more flexible is key to getting the economy back on its feet," said Federation of Small Businesses national chairman Mike Cherry.

"By providing employers with the adaptability they'll require as businesses adjust to a new normal, and bringing forward the flexible furlough launch date, the government is giving hope to small firms right across the UK."

From 1 August the level of government grant will be reduced "to reflect that people are returning to work".

Furloughed workers will continue to receive 80% of their pay, but from August it will include a growing employer contribution. It will start with bosses paying NI and pensions in August, plus 10% of pay in September, rising to 20% in October.

The details: How employers' contributions will increase?

During August the government will pay 80% of wages up to a cap of £2,500. Employers will have to pay NI and pension contributions. For the average claim, that's 5% of the gross employment costs the employer would have incurred had the employee had not been furloughed.

In September, the government will cut its grants to 70% of wages up to a cap of £2,190. Employers will pay NI and pension contributions and 10% of wages to make up the 80% total up to a cap of £2,500. That works out at 14% of the average gross employment costs the employer would have incurred.

In October the government grant will be cut to 60% of wages up to a cap of £1,875. Employers will pay NI and pension contributions and 20% of wages to make up the 80% total up to a cap of £2,500. That's 23% of the gross employment costs the employer would have incurred had the employee not been furloughed.

- Published29 May 2020

- Published30 September 2021

- Published27 May 2020

- Published15 May 2020