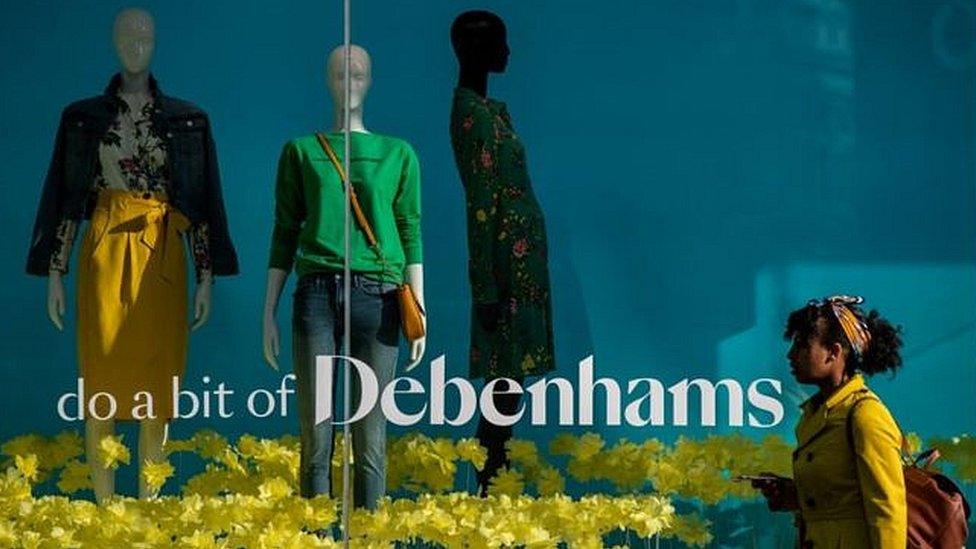

Debenhams hires liquidator in contingency plan

- Published

Debenhams has appointed a firm to draw up contingency plans for a possible liquidation of the department store.

The company, which is in administration, has hired Hilco Capital, a firm that specialises in winding up struggling retailers.

Debenhams said it was "trading strongly" and Hilco's appointment did not mean a liquidation was likely.

Last week Debenhams said it would axe 2,500 more jobs, on top of 4,000 cuts it announced in May.

Debenhams filed for administration in April - the second time in a little over a year - and is examining options to exit the process.

These include the current owners continuing to run the business, a sale of Debenhams or a joint venture with new or existing investors.

But if the administrators, FRP Advisory, fail to find a buyer or new investment, Debenhams faces liquidation - putting 14,000 jobs at risk.

A spokesperson for the department store said: "Debenhams is trading strongly, with 124 stores reopened and a healthy cash position."

Debenhams began reopening its shops in June after being closed since lockdown in late March to stop the spread of the coronavirus.

Since lockdown started, it has announced store closures and job cuts.

However, the company was struggling before the pandemic, including issuing a string of profit warnings.

Prior to last year's administration, Sports Direct owner Mike Ashley had proposed injecting £200m into Debenhams.

The offer from Mr Ashley, who also owns House of Fraser, was rejected and Debenhams entered a pre-pack administration which allowed it to keep trading.

Hilco has worked on a number of high-profile liquidations in the retail sector including BHS, electronics specialist Maplin and Woolworths.

- Published9 June 2020

- Published4 June 2020