Tiffany suing LVMH over stalled takeover talks

- Published

Tiffany employs more than 14,000 people and operates about 300 stores

US jeweller Tiffany & Co. is suing luxury goods giant LVMH for stalling over a high-profile takeover deal.

LVMH said it had been requested by the French government to delay the takeover due to tariff threats from the US.

The luxury goods firm already said it was taking another look at the $16.2bn (£12.5bn) deal, which was struck before the coronavirus pandemic hit.

Tiffany said, external it was filing a lawsuit to force the deal to go forward.

It accused LVMH of deliberately stalling to avoid completing the deal and questioned the firm's bid to pin its decision on the tariff dispute, saying it was a sign LVMH had "unclean hands".

"We believe that LVMH will seek to use any available means in an attempt to avoid closing the transaction on the agreed terms," said Tiffany chairman Roger Farah.

Doubts about the deal

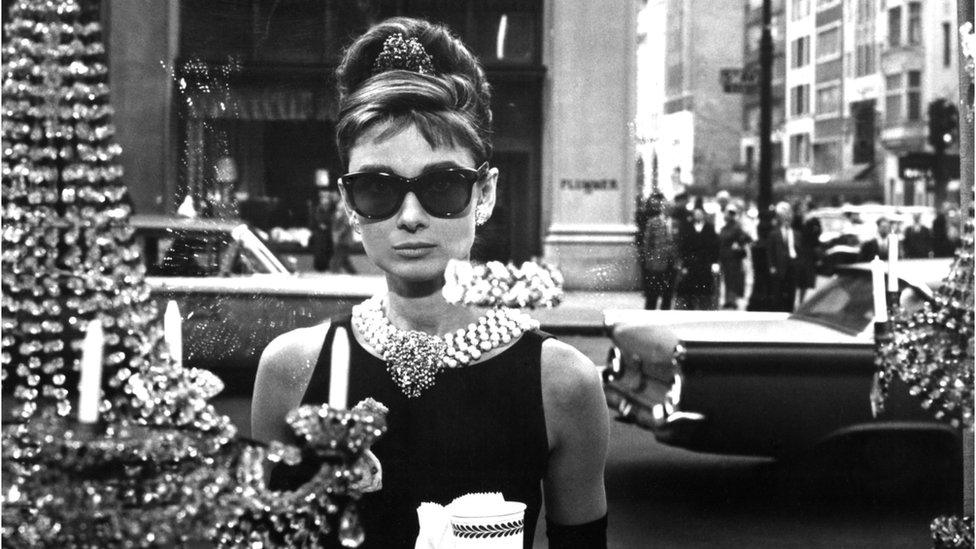

LVMH's billionaire chief executive Bernard Arnault had long coveted buying Tiffany, a brand that hit global fame after the 1961 Audrey Hepburn film Breakfast at Tiffany's.

In November 2019, after back-and-forth, he agreed to pay $135 a share, promising to restore the lustre of the jeweller's brand, which had been losing favour among younger buyers.

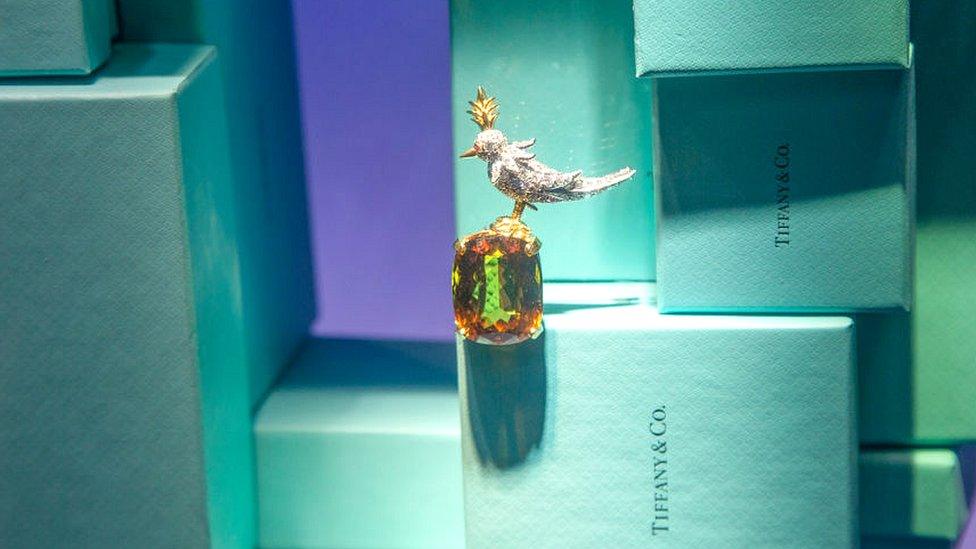

Tiffany is known for its signature robin's-egg blue packaging

But questions about the impact of coronavirus - which has slammed revenue in the luxury sector and prompted a 36% drop in Tiffany sales, external in the first half of the year - cast doubt over the deal.

In its statement, LVMH, which already owns about 75 brands including Christian Dior and Dom Perignon, said "a succession of events which undermine the acquisition of Tiffany & Co" had prompted the board to review the situation.

It said the board had concluded it would be unable to complete the deal by the closing deadline of 24 November outlined in the 2019 merger agreement.

"As it stands, the Group LVMH will therefore not be able to complete the acquisition of Tiffany & Co," it said.

Legal fight

LVMH said Tiffany had asked to extend the closing date and the board had been directed by the French government to defer the acquisition until after 6 January "in reaction to the threat of taxes on French products by the US".

The Breakfast at Tiffany's film starring Audrey Hepburn made the brand famous

But Tiffany accused LVMH of not doing its part to win approval of the deal from antitrust authorities.

"This latest development represents nothing more than LVMH's most recent effort to avoid its obligation to complete the transaction on the agreed terms, not dissimilar from LVMH's baseless, opportunistic attempts to use the US social justice protests and the Covid-19 pandemic to avoid paying the agreed price for Tiffany shares," the firm said.

Tiffany added that its business remained strong, with sales in the last three months of 2020 expected to exceed the same period last year.

Tiffany shares fell more than 10% on the news to less than $110, while LVMH shares dipped slightly.

- Published4 June 2020

- Published25 November 2019