Small firms thrown lifeline in insurance test case ruling

- Published

- comments

Small businesses have been thrown a lifeline after the High Court ruled some insurers should have paid out for losses caused by lockdown.

Judges ruled that the disease clauses in some business interruption policies should have meant they were covered.

Following lockdown, a host of businesses had to close and many looked to insurers to cover their losses.

But many insurers disputed the claims, arguing policies were never meant to cover such unprecedented restrictions.

The test case was brought by the Financial Conduct Authority and had the potential to affect 370,000 mostly small businesses.

The insurers can appeal against the decision. Policyholders should hear from their insurer within seven days.

Christopher Woolard, interim chief executive of the FCA, said the ruling removed "a large number" of roadblocks to successful claims, as well as clarifying those that might not be successful.

"We are pleased that the court has substantially found in favour of the arguments we presented on the majority of the key issues.

"Today's judgement is a significant step in resolving the uncertainty being faced by policyholders.

"Coronavirus is causing substantial loss and distress to businesses and many are under immense financial strain to stay afloat."

'We have been under immense stress'

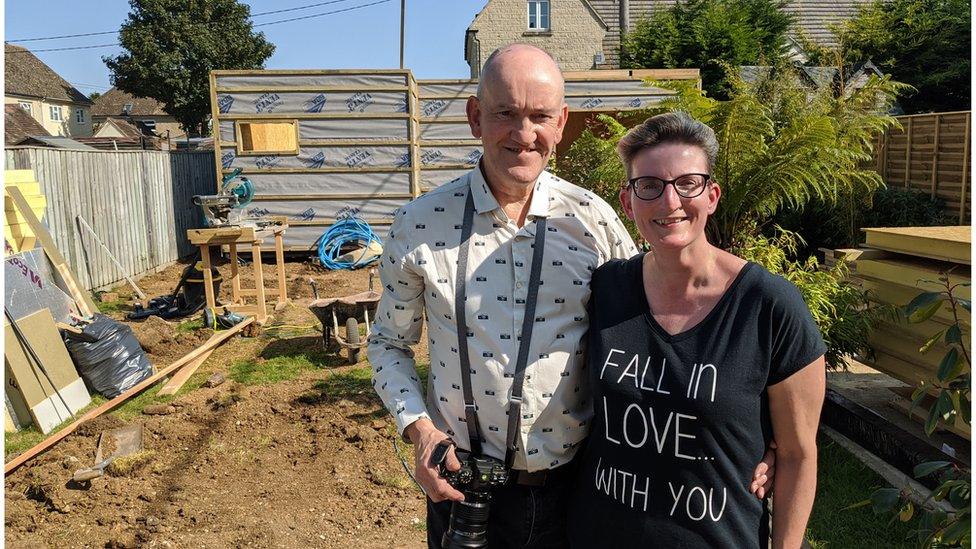

Anna Smart and her husband Robin

Anna Smart runs a photography studio in Oxfordshire with her husband Robin and thought she was covered by business interruption insurance.

But when she was turned down by her insurer, she was forced to make her one member of staff redundant and move out of their premises.

She said it was "painful" to let someone go and it felt like "ditching a member of the family".

Instead, they have used a Bounce Back loan to build a studio in their back garden.

Businesses such as hers were under "immense" stress, she said, while some had already been forced to close permanently, irrespective of the result of the case.

Hospitality Insurance Group Action (Higa), one of the campaign groups backing the FCA's case, said thousands of UK hospitality businesses should now be able to receive pay-outs as a result of the judgement.

Sonia Campbell, of law firm Mishcon de Reya, which represents Higa, said: "This is fantastic news which has shown that we were right to pursue insurers who across the board denied cover for Covid-related losses.

"I would now urge other hospitality businesses to join us to ensure that they can successfully recover payments from insurers in line with the court's decision."

The Hiscox Action Group (HAG), which has more than 400 members and also intervened in the case, called Tuesday's ruling a "landmark".

Steering committee member Mark Killick said: "The most important thing now is that the insurers accept this ruling and start to pay out rather than embark on a fruitless appeals process that will just cause more suffering for the very policyholders they were meant to protect."

'Blanket denials'

As of July, about 400 companies had complained to the financial ombudsman, saying they had been wrongly denied cover for lockdown-related losses.

In response, the FCA brought its test case, arguing that while some insurers had provided payouts to customers, many claims had been "rejected" under "blanket denials of cover".

It asked the High Court to decide on the correct interpretation of a selection of policies, with judges in the end looking at 21 issued by eight separate insurers - among them giants such as Hiscox, RSA, QBE and Zurich.

The ruling could affect many more policies. However, the regulator added: "Although the judgement will bring welcome news for many policyholders, the judgement did not say that the eight defendant insurers are liable across all of the 21 different types of policy wording in the representative sample considered by the court.

"Each policy needs to be considered against the detailed judgement to work out what it means for that policy."

Insurer Hiscox said it was "assessing the judgement in detail" to see how it applied to claims made by individual policyholders.

Huw Evans, director general of the Association of British Insurers, said: "Insurers have supported this fast-track court process led by the FCA to help bring clarity for customers and we welcome the speed with which the court has delivered a ruling.

"The judgment divides evenly between insurers and policyholders on the main issues. The national lockdown was an unprecedented situation that posed understandable questions of interpretation for some business insurance contracts.

"Insurers always regret any contract dispute with their customers and will continue to reflect on feedback from recent events."

Both sides have some grounds to celebrate after this ruling.

For policyholders, there is progress towards the payout they believe they are entitled to.

They may still have to wait some time to see the money. Some will ultimately be disappointed to not get a penny.

For insurers, there is some relief as some may not be paying out as much as could have been the case in their worst-case scenario.

Both sides wanted clarity, quickly, but this dispute may still have more twists and turns before it is finally settled.

- Published20 July 2020

- Published1 June 2020