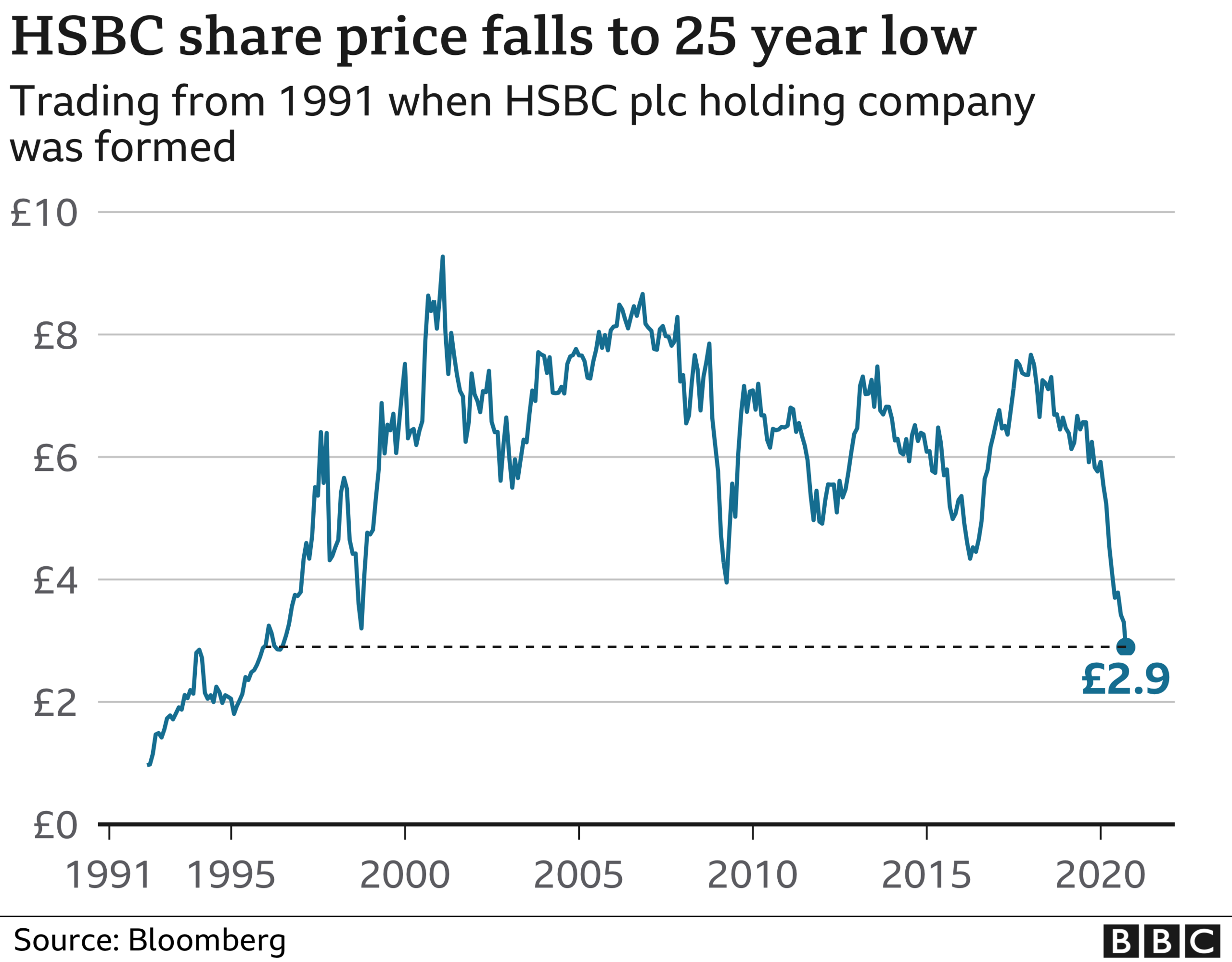

HSBC's shares dive to lowest level since 1995

- Published

HSBC's share price has fallen to its lowest level since 1995 amid allegations of money laundering.

In 2013 and 2014 the bank allowed fraudsters to transfer millions of dollars around the world even after it had learned of their scam, leaked secret files show.

HSBC says it has always met its legal duties on reporting such activity.

On Monday in Hong Kong, the shares fell more than 5.3% to close at HK$29.30. In London they fell by a similar amount.

Leaked documents from the US Financial Crimes Enforcement Network (FinCEN), involving about $2tn of transactions have revealed how some of the world's biggest banks have allowed criminals to move dirty money around the world.

Shares in rival banks named in the papers have also been hit. At lunchtime, Standard Chartered and Barclays were down by 5% and 6% respectively, while Germany's Deutsche Bank was down 8%.

The share price falls came against a backdrop of broader negative sentiment on share markets. UK shares were down sharply amid fears of further Covid-related restrictions.

HSBC had been under pressure on multiple fronts before the files were leaked and its shares have taken a particularly hard battering this year, falling by some 50%.

It has been at the sharp end of political pressures in Hong Kong, and from the pandemic fallout.

Although HSBC is headquartered in London, more than half of its profits come from Asia and its shares are important components of both the London and Hong Kong share markets.

Its role in a $80m (£62m) fraud is detailed inthe FinCEN leak of documents - banks' "suspicious activity reports".

HSBC moved the money through its US business to HSBC accounts in Hong Kong in 2013 and 2014.

The bank says it has always reported such activity in accordance with its legal obligations.

Multiple pressures

HSBC, which is Europe's biggest bank, has set aside between $8bn and $13bn this year for bad loans as it expects more people and businesses to default on their repayments because of the coronavirus pandemic.

In August, it reported a 65% drop in pre-tax profits to $4.3bn for the first half of the year - much steeper than analysts had forecast.

It also became embroiled in a political battle over its support of China's national security law in Hong Kong and was lambasted by both the US and UK.

Cost-cutting

HSBC is currently pushing ahead with major restructuring of its global banking operations.

Chief executive Noel Quinn, who officially took over in March, said the bank would further pivot into Asia as its European operations lose money.

Mr Quinn said HSBC would "accelerate" an earlier restructuring plan which includes the axing of 35,000 jobs.