Coronavirus: Rolls-Royce to raise billions in Covid-lifeline

- Published

- comments

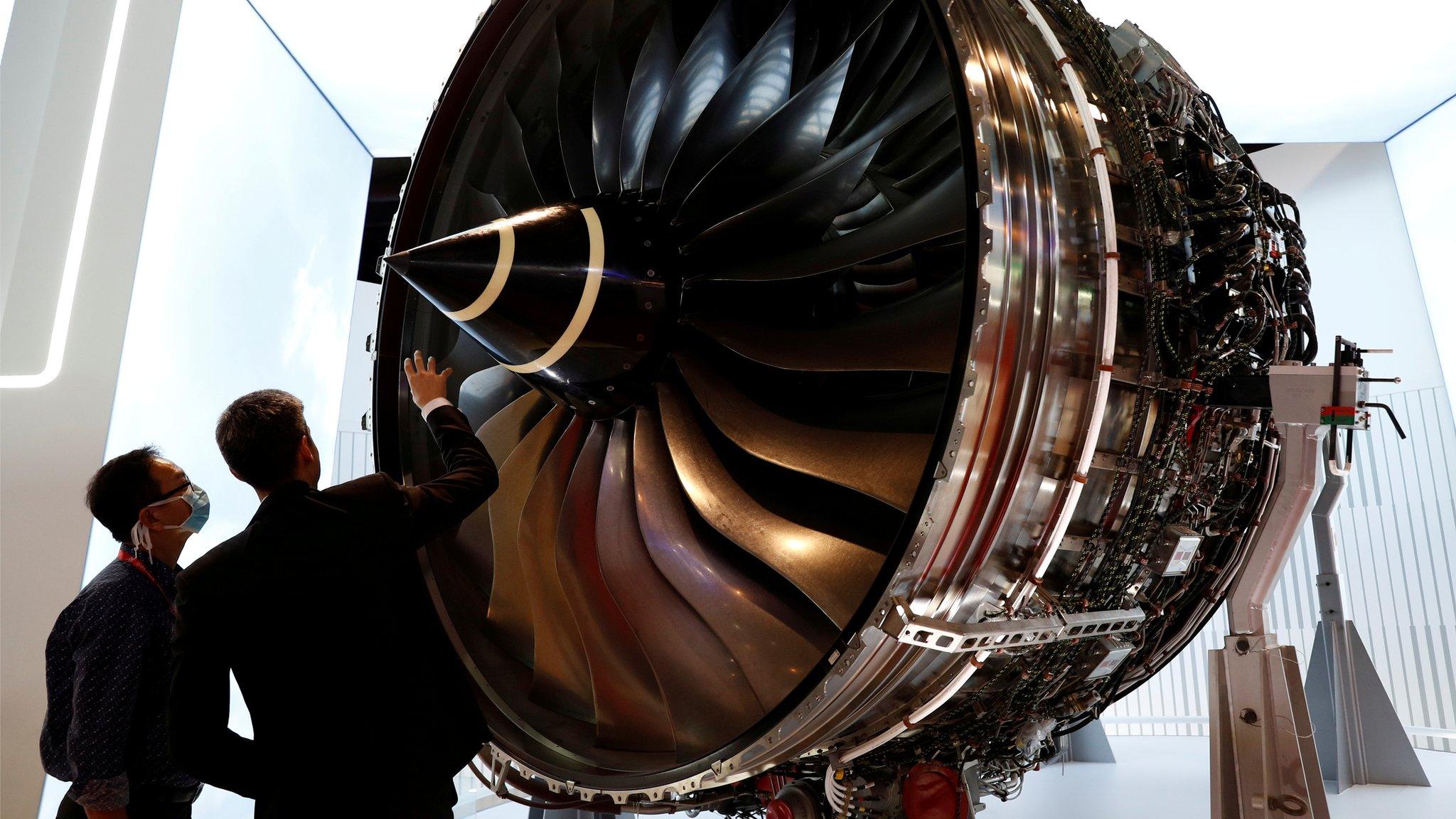

Rolls-Royce has announced it will seek to raise billions of pounds to bolster its finances after a "sharp deterioration" in civil aerospace because of the pandemic.

The plane engine maker will seek to raise £2bn from its shareholders through a rights issue.

Rolls-Royce will also raise funds by issuing new debt, while the rights issue could unlock further financing.

The company has been hit by the fall in air travel amid the Covid-19 outbreak.

The rights issue could trigger a further £1bn loan from UK Export Finance, the government's trade finance body. Rolls-Royce has already borrowed £2bn from the state.

But Rolls-Royce said an extension of a government loan was dependent on both UK Export Finance and HM Treasury approving the terms of the rights issue. "There is therefore no guarantee that this increase will take place," it said.

The government holds a "golden share" in Rolls-Royce which prevents the company - which is deemed to be of strategic interest to the UK - from coming under foreign control.

There had been rumours that Rolls-Royce had been in talks with sovereign wealth funds in Singapore and Kuwait to invest in the business.

The company also said it had secured commitments for a new £1bn two-year loan facility andit is planning to issue bonds to raise a further £1bn.

Rolls-Royce chief executive Warren East, said: "The capital raise announced today improves our resilience to navigate the current uncertain operating environment.

"The sudden and material effect of the Covid-19 pandemic has had a significant impact on the commercial aviation industry, resulting in a sharp deterioration in the financial performance of our civil aerospace business and, to a lesser extent, our power systems business."

After flirting with the investment arms of the governments of Kuwait and Singapore, Rolls-Royce has turned to its existing shareholders to come up with the money it needs to survive the pandemic.

It makes money not from selling engines, but from the payments airlines make when those engines are flying. Flying hours have roughly halved since the pandemic started, and Rolls-Royce - and everyone else - does not really know when they will go back to pre-coronavirus levels.

If the rights issue is successful - and it is fully-underwritten by City banks, and pitched at a deep discount to the current market price of Roll-Royce shares - it will unlock another £3bn worth of loans. The £5bn recapitalisation should be enough, the company says, to see it through most forecasts of another coronavirus spike.

There is an element of government support here for what is one of the UK's most important exporters. One third of the new loans will be guaranteed by UK Export Finance, an arm of the government - although Rolls-Royce cautions the support is conditional on the rights issue going through, and further negotiations with the Treasury.

The big question now is whether Rolls-Royce has done enough. The course of the virus is difficult to predict, as is the future behaviour of air travellers even if it is defeated. Shareholders being asked to stump up the cash would like some certainty - and that is in short supply.

'Room for manoeuvre'

Under the rights issue, investors will get 10 shares for every three they, own priced at 32p - a heavy discount to its share price on 30 September which closed at 130p.

Rolls-Rolls has already announced it will cut 9,000 jobs in an effort to save costs and plans to sell-off parts of its business to raise £2bn.

Rolls-Royce chief executive Warren East said the fund-raising "improves our resilience"

While the engineering group also designs and makes products such as engines and turbines for the defence, marine, and oil and gas industries, civil aerospace is by far its biggest business and accounts for 51% of its revenues.

It operates a "power by hour" model, which means Rolls-Royce makes money every time a plane using one of its engines is flown, generating around £4bn a year.

However, the airline industry has virtually ground to a halt since the coronavirus crisis emerged.

"There is little end in sight for the falling demand for new planes," said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

But she said its financing plans should give Rolls-Royce "a lot more room for manoeuvre to help it navigate the Covid crisis".

Rolls-Royce's share price fell 5.85% to 122.4p in early trading in London.

- Published20 September 2020

- Published27 August 2020