Coronavirus drives shop closures to new record

- Published

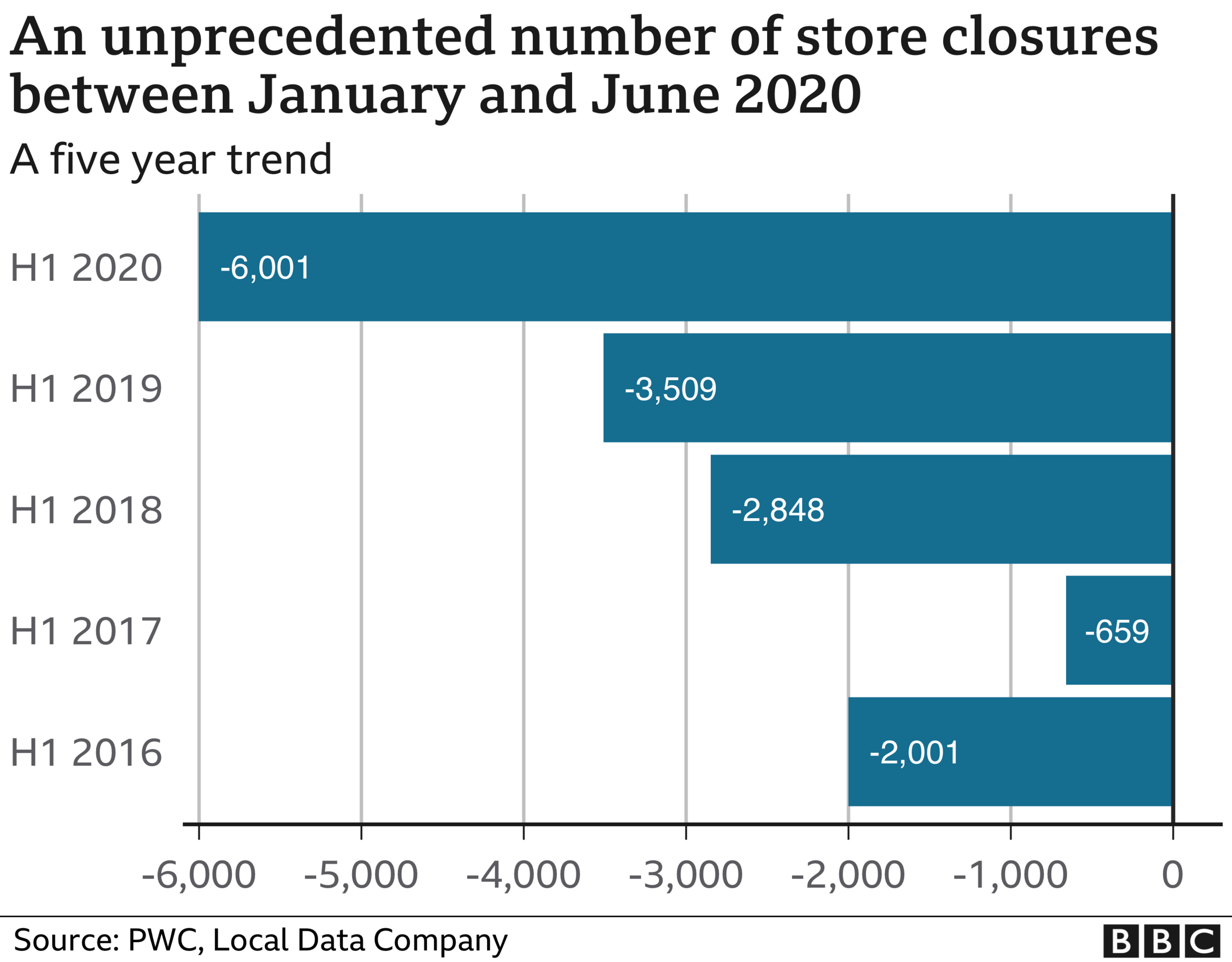

A record number of shops closed on UK high streets during the first half of this year as the coronavirus lockdown hit many stores hard, data shows.

Some 11,120 chain store outlets shut between January and June, according to research by the Local Data Company and accountancy firm PwC.

Although more than 5,000 shops opened during the same period it was not enough to fill the gaps, resulting in a net decline of 6,001 stores.

The final total could even be higher.

Researchers did not count outlets that had yet to reopen after the coronavirus lockdown ended. Many never will.

The data includes shops, hospitality chains, and services such as post offices and banks, but it does not include small independent businesses.

High streets were already experiencing upheaval long before the pandemic struck.

Shops were closing at an average rate of 16 per day in 2019, according to the Local Data Company, which tracks vacancies rates.

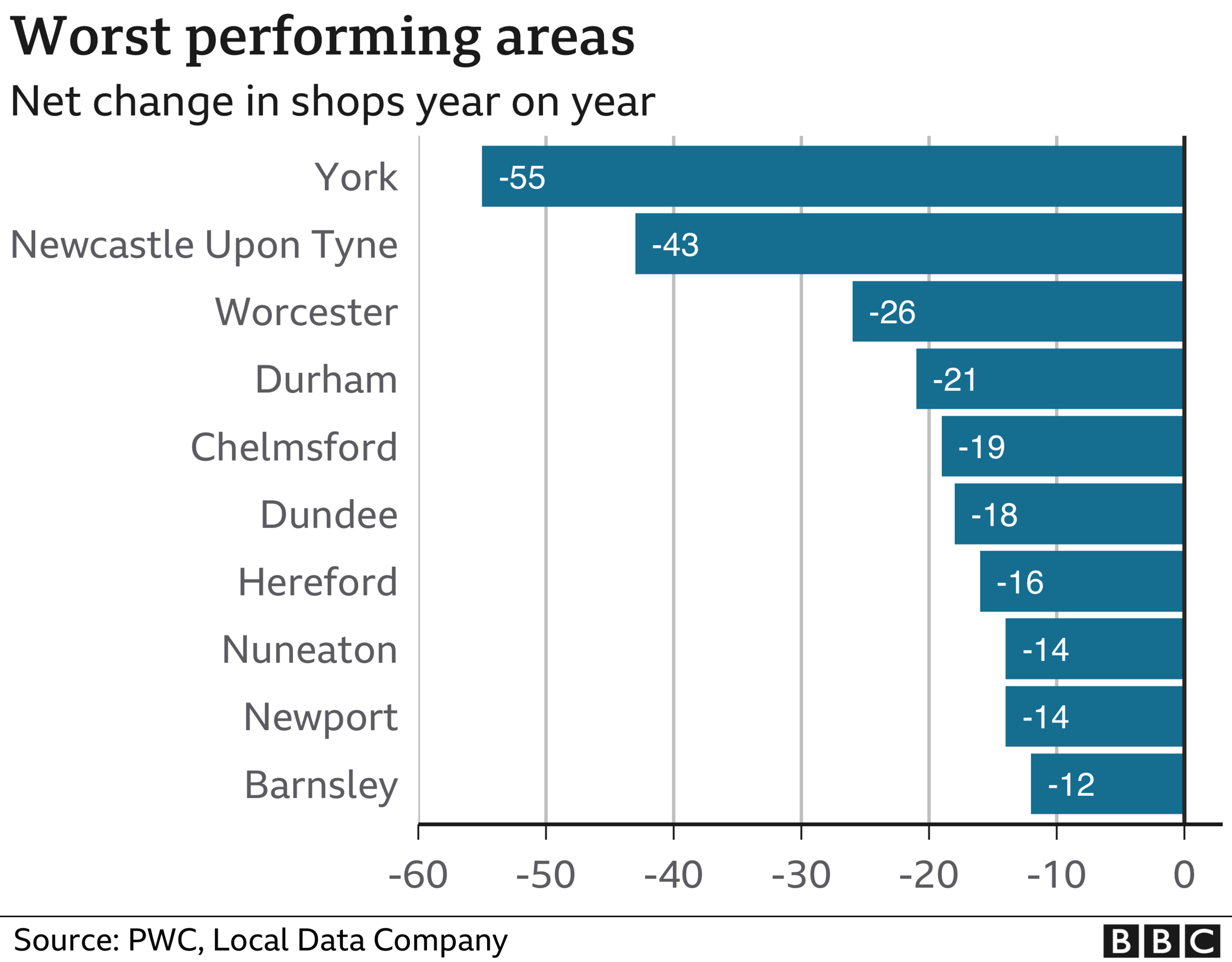

But the pandemic is turbo-charging change as more people shop online. The research found that York has been the worst affected area, with a net loss of 55 outlets.

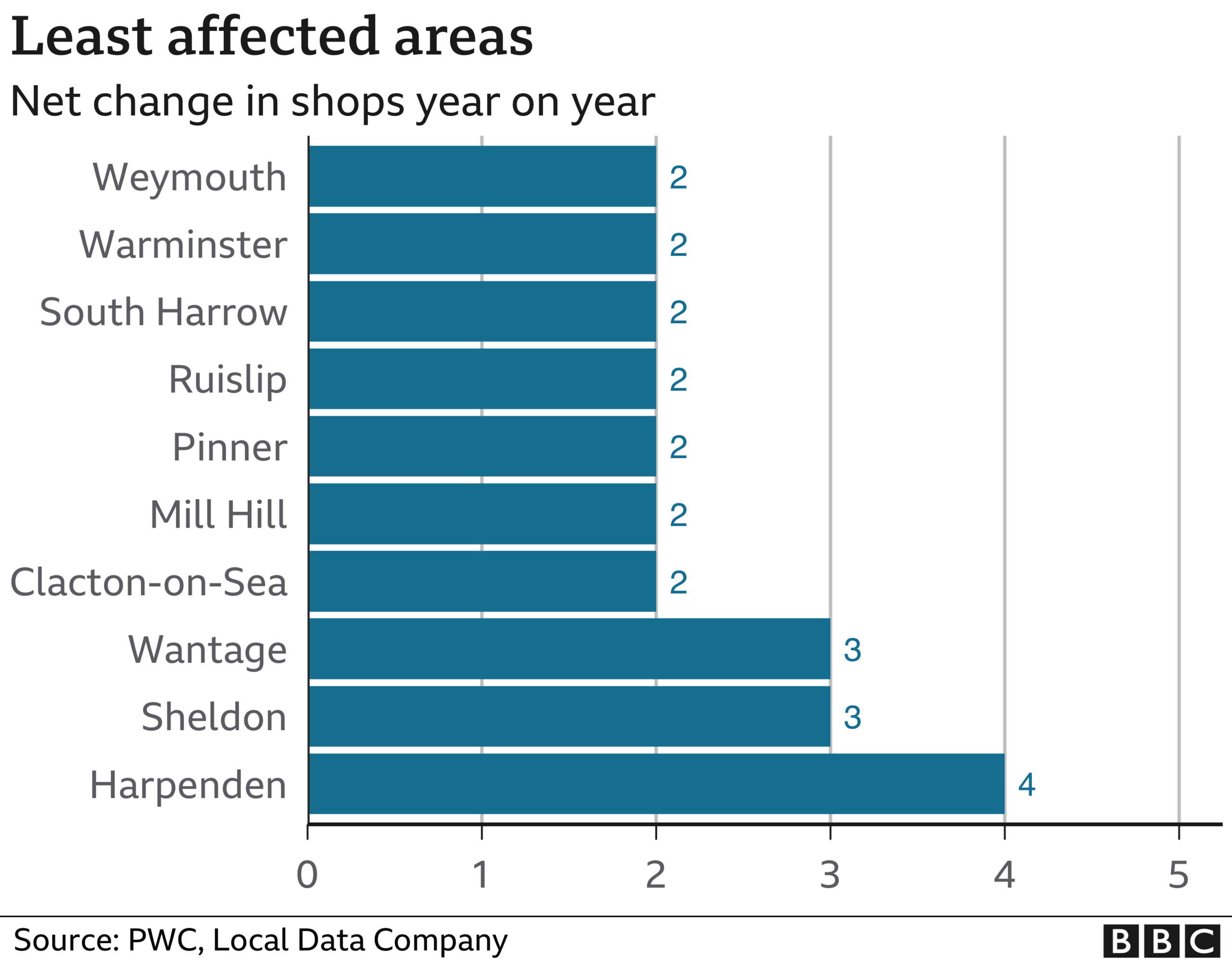

Harpenden, in Hertfordshire, meanwhile has fared better than any other location with a net increase in stores.

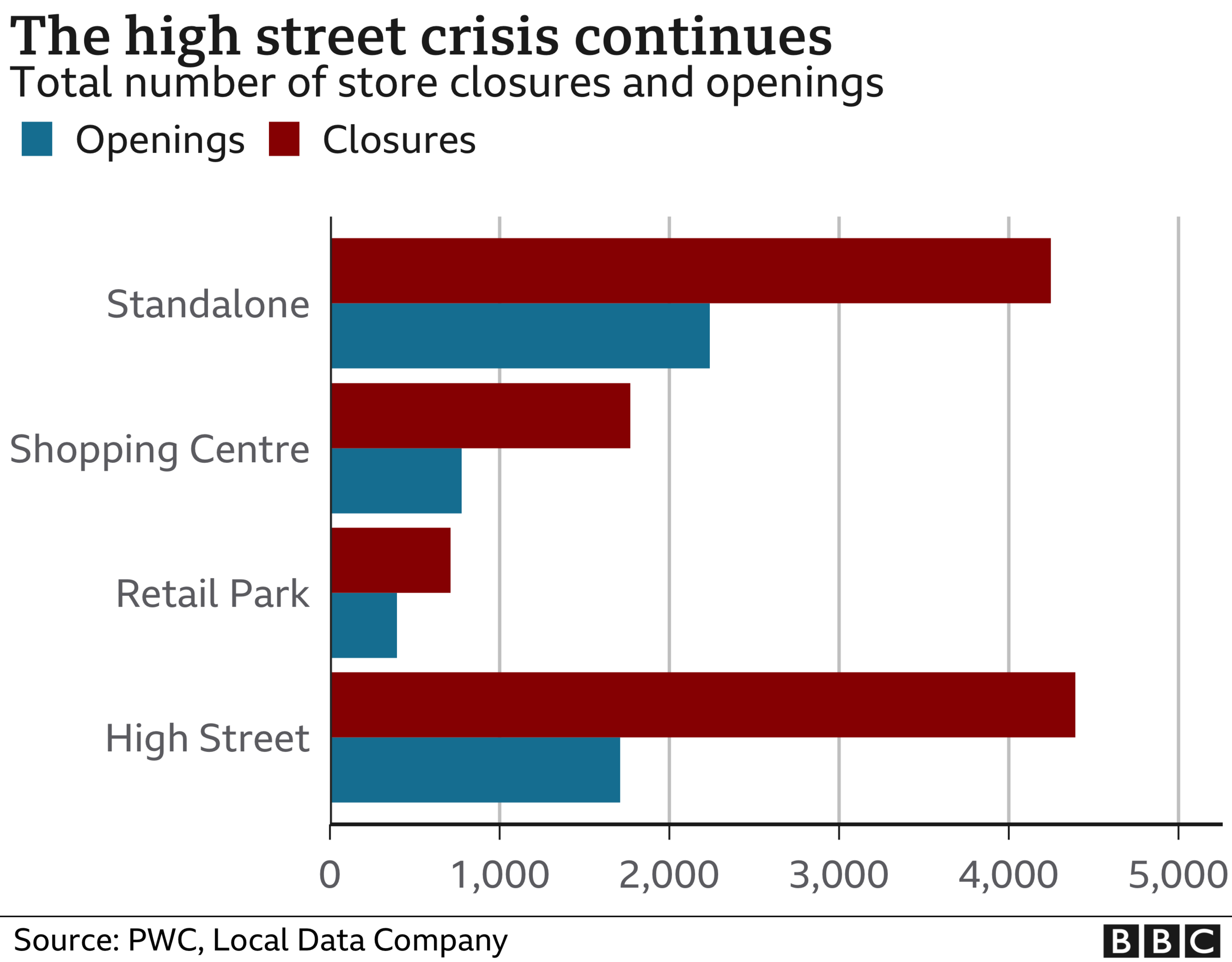

High streets have borne the brunt of the closures. Retail parks have proved far more resilient. Standalone stores mean units which are out of town, but not in a retail park or shopping centre, for instance a large supermarket or an Ikea.

The Local Data Company and PwC have been analysing the changes in the top 500 shopping locations for the past decade. This year's findings include all high streets, shopping centres and retail parks in Britain. They've reviewed existing data to allow comparisons with the previous five years.

These new figures show the profound impact the pandemic is having on our town centres and high streets.

"For local authorities, it's now critical how they respond to this significant and growing decline in store occupants," says Lucy Stainton, head of retail and strategic partnerships at the Local Data Company.

Whilst many city centres remain quiet, the pandemic has prompted something of a resurgence in local high streets with people increasingly wanting to shop locally if they're working from home.

Lisa Hooker, consumer markets leader at PwC, says amid the turmoil, there continues to be a steady flow of openings: "With the continued roll out of value retailers, the boom in takeaways and pizza delivery shops and demand for services that can still only be delivered locally, such as tradesmen outlets, building products or locksmiths, shows that despite the stark numbers there remains a future for physical stores.

"It's likely that whatever happens retail will come out of this smaller and stronger," she believes.

More closures are still to come, however. Retailers and hospitality chains are continuing to restructure their businesses, cutting stores and many thousands of jobs to survive.

Many have done deals with landlords to reduce rent bills, but billions of pounds of rent still remains unpaid thanks to the government ban on evictions to give struggling firms some breathing space, arrears which have only been postponed.

Another key factor is business rates. Thanks to the government's rates holiday, retail and hospitality firms don't have to start paying this tax again till April next year.

They say if it isn't extended, this could deal a final blow for the viability of many stores.

Correction: an earlier version of the first graphic showed the worst performing cities in the wrong order.

- Published16 October 2020

- Published6 October 2020