UK job losses 'could be larger than forecast'

- Published

- comments

UK unemployment could climb higher than current forecasts as the pandemic continues to hit jobs, a Bank of England policymaker has said.

Gertjan Vlieghe, a member of the Bank's Monetary Policy Committee, warned the jobless rate could rise above the Bank's predicted peak of 7.5%.

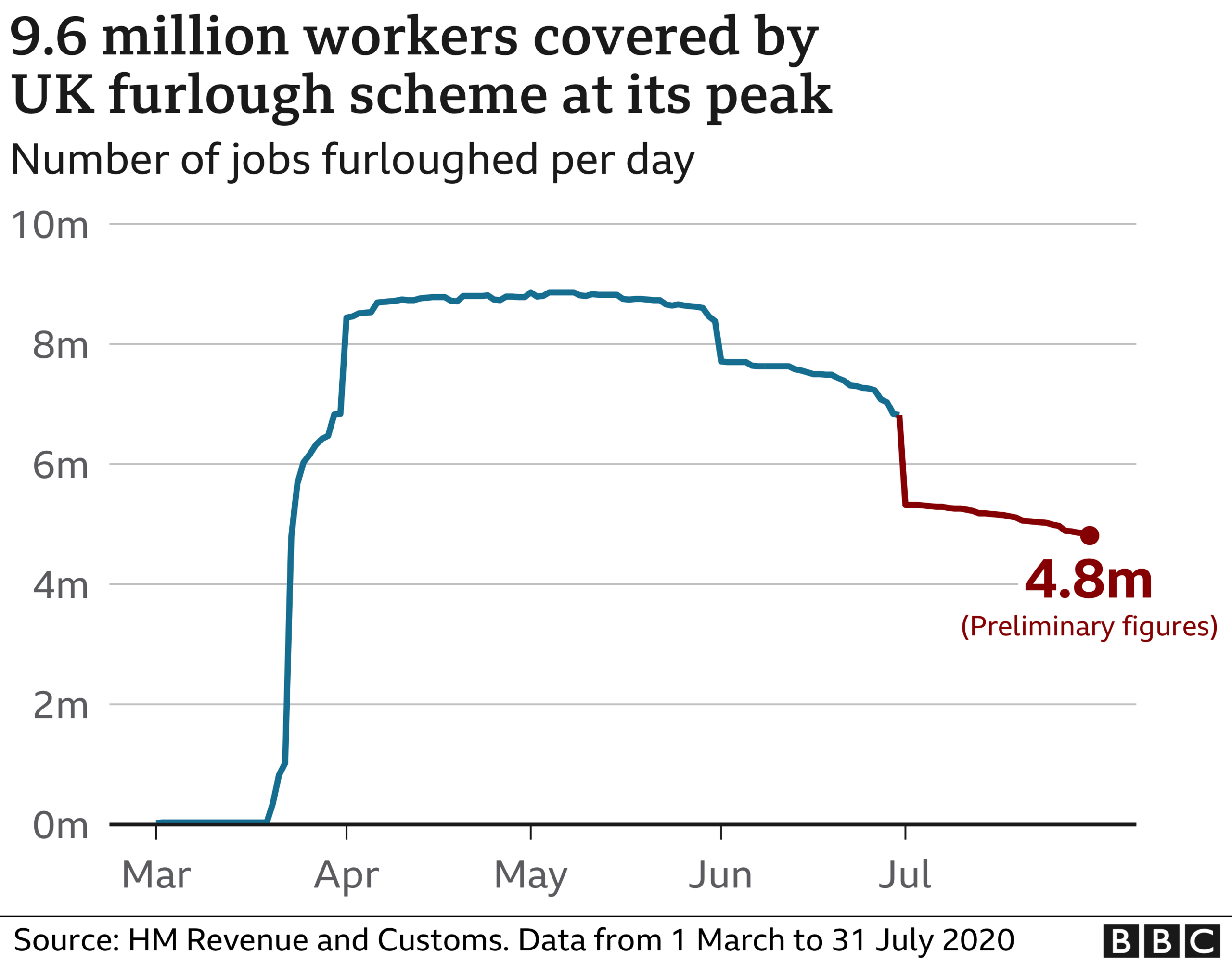

In a speech on Tuesday, he said not all of the current two million furloughed workers would return to their jobs.

"The risks are skewed towards even larger [job] losses," he said.

"Even though the headline rate of unemployment has moved up only moderately so far, evaluating unemployment accurately during the pandemic is a phenomenal challenge," Mr Vlieghe said.

At the height of the pandemic earlier this year more than 30% of the private sector workforce was on furlough, he pointed out.

Since then more than two-thirds have returned to work, but that still leaves 9% of the private sector workforce, or just over two million, who are not.

Mr Vlieghe pointed out that in the global financial crisis of 2008-09 a net 3.3% of the workforce lost their job. In the 1990s recession, that number was 3.8%, and in the 1980s recession, it was 6.6%.

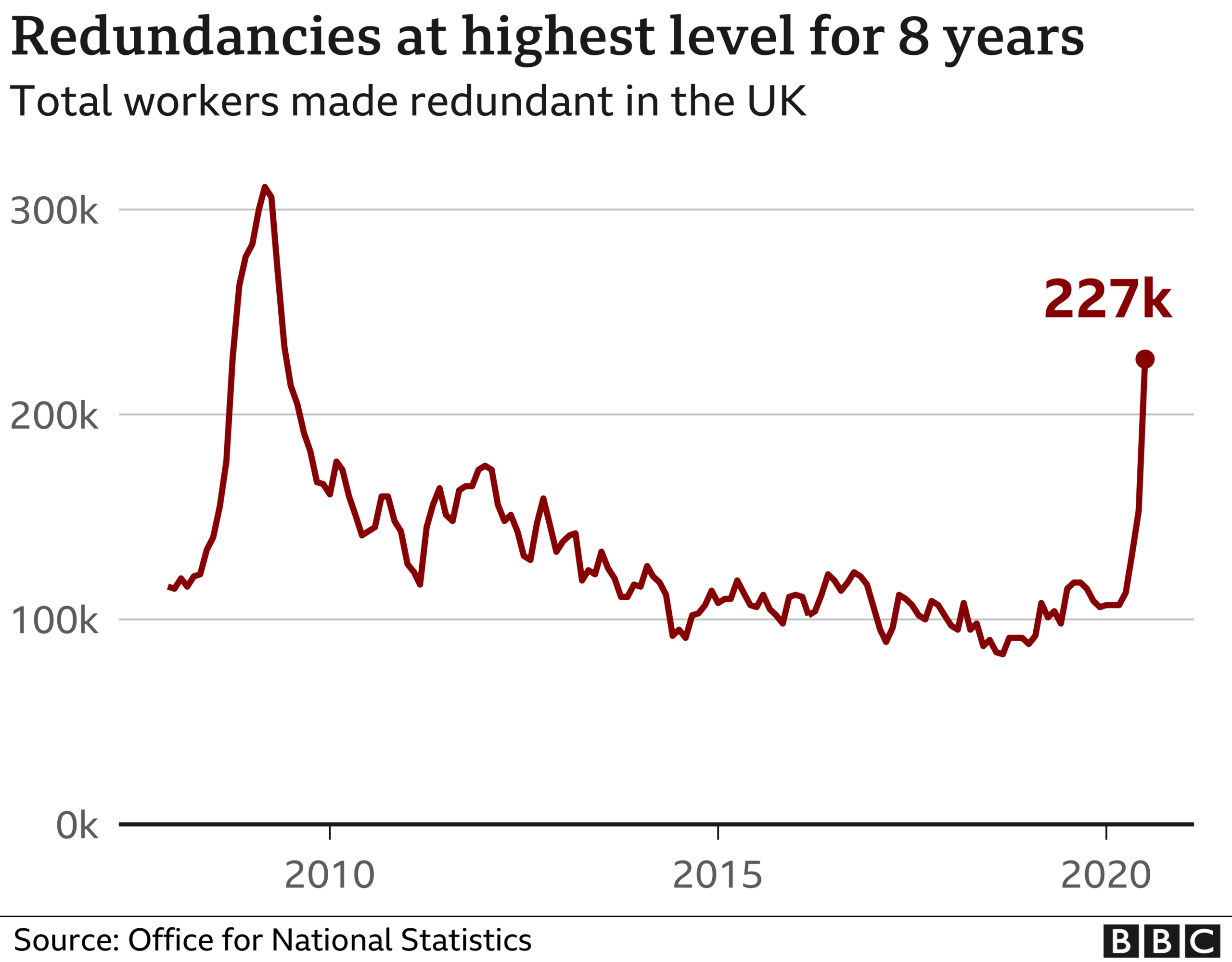

Figures released last week showed the unemployment rate hit 4.5% in the three months to August, the highest in more than three years, while redundancies rose to their highest level since 2009

'Downside risks'

In August. the Bank of England forecast that the unemployment rate would reach a peak of 7.5%, implying aggregate net job losses on the same scale as in the global financial crisis.

But that figure looks like an underestimate now, Mr Vlieghe said.

"The fact that redundancies are rising sharply and the number of vacancies is only at around 60% of its level at the start of this year makes it difficult to see a scenario where all of the remaining furloughed workers are reintegrated seamlessly into the labour force," he said.

There is huge uncertainty about the scale of job losses, in both directions, he added, "but in my view, the risks are skewed towards even larger losses, implying even more slack in the economy than in our central projection."

He predicted the economy may need further financial stimulus, "given that virus prevalence has been increasing again recently" and "it appears that the downside risks to the economic outlook are starting to materialise".

- Published13 October 2020

- Published26 March

- Published13 October 2020

- Published9 October 2020