Long live furlough: Was the wage subsidy plan a success?

- Published

- comments

Chancellor Rishi Sunak had a chart in his office comparing the UK's furlough scheme with European equivalents

The furlough scheme has undoubtedly delivered on its principle aim - to prevent mass unemployment in the immediate aftermath of the pandemic shutdowns.

The technical task at HMRC alone of turning around the funding for wages for 9 million jobs should not be underestimated.

Other departments have not managed to deliver such immediately required innovations at the pace required.

Speed was rightly prioritised at the expense of rigorous eligibility checks.

It has been expensive, obviously. The final bill will be in line with the annual cost of the UK defence budget around £50bn.

The fact that the markets have continued to lend money to the UK Government at record low interest rates, underscores the notion that it would have been more expensive in terms of long term unemployment scarring, not to have deployed the scheme.

Nine in ten of those furloughed remained on payrolls. The wider point of the scheme was to maintain the contractual employment relationship for millions of jobs, through the shutdowns.

Credibility of those behind the scheme was essential to get hundreds of thousands of businesses to trust the Treasury to repay the wages that they could not afford to pay. It was important at the outset for the likes of the Bank of England Governor Andrew Bailey to tell employers not to fire people.

Many high streets are still waiting to see shoppers return to pre-pandemic levels

Long-term cost

The borrowing will be repaid over a very long period of time.

It won't mean immediate tax rises. But it will mean over a decade or more, some higher taxes and lower spending than would otherwise have been the case.

But it is telling that in his office at the Treasury the Chancellor has grids comparing the generosity of every such scheme around the world. And he was keen to be able to make claims that the UK has been the most generous.

Clearly there were some big gaps in provision for some types of self employed people.

But even the existing self employed scheme has been criticised for its lack of targeting, particularly claims made by those whose business has only been hit a little.

There is a wider debate to be had about whether knowing there was £50bn plus available, paying 80% of the wages of 9m jobs would have been the right way to go. Or could it have been more targeted at those in need or, indeed, less generous and more universal?

Furlough 2.0

But the real test of the need for the furlough scheme, was the fact that when the Chancellor tried to wind it down, it has, basically, been half-kept at least until the Spring, under the guise of the Job Support Scheme.

Importantly people will not be paid to stay at home completely. At some wage levels though, even with a less generous headline scheme, the effect of the £1000 Jobs Retention Bonus, will mean that for some furloughed workers, the taxpayer will effectively be paying more than 100% of wages.

The scheme has now evolved into a continental European style short working scheme.

Upon its creation, it was always clear that stopping the scheme would be very difficult.

There is now a public expectation, a precedent, for actions such as this. Some less generous permanent version of this scheme, as has occurred on the continent, is far from unthinkable.

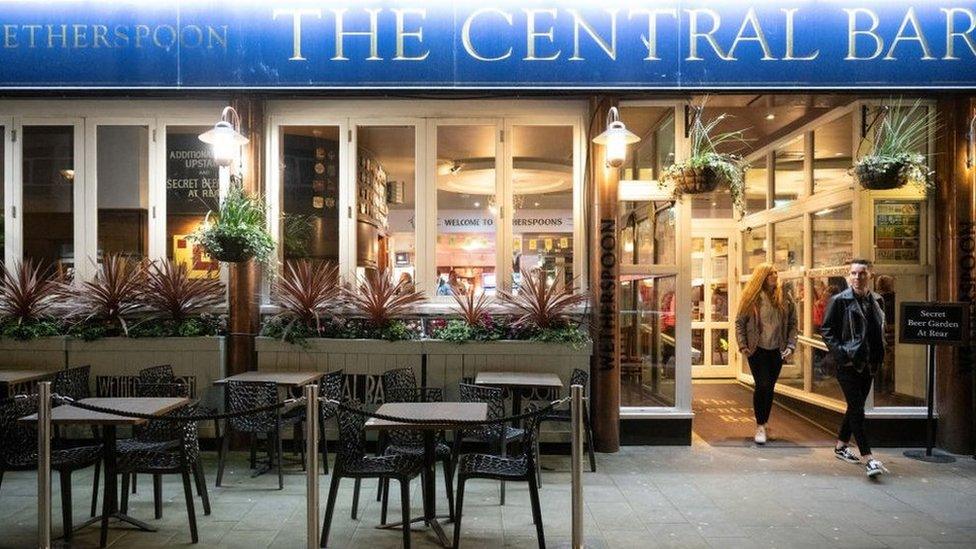

Many pubs still have far fewer customers so are placing staff on the furlough replacement, the Job Support Scheme

Comparisons to the Continent

The Kurzarbeit scheme in Germany has been a tool of social support but also a considerable back door subsidy to that country's mighty industrial export sector.

That German scheme was born out of Chancellor Merkel locking industry and business in a hotel for two days.

Here we have seen unprecedented negotiations between a Conservative Chancellor, the CBI and TUC.

There is a small irony that this is precisely the sort of Government interventionist policy that has in the past motivated British critiques of a "sclerotic" European Union, unable to adjust to fast economic changes.

That debate is perhaps for another day. Any move back in the direction of full furlough would have to be considered in the context of hypothetical national "Tier 4" restrictions, as the second wave intensifies.

For now as the furlough scheme ends, its essence clearly lives on, and could well change UK public policy forever.

- Published30 September 2021

- Published28 October 2020

- Published29 October 2020